Steward Partners Investment Advisory LLC cut its position in shares of Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report) by 30.2% during the 4th quarter, according to the company in its most recent filing with the SEC. The firm owned 2,139 shares of the company's stock after selling 924 shares during the quarter. Steward Partners Investment Advisory LLC's holdings in Medpace were worth $711,000 as of its most recent filing with the SEC.

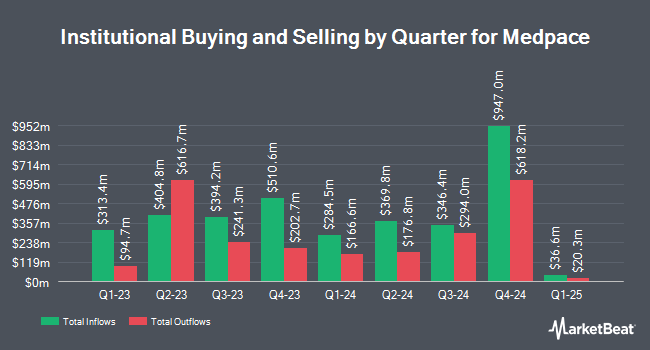

Several other hedge funds also recently modified their holdings of MEDP. Proficio Capital Partners LLC increased its position in shares of Medpace by 34,497.4% during the 4th quarter. Proficio Capital Partners LLC now owns 242,528 shares of the company's stock valued at $80,575,000 after purchasing an additional 241,827 shares during the period. Iron Triangle Partners LP acquired a new position in shares of Medpace in the 3rd quarter worth $64,371,000. GW&K Investment Management LLC grew its holdings in shares of Medpace by 93.9% in the 4th quarter. GW&K Investment Management LLC now owns 275,460 shares of the company's stock worth $91,516,000 after acquiring an additional 133,379 shares during the last quarter. Wellington Management Group LLP grew its holdings in shares of Medpace by 36.0% in the 3rd quarter. Wellington Management Group LLP now owns 415,255 shares of the company's stock worth $138,612,000 after acquiring an additional 109,886 shares during the last quarter. Finally, DF Dent & Co. Inc. grew its holdings in shares of Medpace by 189.9% in the 3rd quarter. DF Dent & Co. Inc. now owns 161,298 shares of the company's stock worth $53,841,000 after acquiring an additional 105,659 shares during the last quarter. 77.98% of the stock is currently owned by institutional investors and hedge funds.

Medpace Trading Down 3.4 %

Shares of MEDP stock opened at $325.87 on Wednesday. Medpace Holdings, Inc. has a 1-year low of $302.01 and a 1-year high of $459.77. The company has a market capitalization of $9.93 billion, a price-to-earnings ratio of 25.80, a P/E/G ratio of 3.81 and a beta of 1.47. The stock's fifty day simple moving average is $341.06 and its 200-day simple moving average is $342.12.

Medpace (NASDAQ:MEDP - Get Free Report) last issued its quarterly earnings results on Monday, February 10th. The company reported $3.67 earnings per share for the quarter, beating analysts' consensus estimates of $2.96 by $0.71. Medpace had a return on equity of 51.48% and a net margin of 19.17%. On average, sell-side analysts predict that Medpace Holdings, Inc. will post 12.29 EPS for the current year.

Analyst Ratings Changes

Separately, Robert W. Baird lifted their target price on Medpace from $354.00 to $362.00 and gave the stock a "neutral" rating in a report on Monday, January 27th. Seven investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat, Medpace currently has an average rating of "Hold" and a consensus price target of $381.44.

Get Our Latest Report on MEDP

Medpace Company Profile

(

Free Report)

Medpace Holdings, Inc engages in the provision of outsourced clinical development services to the biotechnology, pharmaceutical and medical device industries. Its services include medical department, clinical trial management, data-driven feasibility, study-start-up, clinical monitoring, regulatory affairs, patient recruitment and retention, medical writing, biometrics and data sciences, pharmacovigilance, core laboratory, laboratories, clinics, and quality assurance.

See Also

Want to see what other hedge funds are holding MEDP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Medpace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medpace wasn't on the list.

While Medpace currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.