Massachusetts Financial Services Co. MA lowered its position in shares of Wheaton Precious Metals Corp. (NYSE:WPM - Free Report) by 4.2% in the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 7,231,391 shares of the company's stock after selling 314,981 shares during the period. Massachusetts Financial Services Co. MA owned 1.59% of Wheaton Precious Metals worth $441,693,000 as of its most recent filing with the SEC.

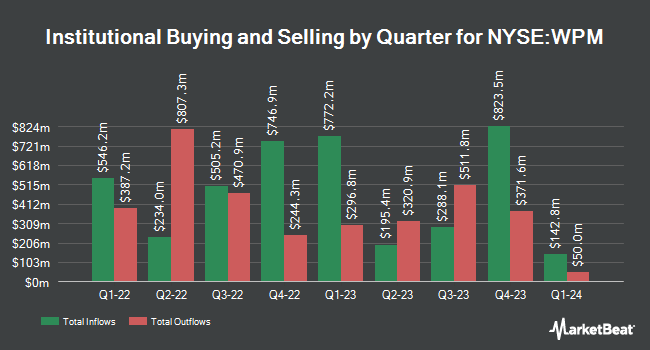

Several other institutional investors have also modified their holdings of WPM. Canoe Financial LP acquired a new stake in Wheaton Precious Metals in the 3rd quarter valued at about $113,017,000. AMF Tjanstepension AB boosted its position in Wheaton Precious Metals by 593.5% during the second quarter. AMF Tjanstepension AB now owns 1,608,134 shares of the company's stock worth $84,388,000 after purchasing an additional 1,376,231 shares during the period. Barings LLC bought a new stake in Wheaton Precious Metals during the second quarter worth approximately $65,405,000. TD Asset Management Inc boosted its position in Wheaton Precious Metals by 22.5% during the second quarter. TD Asset Management Inc now owns 5,950,317 shares of the company's stock worth $311,920,000 after purchasing an additional 1,092,480 shares during the period. Finally, Price T Rowe Associates Inc. MD boosted its position in shares of Wheaton Precious Metals by 16.0% in the first quarter. Price T Rowe Associates Inc. MD now owns 7,309,175 shares of the company's stock valued at $344,483,000 after acquiring an additional 1,010,307 shares during the period. Institutional investors own 70.34% of the company's stock.

Wheaton Precious Metals Stock Up 0.5 %

Wheaton Precious Metals stock traded up $0.34 during mid-day trading on Friday, reaching $63.82. 5,675,414 shares of the company's stock were exchanged, compared to its average volume of 1,785,925. The firm has a market capitalization of $28.95 billion, a PE ratio of 47.57, a P/E/G ratio of 2.28 and a beta of 0.77. The business's fifty day simple moving average is $62.99 and its 200 day simple moving average is $59.06. Wheaton Precious Metals Corp. has a one year low of $38.57 and a one year high of $68.64.

Wheaton Precious Metals (NYSE:WPM - Get Free Report) last posted its earnings results on Friday, November 8th. The company reported $0.34 EPS for the quarter, hitting the consensus estimate of $0.34. Wheaton Precious Metals had a return on equity of 8.85% and a net margin of 50.05%. The business had revenue of $308.25 million during the quarter, compared to analysts' expectations of $324.57 million. During the same period in the previous year, the business earned $0.27 earnings per share. On average, sell-side analysts forecast that Wheaton Precious Metals Corp. will post 1.44 earnings per share for the current year.

Wheaton Precious Metals Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Thursday, November 21st will be given a dividend of $0.155 per share. This represents a $0.62 dividend on an annualized basis and a yield of 0.97%. The ex-dividend date of this dividend is Thursday, November 21st. Wheaton Precious Metals's payout ratio is 46.27%.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on WPM. National Bank Financial raised Wheaton Precious Metals from a "sector perform" rating to an "outperform" rating in a research report on Thursday, October 10th. Jefferies Financial Group raised their target price on Wheaton Precious Metals from $67.00 to $77.00 and gave the company a "buy" rating in a research note on Friday, October 4th. UBS Group began coverage on Wheaton Precious Metals in a research note on Monday. They issued a "buy" rating and a $78.00 target price for the company. TD Securities lifted their price objective on Wheaton Precious Metals from $74.00 to $75.00 and gave the stock a "buy" rating in a research report on Friday, November 8th. Finally, Stifel Canada cut Wheaton Precious Metals from a "strong-buy" rating to a "hold" rating in a report on Monday, October 21st. One equities research analyst has rated the stock with a hold rating and nine have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $71.67.

Read Our Latest Stock Analysis on Wheaton Precious Metals

About Wheaton Precious Metals

(

Free Report)

Wheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 2017. Wheaton Precious Metals Corp.

Further Reading

Before you consider Wheaton Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wheaton Precious Metals wasn't on the list.

While Wheaton Precious Metals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.