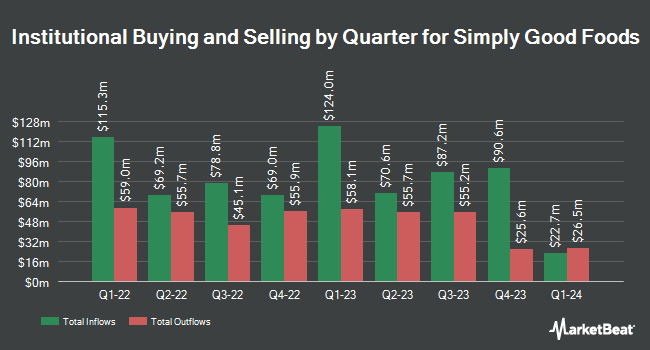

Massachusetts Financial Services Co. MA purchased a new stake in The Simply Good Foods Company (NASDAQ:SMPL - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 787,767 shares of the financial services provider's stock, valued at approximately $27,391,000. Massachusetts Financial Services Co. MA owned 0.79% of Simply Good Foods at the end of the most recent reporting period.

Several other institutional investors and hedge funds also recently modified their holdings of the company. Vanguard Group Inc. raised its holdings in shares of Simply Good Foods by 1.6% in the 1st quarter. Vanguard Group Inc. now owns 11,099,351 shares of the financial services provider's stock valued at $377,711,000 after purchasing an additional 174,157 shares during the period. Dimensional Fund Advisors LP boosted its stake in shares of Simply Good Foods by 6.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 3,223,666 shares of the financial services provider's stock worth $116,468,000 after acquiring an additional 203,914 shares during the period. Boston Trust Walden Corp bought a new position in shares of Simply Good Foods during the 3rd quarter worth approximately $80,270,000. Principal Financial Group Inc. increased its holdings in shares of Simply Good Foods by 14.3% during the 2nd quarter. Principal Financial Group Inc. now owns 1,474,736 shares of the financial services provider's stock worth $53,282,000 after acquiring an additional 184,539 shares during the last quarter. Finally, Victory Capital Management Inc. raised its stake in Simply Good Foods by 13.5% in the 3rd quarter. Victory Capital Management Inc. now owns 1,045,457 shares of the financial services provider's stock valued at $36,351,000 after acquiring an additional 124,655 shares during the period. 88.45% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research firms have commented on SMPL. Stephens decreased their price objective on shares of Simply Good Foods from $44.00 to $42.00 and set an "overweight" rating on the stock in a report on Wednesday, October 23rd. Citigroup lowered their price target on shares of Simply Good Foods from $46.00 to $43.00 and set a "buy" rating on the stock in a research report on Thursday, November 14th. Three equities research analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $40.78.

Check Out Our Latest Stock Analysis on Simply Good Foods

Simply Good Foods Price Performance

SMPL stock traded up $0.17 during mid-day trading on Tuesday, hitting $40.01. The stock had a trading volume of 1,021,214 shares, compared to its average volume of 896,289. The firm has a fifty day simple moving average of $34.86 and a 200 day simple moving average of $35.02. The Simply Good Foods Company has a 52 week low of $30.00 and a 52 week high of $43.00. The company has a current ratio of 4.05, a quick ratio of 2.75 and a debt-to-equity ratio of 0.23. The firm has a market capitalization of $4.01 billion, a P/E ratio of 28.88, a P/E/G ratio of 3.45 and a beta of 0.64.

Simply Good Foods (NASDAQ:SMPL - Get Free Report) last released its earnings results on Thursday, October 24th. The financial services provider reported $0.50 earnings per share for the quarter, hitting the consensus estimate of $0.50. Simply Good Foods had a return on equity of 10.23% and a net margin of 10.46%. The firm had revenue of $375.70 million during the quarter, compared to analysts' expectations of $373.07 million. During the same period in the prior year, the company earned $0.41 earnings per share. The company's quarterly revenue was up 17.3% on a year-over-year basis. As a group, research analysts forecast that The Simply Good Foods Company will post 1.76 EPS for the current year.

Insider Activity at Simply Good Foods

In related news, Director Joseph Scalzo sold 25,000 shares of Simply Good Foods stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $35.99, for a total transaction of $899,750.00. Following the sale, the director now directly owns 139,204 shares in the company, valued at $5,009,951.96. This trade represents a 15.22 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Brian K. Ratzan sold 50,000 shares of the company's stock in a transaction that occurred on Thursday, November 14th. The shares were sold at an average price of $37.38, for a total transaction of $1,869,000.00. Following the completion of the transaction, the director now owns 2,049,387 shares of the company's stock, valued at approximately $76,606,086.06. This trade represents a 2.38 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 327,869 shares of company stock valued at $12,139,570. 10.98% of the stock is owned by insiders.

About Simply Good Foods

(

Free Report)

The Simply Good Foods Company operates as a consumer-packaged food and beverage company in North America and internationally. The company develops, markets, and sells snacks and meal replacements. It offers protein bars, ready-to-drink shakes, sweet and salty snacks, cookies, protein chips, and recipes under the Atkins and Quest brand names.

Featured Stories

Before you consider Simply Good Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simply Good Foods wasn't on the list.

While Simply Good Foods currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.