Zurcher Kantonalbank Zurich Cantonalbank trimmed its stake in shares of MasTec, Inc. (NYSE:MTZ - Free Report) by 3.6% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 111,674 shares of the construction company's stock after selling 4,174 shares during the quarter. Zurcher Kantonalbank Zurich Cantonalbank owned about 0.14% of MasTec worth $13,747,000 as of its most recent filing with the Securities and Exchange Commission.

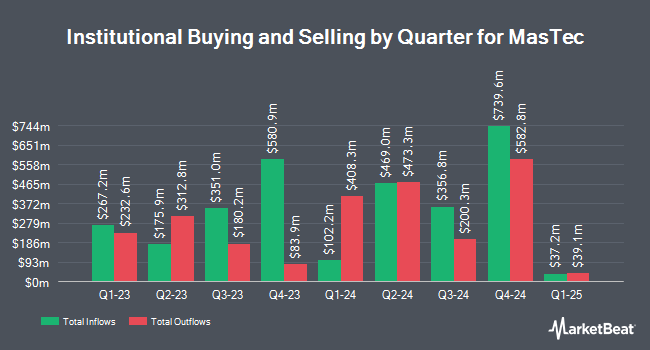

Other hedge funds and other institutional investors also recently modified their holdings of the company. Swedbank AB acquired a new stake in MasTec in the first quarter valued at about $5,287,000. Boston Partners purchased a new position in shares of MasTec during the 1st quarter worth approximately $748,000. Texas Permanent School Fund Corp lifted its holdings in shares of MasTec by 8.9% in the 2nd quarter. Texas Permanent School Fund Corp now owns 57,522 shares of the construction company's stock valued at $6,154,000 after buying an additional 4,716 shares during the period. Makena Capital Management LLC boosted its stake in shares of MasTec by 41.4% in the third quarter. Makena Capital Management LLC now owns 87,146 shares of the construction company's stock valued at $10,728,000 after buying an additional 25,532 shares in the last quarter. Finally, Dynamic Technology Lab Private Ltd acquired a new position in MasTec during the third quarter worth $1,470,000. 78.10% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at MasTec

In other news, COO Robert E. Apple sold 800 shares of the business's stock in a transaction on Monday, October 7th. The shares were sold at an average price of $130.04, for a total transaction of $104,032.00. Following the completion of the sale, the chief operating officer now directly owns 216,402 shares of the company's stock, valued at $28,140,916.08. The trade was a 0.37 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director C Robert Campbell sold 3,000 shares of the company's stock in a transaction on Wednesday, September 18th. The stock was sold at an average price of $116.26, for a total value of $348,780.00. Following the sale, the director now owns 48,173 shares of the company's stock, valued at approximately $5,600,592.98. The trade was a 5.86 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 55,823 shares of company stock worth $7,493,301. Insiders own 21.30% of the company's stock.

MasTec Trading Down 0.3 %

Shares of NYSE MTZ traded down $0.49 during midday trading on Friday, reaching $144.06. 557,516 shares of the stock were exchanged, compared to its average volume of 970,256. The stock has a 50 day moving average price of $131.53 and a 200-day moving average price of $116.40. The company has a current ratio of 1.24, a quick ratio of 1.20 and a debt-to-equity ratio of 0.76. The company has a market capitalization of $11.42 billion, a P/E ratio of 128.63 and a beta of 1.70. MasTec, Inc. has a 52-week low of $57.38 and a 52-week high of $150.12.

Wall Street Analysts Forecast Growth

Several equities research analysts have commented on the stock. UBS Group boosted their target price on shares of MasTec from $129.00 to $147.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. DA Davidson upped their target price on shares of MasTec from $120.00 to $125.00 and gave the stock a "buy" rating in a research report on Monday, August 5th. Stifel Nicolaus lifted their price target on shares of MasTec from $121.00 to $150.00 and gave the company a "buy" rating in a research report on Thursday, October 10th. The Goldman Sachs Group upped their price target on MasTec from $115.00 to $130.00 and gave the stock a "neutral" rating in a report on Wednesday, October 9th. Finally, TD Cowen raised their price objective on MasTec from $115.00 to $160.00 and gave the company a "buy" rating in a research note on Monday, November 4th. Two equities research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company's stock. According to data from MarketBeat.com, MasTec has a consensus rating of "Moderate Buy" and a consensus price target of $148.62.

View Our Latest Research Report on MTZ

MasTec Company Profile

(

Free Report)

MasTec, Inc, an infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada. It operates through five segments: Communications, Clean Energy and Infrastructure, Oil and Gas, Power Delivery, and Other.

Featured Stories

Before you consider MasTec, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MasTec wasn't on the list.

While MasTec currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.