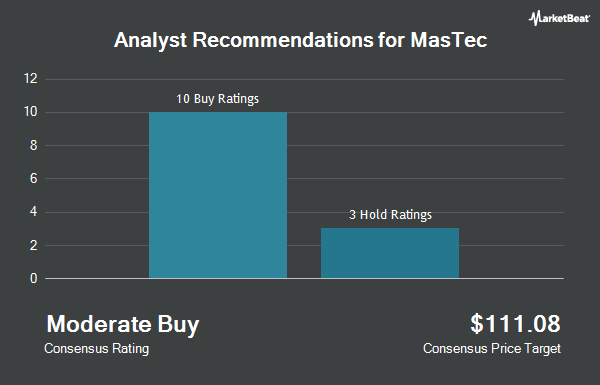

MasTec, Inc. (NYSE:MTZ - Get Free Report) has been assigned an average rating of "Moderate Buy" from the thirteen research firms that are currently covering the stock, MarketBeat reports. Two analysts have rated the stock with a hold recommendation and eleven have assigned a buy recommendation to the company. The average 1-year target price among analysts that have updated their coverage on the stock in the last year is $148.62.

Several research analysts have recently issued reports on MTZ shares. UBS Group upped their price objective on MasTec from $129.00 to $147.00 and gave the company a "buy" rating in a research note on Wednesday, October 23rd. Robert W. Baird upped their price target on shares of MasTec from $120.00 to $153.00 and gave the company a "neutral" rating in a research report on Monday, November 4th. The Goldman Sachs Group lifted their price target on shares of MasTec from $115.00 to $130.00 and gave the stock a "neutral" rating in a report on Wednesday, October 9th. B. Riley restated a "buy" rating and issued a $166.00 price objective (up from $151.00) on shares of MasTec in a report on Tuesday, November 5th. Finally, JPMorgan Chase & Co. began coverage on MasTec in a report on Monday, October 7th. They set an "overweight" rating and a $153.00 target price on the stock.

Get Our Latest Report on MTZ

MasTec Price Performance

MTZ stock traded down $0.49 during midday trading on Friday, reaching $144.06. 557,516 shares of the stock were exchanged, compared to its average volume of 857,561. MasTec has a 52 week low of $57.38 and a 52 week high of $150.12. The company has a fifty day moving average price of $131.53 and a 200 day moving average price of $116.34. The company has a debt-to-equity ratio of 0.76, a current ratio of 1.24 and a quick ratio of 1.20. The stock has a market capitalization of $11.41 billion, a PE ratio of 128.63 and a beta of 1.70.

Insider Activity at MasTec

In related news, COO Robert E. Apple sold 800 shares of the firm's stock in a transaction dated Monday, October 7th. The stock was sold at an average price of $130.04, for a total value of $104,032.00. Following the sale, the chief operating officer now directly owns 216,402 shares of the company's stock, valued at $28,140,916.08. This trade represents a 0.37 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director C Robert Campbell sold 3,000 shares of the company's stock in a transaction on Wednesday, September 18th. The stock was sold at an average price of $116.26, for a total transaction of $348,780.00. Following the completion of the transaction, the director now owns 48,173 shares of the company's stock, valued at $5,600,592.98. This trade represents a 5.86 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 55,823 shares of company stock worth $7,493,301. Corporate insiders own 21.30% of the company's stock.

Hedge Funds Weigh In On MasTec

Institutional investors and hedge funds have recently made changes to their positions in the business. Pacer Advisors Inc. raised its stake in MasTec by 65.6% during the 3rd quarter. Pacer Advisors Inc. now owns 2,260,865 shares of the construction company's stock valued at $278,312,000 after buying an additional 895,227 shares during the last quarter. State Street Corp grew its holdings in shares of MasTec by 1.4% in the third quarter. State Street Corp now owns 1,823,967 shares of the construction company's stock worth $224,530,000 after acquiring an additional 24,522 shares during the period. Hood River Capital Management LLC increased its position in MasTec by 59.8% during the second quarter. Hood River Capital Management LLC now owns 1,194,250 shares of the construction company's stock valued at $127,773,000 after acquiring an additional 446,762 shares during the last quarter. Geode Capital Management LLC lifted its holdings in MasTec by 1.7% in the third quarter. Geode Capital Management LLC now owns 1,026,295 shares of the construction company's stock valued at $126,370,000 after acquiring an additional 16,844 shares during the period. Finally, Point72 Asset Management L.P. lifted its holdings in MasTec by 57.7% in the third quarter. Point72 Asset Management L.P. now owns 764,389 shares of the construction company's stock valued at $94,096,000 after acquiring an additional 279,778 shares during the period. Institutional investors own 78.10% of the company's stock.

About MasTec

(

Get Free ReportMasTec, Inc, an infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada. It operates through five segments: Communications, Clean Energy and Infrastructure, Oil and Gas, Power Delivery, and Other.

Featured Articles

Before you consider MasTec, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MasTec wasn't on the list.

While MasTec currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.