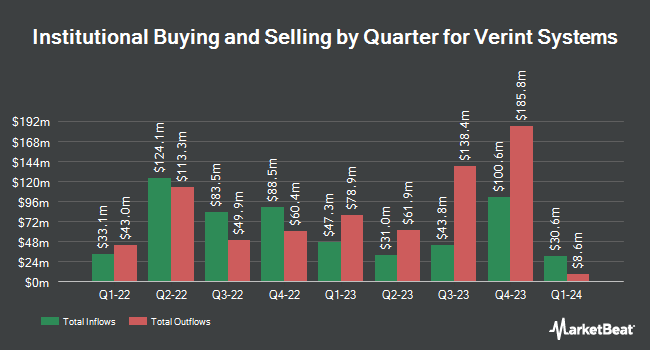

Massachusetts Financial Services Co. MA cut its stake in Verint Systems Inc. (NASDAQ:VRNT - Free Report) by 31.1% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 850,847 shares of the technology company's stock after selling 383,823 shares during the period. Massachusetts Financial Services Co. MA owned about 1.37% of Verint Systems worth $21,552,000 at the end of the most recent reporting period.

A number of other large investors have also recently bought and sold shares of VRNT. Vanguard Group Inc. lifted its holdings in Verint Systems by 2.6% during the 1st quarter. Vanguard Group Inc. now owns 7,367,685 shares of the technology company's stock valued at $244,239,000 after purchasing an additional 185,105 shares during the last quarter. Price T Rowe Associates Inc. MD grew its position in Verint Systems by 46.5% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 104,984 shares of the technology company's stock worth $3,481,000 after acquiring an additional 33,303 shares during the last quarter. Comerica Bank increased its holdings in Verint Systems by 572.8% during the 1st quarter. Comerica Bank now owns 44,694 shares of the technology company's stock valued at $1,482,000 after purchasing an additional 38,051 shares in the last quarter. Teachers Retirement System of The State of Kentucky acquired a new position in Verint Systems in the first quarter worth $1,388,000. Finally, SG Americas Securities LLC grew its holdings in shares of Verint Systems by 282.1% during the second quarter. SG Americas Securities LLC now owns 14,767 shares of the technology company's stock worth $475,000 after purchasing an additional 10,902 shares during the last quarter. 94.95% of the stock is currently owned by institutional investors.

Verint Systems Trading Down 1.7 %

VRNT traded down $0.43 during midday trading on Tuesday, reaching $24.39. 356,545 shares of the company were exchanged, compared to its average volume of 670,635. The stock has a market capitalization of $1.51 billion, a P/E ratio of 36.40, a PEG ratio of 1.03 and a beta of 1.25. Verint Systems Inc. has a one year low of $21.27 and a one year high of $38.17. The stock's 50-day simple moving average is $23.72 and its 200 day simple moving average is $29.20. The company has a debt-to-equity ratio of 0.49, a quick ratio of 1.36 and a current ratio of 1.41.

Verint Systems (NASDAQ:VRNT - Get Free Report) last issued its quarterly earnings data on Wednesday, September 4th. The technology company reported $0.49 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.53 by ($0.04). The firm had revenue of $210.17 million for the quarter, compared to analyst estimates of $212.81 million. Verint Systems had a net margin of 6.78% and a return on equity of 16.17%. The firm's revenue for the quarter was up .0% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $0.22 EPS. As a group, analysts forecast that Verint Systems Inc. will post 1.97 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of research analysts recently issued reports on the company. Wedbush reaffirmed an "outperform" rating and issued a $38.00 price target on shares of Verint Systems in a report on Thursday, September 26th. Jefferies Financial Group reduced their target price on shares of Verint Systems from $32.00 to $28.00 and set a "hold" rating on the stock in a research report on Thursday, September 5th. Evercore ISI lowered their price target on shares of Verint Systems from $34.00 to $30.00 and set an "in-line" rating for the company in a report on Thursday, September 5th. Royal Bank of Canada restated an "outperform" rating and set a $36.00 target price on shares of Verint Systems in a research report on Thursday, September 5th. Finally, Needham & Company LLC reaffirmed a "buy" rating and set a $40.00 price target on shares of Verint Systems in a research note on Wednesday, September 25th. Three analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $34.67.

Check Out Our Latest Research Report on Verint Systems

Insiders Place Their Bets

In other news, CFO Grant A. Highlander sold 3,389 shares of the company's stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $25.85, for a total value of $87,605.65. Following the completion of the transaction, the chief financial officer now owns 131,267 shares in the company, valued at $3,393,251.95. This represents a 2.52 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Dan Bodner sold 16,932 shares of the company's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $25.85, for a total value of $437,692.20. Following the transaction, the chief executive officer now directly owns 592,832 shares of the company's stock, valued at $15,324,707.20. This represents a 2.78 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 33,811 shares of company stock worth $874,014. Corporate insiders own 1.70% of the company's stock.

About Verint Systems

(

Free Report)

Verint Systems Inc provides customer engagement solutions worldwide. It offers forecasting and scheduling, channels and routing, knowledge management, fraud and security solutions, quality and compliance, analytics and insights, real-time assistance, self-services, financial compliance, and voice pf the consumer solutions.

Further Reading

Before you consider Verint Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verint Systems wasn't on the list.

While Verint Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.