Quantbot Technologies LP increased its position in shares of Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report) by 87.8% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 12,604 shares of the company's stock after purchasing an additional 5,892 shares during the quarter. Quantbot Technologies LP's holdings in Medpace were worth $4,207,000 at the end of the most recent reporting period.

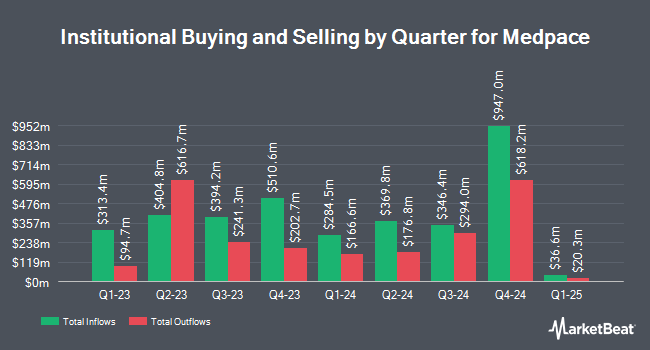

Other large investors have also recently added to or reduced their stakes in the company. Cetera Advisors LLC lifted its stake in Medpace by 162.4% in the first quarter. Cetera Advisors LLC now owns 2,608 shares of the company's stock valued at $1,054,000 after buying an additional 1,614 shares during the last quarter. Baillie Gifford & Co. increased its stake in Medpace by 175.6% in the 3rd quarter. Baillie Gifford & Co. now owns 14,876 shares of the company's stock worth $4,966,000 after purchasing an additional 9,478 shares in the last quarter. Virtu Financial LLC purchased a new position in Medpace in the 1st quarter worth about $1,239,000. CWA Asset Management Group LLC acquired a new stake in Medpace during the 3rd quarter worth about $1,306,000. Finally, Oppenheimer Asset Management Inc. boosted its position in Medpace by 6.3% during the 3rd quarter. Oppenheimer Asset Management Inc. now owns 45,473 shares of the company's stock worth $15,179,000 after acquiring an additional 2,675 shares during the period. 77.98% of the stock is currently owned by institutional investors.

Medpace Stock Performance

NASDAQ:MEDP opened at $335.21 on Wednesday. The stock has a 50-day simple moving average of $339.37 and a 200 day simple moving average of $372.21. The company has a market cap of $10.42 billion, a PE ratio of 29.35, a PEG ratio of 1.87 and a beta of 1.37. Medpace Holdings, Inc. has a 52-week low of $268.80 and a 52-week high of $459.77.

Medpace (NASDAQ:MEDP - Get Free Report) last released its quarterly earnings results on Monday, October 21st. The company reported $3.01 EPS for the quarter, beating the consensus estimate of $2.77 by $0.24. Medpace had a net margin of 17.66% and a return on equity of 50.87%. The business had revenue of $533.32 million for the quarter, compared to the consensus estimate of $540.99 million. During the same period in the prior year, the company posted $2.22 earnings per share. Medpace's revenue was up 8.3% compared to the same quarter last year. On average, research analysts predict that Medpace Holdings, Inc. will post 11.93 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several brokerages have recently issued reports on MEDP. Truist Financial reduced their price target on Medpace from $415.00 to $397.00 and set a "hold" rating for the company in a report on Monday, October 14th. StockNews.com downgraded Medpace from a "buy" rating to a "hold" rating in a research report on Friday, September 27th. Jefferies Financial Group cut Medpace from a "buy" rating to a "hold" rating and lowered their price objective for the company from $415.00 to $345.00 in a research report on Wednesday, September 25th. TD Cowen lowered their price objective on Medpace from $413.00 to $372.00 and set a "buy" rating on the stock in a research report on Wednesday, October 23rd. Finally, UBS Group cut Medpace from a "buy" rating to a "neutral" rating and lowered their price target for the company from $420.00 to $350.00 in a research report on Friday, September 27th. Seven analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat, Medpace currently has a consensus rating of "Hold" and a consensus target price of $380.56.

Get Our Latest Stock Analysis on MEDP

About Medpace

(

Free Report)

Medpace Holdings, Inc provides clinical research-based drug and medical device development services in North America, Europe, and Asia. The company offers a suite of services supporting the clinical development process from Phase I to Phase IV in various therapeutic areas. It provides clinical development services to the pharmaceutical, biotechnology, and medical device industries; and development plan design, coordinated central laboratory, project management, regulatory affairs, clinical monitoring, data management and analysis, pharmacovigilance new drug application submissions, and post-marketing clinical support services.

Featured Articles

Want to see what other hedge funds are holding MEDP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Medpace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medpace wasn't on the list.

While Medpace currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.