Maverick Capital Ltd. increased its holdings in Pinterest, Inc. (NYSE:PINS - Free Report) by 47.6% in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 57,180 shares of the company's stock after purchasing an additional 18,430 shares during the period. Maverick Capital Ltd.'s holdings in Pinterest were worth $1,851,000 as of its most recent SEC filing.

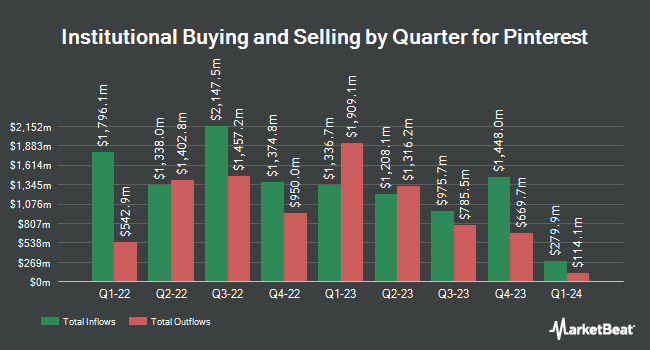

A number of other large investors also recently added to or reduced their stakes in the business. Southpoint Capital Advisors LP purchased a new stake in shares of Pinterest during the third quarter valued at approximately $123,006,000. Ontario Teachers Pension Plan Board boosted its position in Pinterest by 51.5% during the 3rd quarter. Ontario Teachers Pension Plan Board now owns 8,812,117 shares of the company's stock valued at $285,248,000 after buying an additional 2,996,750 shares during the period. 1832 Asset Management L.P. bought a new stake in Pinterest in the 2nd quarter worth $98,655,000. Ninety One UK Ltd grew its holdings in Pinterest by 44.6% in the 2nd quarter. Ninety One UK Ltd now owns 5,445,674 shares of the company's stock worth $239,991,000 after acquiring an additional 1,679,348 shares during the last quarter. Finally, Acadian Asset Management LLC increased its position in shares of Pinterest by 31.6% in the second quarter. Acadian Asset Management LLC now owns 5,645,845 shares of the company's stock valued at $248,793,000 after acquiring an additional 1,356,459 shares during the period. Hedge funds and other institutional investors own 88.81% of the company's stock.

Pinterest Price Performance

Shares of Pinterest stock remained flat at $30.32 during trading hours on Friday. The company's stock had a trading volume of 3,510,815 shares, compared to its average volume of 13,099,546. Pinterest, Inc. has a 1-year low of $27.00 and a 1-year high of $45.19. The company has a market capitalization of $20.49 billion, a price-to-earnings ratio of 101.07, a price-to-earnings-growth ratio of 2.17 and a beta of 1.02. The business's 50 day moving average is $31.80 and its 200 day moving average is $35.35.

Insider Activity

In related news, Director Gokul Rajaram sold 1,150 shares of the stock in a transaction that occurred on Wednesday, October 16th. The shares were sold at an average price of $33.52, for a total value of $38,548.00. Following the completion of the sale, the director now directly owns 33,686 shares of the company's stock, valued at approximately $1,129,154.72. This represents a 3.30 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, insider Wanjiku Juanita Walcott sold 11,862 shares of the company's stock in a transaction that occurred on Wednesday, November 27th. The stock was sold at an average price of $30.82, for a total transaction of $365,586.84. Following the completion of the transaction, the insider now owns 246,921 shares of the company's stock, valued at approximately $7,610,105.22. The trade was a 4.58 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 48,287 shares of company stock valued at $1,547,820 in the last 90 days. Company insiders own 7.11% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have recently issued reports on the company. Benchmark reissued a "hold" rating on shares of Pinterest in a research note on Friday, November 8th. Rosenblatt Securities decreased their price objective on shares of Pinterest from $48.00 to $46.00 and set a "buy" rating for the company in a report on Friday, November 8th. KeyCorp dropped their target price on shares of Pinterest from $45.00 to $39.00 and set an "overweight" rating for the company in a research report on Monday, November 11th. TD Cowen assumed coverage on shares of Pinterest in a research report on Tuesday, November 26th. They set a "buy" rating and a $38.00 price target on the stock. Finally, Robert W. Baird lowered their price objective on shares of Pinterest from $41.00 to $36.00 and set an "outperform" rating for the company in a report on Friday, November 8th. Seven analysts have rated the stock with a hold rating, twenty have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $41.65.

View Our Latest Analysis on PINS

About Pinterest

(

Free Report)

Pinterest, Inc operates as a visual search and discovery platform in the United States and internationally. Its platform allows people to find ideas, such as recipes, home and style inspiration, and others; and to search, save, and shop the ideas. The company was formerly known as Cold Brew Labs Inc and changed its name to Pinterest, Inc in April 2012.

Recommended Stories

Before you consider Pinterest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinterest wasn't on the list.

While Pinterest currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.