Bank of Montreal Can lifted its holdings in shares of Mastercard Incorporated (NYSE:MA - Free Report) by 51.7% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 5,765,714 shares of the credit services provider's stock after acquiring an additional 1,965,782 shares during the quarter. Mastercard makes up 1.3% of Bank of Montreal Can's portfolio, making the stock its 10th biggest position. Bank of Montreal Can owned 0.63% of Mastercard worth $2,846,187,000 as of its most recent SEC filing.

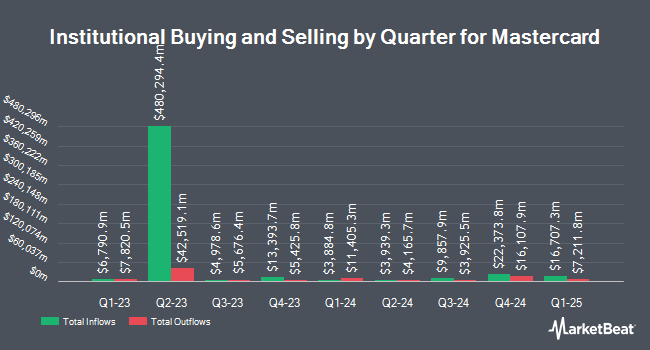

A number of other hedge funds and other institutional investors also recently made changes to their positions in MA. Highline Wealth Partners LLC purchased a new stake in Mastercard in the third quarter worth $25,000. Strategic Investment Solutions Inc. IL purchased a new stake in shares of Mastercard in the second quarter worth $34,000. First Personal Financial Services purchased a new stake in shares of Mastercard in the third quarter worth $39,000. Fairway Wealth LLC purchased a new stake in shares of Mastercard in the second quarter worth $35,000. Finally, Lowe Wealth Advisors LLC grew its stake in shares of Mastercard by 74.0% in the third quarter. Lowe Wealth Advisors LLC now owns 87 shares of the credit services provider's stock worth $43,000 after acquiring an additional 37 shares during the last quarter. Institutional investors own 97.28% of the company's stock.

Wall Street Analysts Forecast Growth

MA has been the topic of several recent analyst reports. Oppenheimer initiated coverage on Mastercard in a research report on Tuesday, October 1st. They set an "outperform" rating and a $591.00 price objective on the stock. Argus raised Mastercard to a "strong-buy" rating in a report on Thursday, August 1st. BNP Paribas downgraded Mastercard from an "outperform" rating to a "neutral" rating and set a $470.00 target price on the stock. in a report on Tuesday, September 3rd. Deutsche Bank Aktiengesellschaft increased their target price on Mastercard from $510.00 to $580.00 and gave the company a "buy" rating in a report on Friday, November 1st. Finally, BMO Capital Markets increased their target price on Mastercard from $550.00 to $565.00 and gave the company an "outperform" rating in a report on Thursday, November 14th. Four research analysts have rated the stock with a hold rating, twenty-two have assigned a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $549.16.

Get Our Latest Stock Analysis on MA

Insider Buying and Selling

In other Mastercard news, CMO Venkata R. Madabhushi sold 4,685 shares of the stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $489.86, for a total transaction of $2,294,994.10. Following the transaction, the chief marketing officer now owns 15,031 shares in the company, valued at approximately $7,363,085.66. This represents a 23.76 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 0.10% of the stock is owned by corporate insiders.

Mastercard Stock Performance

Shares of MA stock traded up $5.74 during mid-day trading on Monday, reaching $526.60. The stock had a trading volume of 4,503,001 shares, compared to its average volume of 2,467,999. The business's fifty day moving average is $507.49 and its 200-day moving average is $474.33. The company has a current ratio of 1.29, a quick ratio of 1.29 and a debt-to-equity ratio of 2.36. The firm has a market cap of $483.33 billion, a price-to-earnings ratio of 39.83, a PEG ratio of 2.32 and a beta of 1.10. Mastercard Incorporated has a 1-year low of $404.32 and a 1-year high of $534.03.

Mastercard (NYSE:MA - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The credit services provider reported $3.89 earnings per share for the quarter, beating analysts' consensus estimates of $3.73 by $0.16. The business had revenue of $7.37 billion for the quarter, compared to analyst estimates of $7.27 billion. Mastercard had a return on equity of 178.27% and a net margin of 45.26%. The company's revenue was up 12.8% on a year-over-year basis. During the same period in the prior year, the company earned $3.39 earnings per share. On average, research analysts forecast that Mastercard Incorporated will post 14.47 earnings per share for the current year.

Mastercard Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, November 8th. Investors of record on Wednesday, October 9th were issued a dividend of $0.66 per share. This represents a $2.64 annualized dividend and a yield of 0.50%. The ex-dividend date was Wednesday, October 9th. Mastercard's dividend payout ratio (DPR) is 19.97%.

Mastercard Profile

(

Free Report)

Mastercard Incorporated, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. The company offers integrated products and value-added services for account holders, merchants, financial institutions, digital partners, businesses, governments, and other organizations, such as programs that enable issuers to provide consumers with credits to defer payments; payment products and solutions that allow its customers to access funds in deposit and other accounts; prepaid programs services; and commercial credit, debit, and prepaid payment products and solutions.

Featured Articles

Before you consider Mastercard, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mastercard wasn't on the list.

While Mastercard currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.