MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH lessened its stake in Coca-Cola Europacific Partners PLC (NASDAQ:CCEP - Free Report) by 11.1% in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 81,112 shares of the company's stock after selling 10,151 shares during the period. MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH's holdings in Coca-Cola Europacific Partners were worth $6,205,000 at the end of the most recent reporting period.

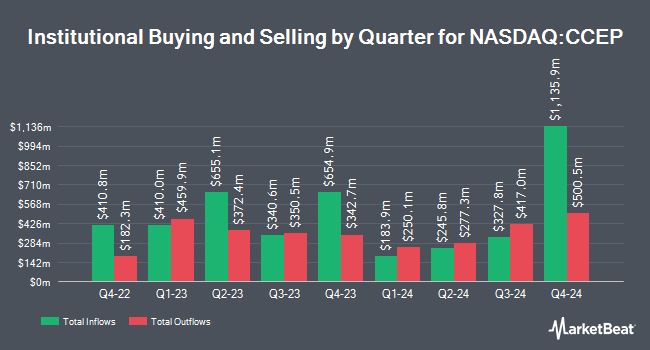

Other large investors have also recently added to or reduced their stakes in the company. Dimensional Fund Advisors LP lifted its holdings in Coca-Cola Europacific Partners by 126.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 51,892 shares of the company's stock worth $3,786,000 after buying an additional 28,951 shares during the last quarter. Pacer Advisors Inc. lifted its stake in Coca-Cola Europacific Partners by 1.2% during the second quarter. Pacer Advisors Inc. now owns 23,772 shares of the company's stock worth $1,732,000 after purchasing an additional 287 shares during the last quarter. EverSource Wealth Advisors LLC boosted its holdings in Coca-Cola Europacific Partners by 442.3% in the second quarter. EverSource Wealth Advisors LLC now owns 2,527 shares of the company's stock worth $186,000 after purchasing an additional 2,061 shares during the period. Marshall Wace LLP acquired a new stake in shares of Coca-Cola Europacific Partners during the second quarter worth $1,846,000. Finally, Point72 Asset Management L.P. lifted its position in shares of Coca-Cola Europacific Partners by 144.1% in the 2nd quarter. Point72 Asset Management L.P. now owns 1,204,721 shares of the company's stock worth $87,788,000 after buying an additional 711,121 shares during the last quarter. 31.35% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

A number of equities research analysts recently weighed in on CCEP shares. JPMorgan Chase & Co. downgraded shares of Coca-Cola Europacific Partners from an "overweight" rating to a "neutral" rating and lowered their price objective for the company from $85.00 to $82.00 in a research report on Wednesday, November 27th. UBS Group increased their price target on Coca-Cola Europacific Partners from $82.50 to $90.00 and gave the stock a "buy" rating in a research report on Thursday, December 12th. Citigroup upgraded Coca-Cola Europacific Partners to a "strong-buy" rating in a research report on Thursday, October 3rd. Barclays dropped their target price on Coca-Cola Europacific Partners from $86.00 to $83.00 and set an "overweight" rating on the stock in a research report on Friday, January 17th. Finally, Morgan Stanley raised shares of Coca-Cola Europacific Partners from an "equal weight" rating to an "overweight" rating in a report on Monday, December 9th. Four equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $84.11.

Check Out Our Latest Analysis on Coca-Cola Europacific Partners

Coca-Cola Europacific Partners Price Performance

Coca-Cola Europacific Partners stock traded up $0.47 during trading hours on Friday, hitting $76.78. 1,381,916 shares of the company traded hands, compared to its average volume of 1,586,048. Coca-Cola Europacific Partners PLC has a 1-year low of $65.77 and a 1-year high of $82.32. The firm's 50-day simple moving average is $76.78 and its two-hundred day simple moving average is $76.97. The company has a quick ratio of 0.63, a current ratio of 0.85 and a debt-to-equity ratio of 1.12.

Coca-Cola Europacific Partners Increases Dividend

The business also recently disclosed a semi-annual dividend, which was paid on Tuesday, December 3rd. Investors of record on Friday, November 15th were paid a dividend of $1.34 per share. This represents a dividend yield of 2.6%. The ex-dividend date was Friday, November 15th. This is a positive change from Coca-Cola Europacific Partners's previous semi-annual dividend of $0.79.

Coca-Cola Europacific Partners Company Profile

(

Free Report)

Coca-Cola Europacific Partners PLC, together with its subsidiaries, produces, distributes, and sells a range of non-alcoholic ready to drink beverages. It offers flavours, mixers, and energy drinks; soft drinks, waters, enhanced water, and isotonic drinks; and ready-to-drink tea and coffee, juices, and other drinks.

Further Reading

Before you consider Coca-Cola Europacific Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola Europacific Partners wasn't on the list.

While Coca-Cola Europacific Partners currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.