Mattel (NASDAQ:MAT - Get Free Report) was upgraded by investment analysts at StockNews.com from a "hold" rating to a "buy" rating in a report released on Wednesday.

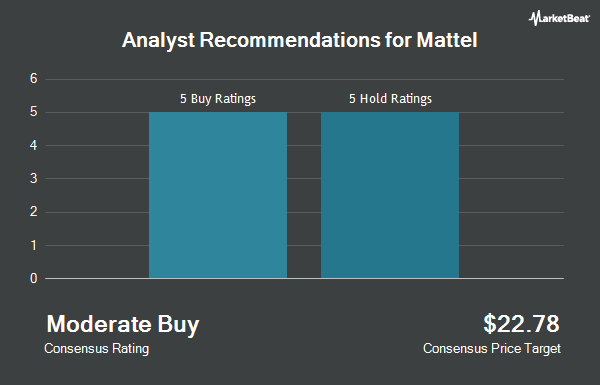

A number of other equities analysts have also commented on MAT. Jefferies Financial Group upgraded Mattel from a "hold" rating to a "buy" rating and lifted their target price for the stock from $20.00 to $28.00 in a report on Wednesday, February 5th. DA Davidson boosted their price objective on Mattel from $27.00 to $30.00 and gave the stock a "buy" rating in a research report on Wednesday, February 5th. Finally, Morgan Stanley upped their price target on Mattel from $22.00 to $23.00 and gave the company an "equal weight" rating in a research report on Wednesday, February 5th. Three investment analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat.com, Mattel has a consensus rating of "Moderate Buy" and an average target price of $25.57.

View Our Latest Stock Report on MAT

Mattel Trading Down 1.0 %

NASDAQ MAT opened at $20.66 on Wednesday. Mattel has a 12 month low of $15.87 and a 12 month high of $22.07. The stock has a 50 day moving average of $19.77 and a 200-day moving average of $19.22. The company has a current ratio of 2.38, a quick ratio of 2.00 and a debt-to-equity ratio of 1.03. The company has a market cap of $6.88 billion, a PE ratio of 12.91, a PEG ratio of 2.35 and a beta of 0.65.

Mattel (NASDAQ:MAT - Get Free Report) last issued its quarterly earnings results on Tuesday, February 4th. The company reported $0.35 EPS for the quarter, topping analysts' consensus estimates of $0.20 by $0.15. Mattel had a return on equity of 25.94% and a net margin of 10.07%. During the same period in the previous year, the company earned $0.29 EPS. On average, equities research analysts anticipate that Mattel will post 1.7 EPS for the current fiscal year.

Institutional Investors Weigh In On Mattel

Institutional investors have recently added to or reduced their stakes in the company. EdgePoint Investment Group Inc. increased its stake in shares of Mattel by 14.9% in the 4th quarter. EdgePoint Investment Group Inc. now owns 46,174,919 shares of the company's stock worth $818,681,000 after acquiring an additional 5,984,400 shares in the last quarter. Franklin Resources Inc. boosted its holdings in shares of Mattel by 84.0% in the third quarter. Franklin Resources Inc. now owns 9,352,223 shares of the company's stock worth $176,757,000 after buying an additional 4,270,162 shares during the last quarter. Norges Bank purchased a new position in shares of Mattel in the fourth quarter worth approximately $54,929,000. Hennessy Advisors Inc. purchased a new position in Mattel during the fourth quarter valued at approximately $53,238,000. Finally, Invesco Ltd. lifted its holdings in Mattel by 468.3% during the fourth quarter. Invesco Ltd. now owns 3,394,958 shares of the company's stock valued at $60,193,000 after purchasing an additional 2,797,559 shares in the last quarter. Hedge funds and other institutional investors own 97.15% of the company's stock.

Mattel Company Profile

(

Get Free Report)

Mattel, Inc, a toy and family entertainment company, designs, manufactures, and markets toys and consumer products in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific. The company operates through North America, International, and American Girl segments. It offers dolls and accessories, as well as books, content, gaming, and lifestyle products for children under the Barbie, American Girl, Disney Princess and Disney Frozen, Monster High, and Polly Pocket brands; die-cast vehicles, tracks, playsets, and accessories for kids, adults, and collectors under the Hot Wheels, Hot Wheels Monster Trucks, Hot Wheels Mario Kart, Matchbox, and Cars brand names; and infant, toddler, and preschool products comprising content, toys, live events, and other consumer products under the Fisher-Price, Little People and Imaginext, and Thomas & Friends, and Power wheels brands.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Mattel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mattel wasn't on the list.

While Mattel currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.