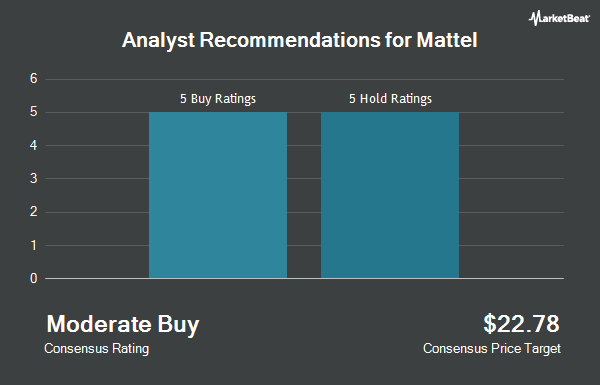

Mattel, Inc. (NASDAQ:MAT - Get Free Report) has been given an average rating of "Hold" by the nine brokerages that are currently covering the stock, MarketBeat reports. Five analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average 12 month target price among brokerages that have issued a report on the stock in the last year is $23.75.

Several brokerages recently issued reports on MAT. Jefferies Financial Group increased their price objective on Mattel from $18.25 to $20.00 and gave the stock a "hold" rating in a report on Tuesday, October 1st. StockNews.com cut Mattel from a "buy" rating to a "hold" rating in a research note on Thursday, October 24th. Morgan Stanley raised their price objective on shares of Mattel from $21.00 to $22.00 and gave the company an "equal weight" rating in a research report on Thursday, October 24th. Bank of America boosted their target price on shares of Mattel from $26.00 to $28.00 and gave the stock a "buy" rating in a research report on Thursday, October 24th. Finally, JPMorgan Chase & Co. raised their price target on shares of Mattel from $22.00 to $23.00 and gave the company a "neutral" rating in a report on Monday, October 21st.

Get Our Latest Stock Analysis on Mattel

Mattel Stock Up 2.0 %

Mattel stock traded up $0.38 during mid-day trading on Monday, hitting $19.07. The company's stock had a trading volume of 4,703,254 shares, compared to its average volume of 3,239,684. Mattel has a 52-week low of $15.87 and a 52-week high of $20.59. The company has a market cap of $6.42 billion, a PE ratio of 11.68, a price-to-earnings-growth ratio of 0.96 and a beta of 0.78. The company has a debt-to-equity ratio of 1.01, a current ratio of 2.45 and a quick ratio of 1.88. The firm's 50 day moving average is $19.09 and its 200 day moving average is $18.39.

Mattel (NASDAQ:MAT - Get Free Report) last posted its quarterly earnings results on Wednesday, October 23rd. The company reported $1.14 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.95 by $0.19. The business had revenue of $1.84 billion during the quarter, compared to analyst estimates of $1.86 billion. Mattel had a net margin of 10.24% and a return on equity of 25.39%. The firm's revenue was down 3.9% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.08 earnings per share. On average, analysts anticipate that Mattel will post 1.46 earnings per share for the current year.

Hedge Funds Weigh In On Mattel

Hedge funds and other institutional investors have recently made changes to their positions in the company. UMB Bank n.a. raised its stake in Mattel by 584.3% during the 3rd quarter. UMB Bank n.a. now owns 1,485 shares of the company's stock worth $28,000 after buying an additional 1,268 shares during the period. V Square Quantitative Management LLC acquired a new position in shares of Mattel in the 3rd quarter valued at approximately $29,000. GAMMA Investing LLC increased its stake in Mattel by 108.5% during the 2nd quarter. GAMMA Investing LLC now owns 2,022 shares of the company's stock worth $33,000 after purchasing an additional 1,052 shares in the last quarter. Blue Trust Inc. raised its holdings in Mattel by 143.2% during the 2nd quarter. Blue Trust Inc. now owns 2,072 shares of the company's stock worth $34,000 after buying an additional 1,220 shares during the period. Finally, Prospera Private Wealth LLC bought a new position in Mattel in the third quarter valued at approximately $34,000. 97.15% of the stock is owned by institutional investors.

Mattel Company Profile

(

Get Free ReportMattel, Inc, a toy and family entertainment company, designs, manufactures, and markets toys and consumer products in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific. The company operates through North America, International, and American Girl segments. It offers dolls and accessories, as well as books, content, gaming, and lifestyle products for children under the Barbie, American Girl, Disney Princess and Disney Frozen, Monster High, and Polly Pocket brands; die-cast vehicles, tracks, playsets, and accessories for kids, adults, and collectors under the Hot Wheels, Hot Wheels Monster Trucks, Hot Wheels Mario Kart, Matchbox, and Cars brand names; and infant, toddler, and preschool products comprising content, toys, live events, and other consumer products under the Fisher-Price, Little People and Imaginext, and Thomas & Friends, and Power wheels brands.

Recommended Stories

Before you consider Mattel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mattel wasn't on the list.

While Mattel currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.