Mayflower Financial Advisors LLC lifted its stake in Klaviyo, Inc. (NYSE:KVYO - Free Report) by 181.4% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 684,948 shares of the company's stock after buying an additional 441,500 shares during the quarter. Klaviyo makes up about 3.6% of Mayflower Financial Advisors LLC's investment portfolio, making the stock its 2nd largest position. Mayflower Financial Advisors LLC owned about 0.26% of Klaviyo worth $24,233,000 as of its most recent filing with the SEC.

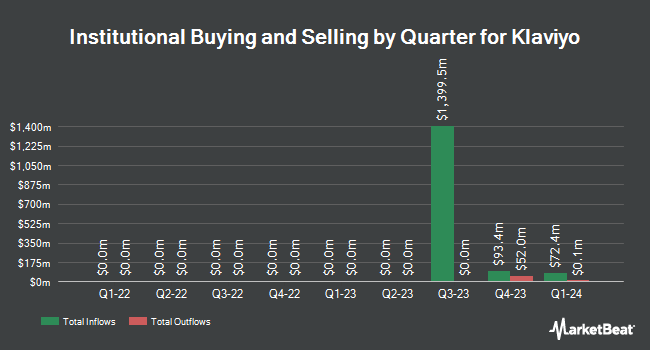

Several other hedge funds have also recently modified their holdings of KVYO. nVerses Capital LLC purchased a new stake in Klaviyo during the third quarter valued at $53,000. EntryPoint Capital LLC purchased a new stake in shares of Klaviyo in the first quarter valued at $71,000. SG Americas Securities LLC purchased a new stake in shares of Klaviyo in the second quarter valued at $236,000. William Marsh Rice University purchased a new stake in shares of Klaviyo in the third quarter valued at $245,000. Finally, Creative Planning purchased a new stake in shares of Klaviyo in the third quarter valued at $254,000. Hedge funds and other institutional investors own 45.43% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages have recently weighed in on KVYO. Robert W. Baird increased their target price on shares of Klaviyo from $42.00 to $45.00 and gave the company an "outperform" rating in a research note on Thursday. Benchmark reduced their target price on shares of Klaviyo from $42.00 to $40.00 and set a "buy" rating on the stock in a research note on Thursday. Canaccord Genuity Group increased their target price on shares of Klaviyo from $32.00 to $40.00 and gave the company a "buy" rating in a research note on Thursday. Barclays increased their target price on shares of Klaviyo from $32.00 to $41.00 and gave the company an "overweight" rating in a research note on Friday, October 11th. Finally, Piper Sandler upped their price target on shares of Klaviyo from $34.00 to $45.00 and gave the stock an "overweight" rating in a report on Friday, October 18th. Three research analysts have rated the stock with a hold rating and fifteen have assigned a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $39.00.

Get Our Latest Stock Report on Klaviyo

Klaviyo Price Performance

NYSE KVYO traded down $0.43 during trading on Friday, reaching $33.35. 2,299,979 shares of the company's stock traded hands, compared to its average volume of 895,890. The firm has a market cap of $8.89 billion, a price-to-earnings ratio of -185.27 and a beta of 1.13. The company's 50 day simple moving average is $35.21 and its two-hundred day simple moving average is $28.70. Klaviyo, Inc. has a 12-month low of $21.26 and a 12-month high of $41.00.

Klaviyo (NYSE:KVYO - Get Free Report) last posted its earnings results on Wednesday, November 6th. The company reported $0.15 EPS for the quarter, beating analysts' consensus estimates of $0.11 by $0.04. Klaviyo had a negative net margin of 5.23% and a positive return on equity of 0.87%. The business had revenue of $235.09 million for the quarter, compared to the consensus estimate of $226.33 million. During the same quarter last year, the firm posted ($1.24) EPS. The company's revenue for the quarter was up 33.7% on a year-over-year basis. Research analysts expect that Klaviyo, Inc. will post -0.01 earnings per share for the current fiscal year.

Insider Transactions at Klaviyo

In other news, CFO Amanda Whalen sold 10,000 shares of Klaviyo stock in a transaction that occurred on Friday, September 6th. The shares were sold at an average price of $29.72, for a total value of $297,200.00. Following the transaction, the chief financial officer now owns 422,813 shares of the company's stock, valued at $12,566,002.36. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. In related news, major shareholder Summit Partners L. P sold 242,601 shares of Klaviyo stock in a transaction that occurred on Friday, August 16th. The shares were sold at an average price of $31.78, for a total value of $7,709,859.78. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CFO Amanda Whalen sold 10,000 shares of Klaviyo stock in a transaction that occurred on Friday, September 6th. The stock was sold at an average price of $29.72, for a total transaction of $297,200.00. Following the completion of the sale, the chief financial officer now owns 422,813 shares of the company's stock, valued at $12,566,002.36. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 789,711 shares of company stock valued at $25,143,646 in the last 90 days. Insiders own 53.24% of the company's stock.

Klaviyo Profile

(

Free Report)

Klaviyo, Inc, a technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company offers Klaviyo, a cloud-native platform for data store, segmentation engine, campaigns and flows, and messaging infrastructure.

Featured Stories

Before you consider Klaviyo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Klaviyo wasn't on the list.

While Klaviyo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.