Retirement Systems of Alabama trimmed its position in McDonald's Co. (NYSE:MCD - Free Report) by 5.2% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 352,028 shares of the fast-food giant's stock after selling 19,156 shares during the quarter. Retirement Systems of Alabama's holdings in McDonald's were worth $107,196,000 at the end of the most recent reporting period.

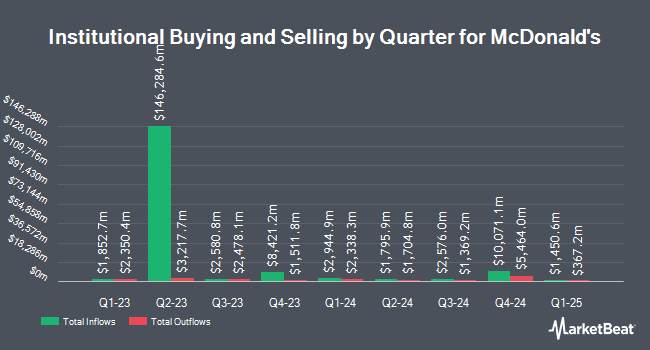

A number of other institutional investors have also added to or reduced their stakes in the business. Geode Capital Management LLC raised its stake in shares of McDonald's by 1.4% during the 3rd quarter. Geode Capital Management LLC now owns 15,916,980 shares of the fast-food giant's stock worth $4,833,510,000 after acquiring an additional 220,365 shares in the last quarter. Wellington Management Group LLP boosted its holdings in McDonald's by 0.9% in the third quarter. Wellington Management Group LLP now owns 15,082,894 shares of the fast-food giant's stock valued at $4,592,892,000 after purchasing an additional 128,800 shares during the last quarter. Legal & General Group Plc raised its position in McDonald's by 3.2% during the second quarter. Legal & General Group Plc now owns 6,149,080 shares of the fast-food giant's stock valued at $1,567,030,000 after acquiring an additional 188,888 shares in the last quarter. Charles Schwab Investment Management Inc. lifted its stake in shares of McDonald's by 0.9% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 5,564,359 shares of the fast-food giant's stock valued at $1,694,403,000 after purchasing an additional 49,106 shares during the period. Finally, Ameriprise Financial Inc. boosted its stake in shares of McDonald's by 8.0% during the 2nd quarter. Ameriprise Financial Inc. now owns 4,761,625 shares of the fast-food giant's stock worth $1,216,677,000 after acquiring an additional 354,196 shares in the last quarter. Hedge funds and other institutional investors own 70.29% of the company's stock.

Insider Transactions at McDonald's

In other news, CEO Christopher J. Kempczinski sold 11,727 shares of the business's stock in a transaction that occurred on Monday, September 23rd. The shares were sold at an average price of $300.03, for a total transaction of $3,518,451.81. Following the sale, the chief executive officer now owns 49,885 shares in the company, valued at $14,966,996.55. The trade was a 19.03 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Joseph M. Erlinger sold 1,099 shares of McDonald's stock in a transaction that occurred on Monday, September 23rd. The stock was sold at an average price of $298.57, for a total transaction of $328,128.43. Following the transaction, the insider now owns 11,484 shares in the company, valued at approximately $3,428,777.88. The trade was a 8.73 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 34,099 shares of company stock valued at $10,273,786 in the last three months. 0.23% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

MCD has been the subject of a number of research analyst reports. Wedbush reissued an "outperform" rating and set a $295.00 target price on shares of McDonald's in a report on Wednesday, October 23rd. BMO Capital Markets upped their price target on McDonald's from $315.00 to $335.00 and gave the company an "outperform" rating in a research note on Wednesday, October 30th. Truist Financial lowered their price objective on shares of McDonald's from $350.00 to $342.00 and set a "buy" rating for the company in a research report on Wednesday, October 30th. Bank of America lifted their target price on McDonald's from $321.00 to $324.00 and gave the company a "neutral" rating in a research report on Wednesday, October 30th. Finally, Baird R W cut McDonald's from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, October 23rd. Twelve research analysts have rated the stock with a hold rating and eighteen have given a buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $320.50.

Read Our Latest Stock Report on MCD

McDonald's Stock Performance

Shares of NYSE:MCD traded down $0.03 during trading on Friday, reaching $296.60. The company had a trading volume of 2,547,557 shares, compared to its average volume of 3,467,182. The firm's fifty day moving average is $299.03 and its 200 day moving average is $280.82. The firm has a market capitalization of $212.55 billion, a PE ratio of 26.04, a price-to-earnings-growth ratio of 3.94 and a beta of 0.73. McDonald's Co. has a twelve month low of $243.53 and a twelve month high of $317.90.

McDonald's (NYSE:MCD - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The fast-food giant reported $3.23 earnings per share for the quarter, beating the consensus estimate of $3.18 by $0.05. McDonald's had a net margin of 31.79% and a negative return on equity of 175.42%. The company had revenue of $6.87 billion during the quarter, compared to analyst estimates of $6.82 billion. During the same quarter last year, the firm posted $3.19 EPS. The business's revenue for the quarter was up 2.7% on a year-over-year basis. Equities analysts predict that McDonald's Co. will post 11.75 earnings per share for the current fiscal year.

McDonald's Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be given a dividend of $1.77 per share. This represents a $7.08 dividend on an annualized basis and a dividend yield of 2.39%. The ex-dividend date is Monday, December 2nd. This is an increase from McDonald's's previous quarterly dividend of $1.67. McDonald's's dividend payout ratio is 62.16%.

About McDonald's

(

Free Report)

McDonald's Corporation operates and franchises restaurants under the McDonald's brand in the United States and internationally. It offers food and beverages, including hamburgers and cheeseburgers, various chicken sandwiches, fries, shakes, desserts, sundaes, cookies, pies, soft drinks, coffee, and other beverages; and full or limited breakfast, as well as sells various other products during limited-time promotions.

Recommended Stories

Before you consider McDonald's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and McDonald's wasn't on the list.

While McDonald's currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report