CenterBook Partners LP increased its holdings in shares of MaxCyte, Inc. (NASDAQ:MXCT - Free Report) by 48.2% during the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 867,009 shares of the company's stock after acquiring an additional 281,923 shares during the period. CenterBook Partners LP owned approximately 0.82% of MaxCyte worth $3,607,000 as of its most recent SEC filing.

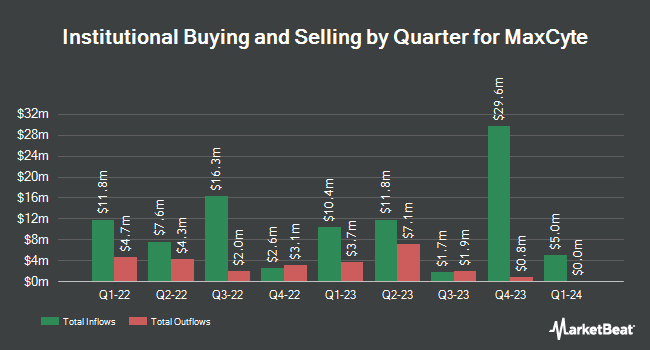

Several other institutional investors and hedge funds have also recently modified their holdings of the business. Franklin Resources Inc. purchased a new stake in shares of MaxCyte in the third quarter valued at approximately $260,000. Barclays PLC raised its position in MaxCyte by 329.3% during the third quarter. Barclays PLC now owns 165,765 shares of the company's stock worth $645,000 after acquiring an additional 127,156 shares during the period. Geode Capital Management LLC grew its position in shares of MaxCyte by 2.0% in the third quarter. Geode Capital Management LLC now owns 2,474,632 shares of the company's stock valued at $9,628,000 after purchasing an additional 47,960 shares during the period. State Street Corp raised its position in shares of MaxCyte by 5.1% during the 3rd quarter. State Street Corp now owns 2,269,135 shares of the company's stock worth $8,827,000 after purchasing an additional 111,066 shares during the last quarter. Finally, Rice Hall James & Associates LLC purchased a new position in MaxCyte in the 4th quarter valued at about $1,098,000. Hedge funds and other institutional investors own 68.81% of the company's stock.

MaxCyte Price Performance

Shares of MXCT stock traded up $0.10 on Tuesday, hitting $2.70. The stock had a trading volume of 1,013,223 shares, compared to its average volume of 529,169. The company's 50 day moving average price is $3.29 and its 200-day moving average price is $3.76. MaxCyte, Inc. has a 1 year low of $2.21 and a 1 year high of $5.26. The firm has a market capitalization of $287.05 million, a P/E ratio of -7.94 and a beta of 1.39.

Wall Street Analyst Weigh In

MXCT has been the subject of several research reports. Stifel Nicolaus dropped their price objective on shares of MaxCyte from $11.00 to $9.00 and set a "buy" rating for the company in a research note on Wednesday, March 12th. BTIG Research set a $6.00 price target on MaxCyte and gave the stock a "buy" rating in a report on Wednesday, March 12th.

View Our Latest Report on MXCT

MaxCyte Profile

(

Free Report)

MaxCyte, Inc, a life sciences company, discovers, develops, and commercializes next-generation cell therapies in the United States and internationally. Its products include ExPERT ATx, a static electroporation instrument for small to medium scale transfection; ExPERT STx, a flow electroporation for protein production and drug development, as well as expression of therapeutic targets for cell-based assays; ExPERT GTx, a flow electroporation for large scale transfection in therapeutic applications; and ExPERT VLx for very large volume cell-engineering.

Read More

Before you consider MaxCyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MaxCyte wasn't on the list.

While MaxCyte currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.