Mawer Investment Management Ltd. reduced its position in shares of SharkNinja, Inc. (NYSE:SN - Free Report) by 3.5% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 284,385 shares of the company's stock after selling 10,176 shares during the quarter. Mawer Investment Management Ltd. owned 0.20% of SharkNinja worth $30,915,000 at the end of the most recent quarter.

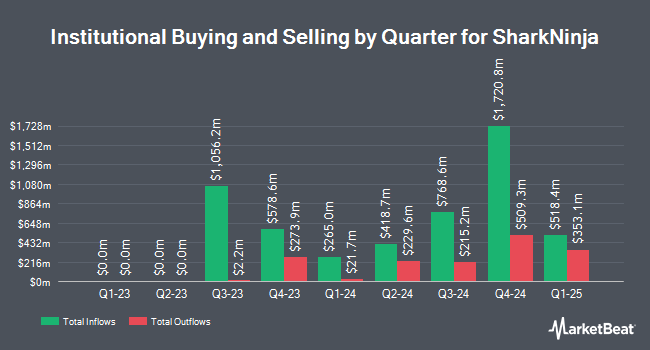

Other hedge funds also recently modified their holdings of the company. Signaturefd LLC lifted its position in shares of SharkNinja by 104.6% in the third quarter. Signaturefd LLC now owns 356 shares of the company's stock worth $39,000 after buying an additional 182 shares during the last quarter. Hollencrest Capital Management acquired a new position in SharkNinja during the 3rd quarter worth $54,000. Waldron Private Wealth LLC acquired a new stake in shares of SharkNinja in the third quarter valued at about $65,000. Picton Mahoney Asset Management bought a new position in shares of SharkNinja in the second quarter worth about $70,000. Finally, Kessler Investment Group LLC bought a new stake in SharkNinja during the 2nd quarter valued at approximately $125,000. Hedge funds and other institutional investors own 34.77% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts have recently issued reports on the stock. Canaccord Genuity Group boosted their price objective on shares of SharkNinja from $126.00 to $128.00 and gave the stock a "buy" rating in a report on Friday, October 25th. JPMorgan Chase & Co. cut their target price on SharkNinja from $128.00 to $120.00 and set an "overweight" rating for the company in a research note on Friday, November 1st. Bank of America boosted their price target on shares of SharkNinja from $100.00 to $110.00 and gave the company a "buy" rating in a report on Tuesday, August 13th. Morgan Stanley lifted their target price on shares of SharkNinja from $80.00 to $93.00 and gave the company an "equal weight" rating in a research report on Friday, November 1st. Finally, The Goldman Sachs Group increased their price target on shares of SharkNinja from $102.00 to $123.00 and gave the stock a "buy" rating in a research report on Monday, October 21st. One equities research analyst has rated the stock with a hold rating and ten have assigned a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $110.85.

Check Out Our Latest Stock Report on SharkNinja

SharkNinja Price Performance

SN traded down $1.42 during trading on Monday, hitting $99.46. The company's stock had a trading volume of 1,415,056 shares, compared to its average volume of 1,209,616. The firm's 50 day moving average price is $104.40 and its two-hundred day moving average price is $87.64. The company has a quick ratio of 0.95, a current ratio of 1.67 and a debt-to-equity ratio of 0.42. SharkNinja, Inc. has a 12 month low of $44.97 and a 12 month high of $112.93. The stock has a market capitalization of $13.92 billion, a price-to-earnings ratio of 39.56, a price-to-earnings-growth ratio of 1.67 and a beta of 1.04.

SharkNinja (NYSE:SN - Get Free Report) last announced its earnings results on Thursday, October 31st. The company reported $1.21 earnings per share for the quarter, topping analysts' consensus estimates of $1.04 by $0.17. The company had revenue of $1.43 billion during the quarter, compared to the consensus estimate of $1.31 billion. SharkNinja had a net margin of 7.02% and a return on equity of 32.55%. The company's revenue was up 33.3% on a year-over-year basis. During the same period in the previous year, the firm posted $0.95 earnings per share. Sell-side analysts forecast that SharkNinja, Inc. will post 3.88 earnings per share for the current fiscal year.

SharkNinja Company Profile

(

Free Report)

SharkNinja, Inc, a product design and technology company, engages in the provision of various solutions for consumers worldwide. It offers cleaning appliances, including corded and cordless vacuums, including handheld and robotic vacuums, as well as other floorcare products comprising steam mops, wet/dry cleaning floor products, and carpet extraction; cooking and beverage appliances, such as air fryers, multi-cookers, outdoor and countertop grills and ovens, coffee systems, carbonation, cookware, cutlery, kettles, toasters and bakeware; food preparation appliances comprising blenders, food processors, ice cream makers, and juicers; and beauty appliances, such as hair dryers and stylers, as well as home environment products comprising air purifiers and humidifiers.

Featured Articles

Before you consider SharkNinja, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SharkNinja wasn't on the list.

While SharkNinja currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.