Meeder Asset Management Inc. grew its position in shares of American International Group, Inc. (NYSE:AIG - Free Report) by 9,003.5% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 69,915 shares of the insurance provider's stock after buying an additional 69,147 shares during the period. Meeder Asset Management Inc.'s holdings in American International Group were worth $5,120,000 as of its most recent SEC filing.

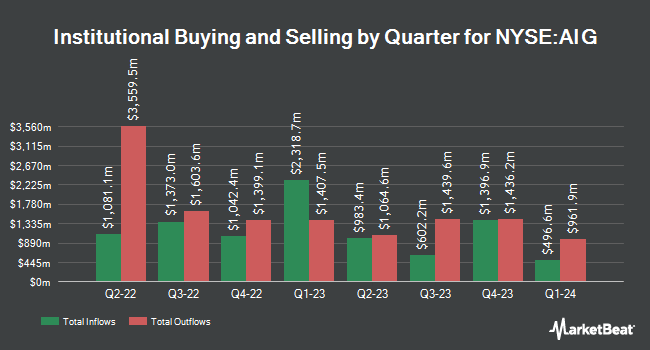

Other hedge funds also recently made changes to their positions in the company. Forum Financial Management LP grew its holdings in shares of American International Group by 1.1% during the second quarter. Forum Financial Management LP now owns 12,173 shares of the insurance provider's stock valued at $904,000 after purchasing an additional 128 shares during the last quarter. Quent Capital LLC grew its position in shares of American International Group by 4.0% during the second quarter. Quent Capital LLC now owns 3,834 shares of the insurance provider's stock worth $285,000 after acquiring an additional 146 shares during the last quarter. Avantax Advisory Services Inc. increased its holdings in shares of American International Group by 2.8% in the 1st quarter. Avantax Advisory Services Inc. now owns 6,106 shares of the insurance provider's stock worth $477,000 after acquiring an additional 165 shares during the period. EP Wealth Advisors LLC lifted its position in American International Group by 4.9% in the 1st quarter. EP Wealth Advisors LLC now owns 3,536 shares of the insurance provider's stock valued at $276,000 after purchasing an additional 165 shares during the last quarter. Finally, Graypoint LLC boosted its stake in American International Group by 2.0% during the 3rd quarter. Graypoint LLC now owns 8,672 shares of the insurance provider's stock valued at $635,000 after purchasing an additional 167 shares during the period. Institutional investors and hedge funds own 90.60% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages recently issued reports on AIG. Citigroup decreased their price objective on American International Group from $89.00 to $87.00 and set a "buy" rating for the company in a report on Tuesday, July 23rd. Barclays initiated coverage on American International Group in a report on Wednesday, September 4th. They set an "overweight" rating and a $90.00 price target on the stock. Piper Sandler reduced their price objective on shares of American International Group from $89.00 to $86.00 and set an "overweight" rating for the company in a report on Friday, August 2nd. Jefferies Financial Group raised their target price on shares of American International Group from $82.00 to $88.00 and gave the company a "buy" rating in a research note on Wednesday, October 9th. Finally, StockNews.com raised shares of American International Group from a "sell" rating to a "hold" rating in a research note on Friday, November 8th. Eight investment analysts have rated the stock with a hold rating and nine have assigned a buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $84.13.

View Our Latest Research Report on AIG

Insiders Place Their Bets

In other American International Group news, major shareholder International Group American sold 5,000,000 shares of the firm's stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $28.86, for a total value of $144,300,000.00. Following the completion of the sale, the insider now owns 279,238,898 shares in the company, valued at approximately $8,058,834,596.28. This trade represents a 1.76 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Company insiders own 0.61% of the company's stock.

American International Group Stock Down 1.3 %

Shares of AIG traded down $1.03 during midday trading on Tuesday, reaching $75.28. 3,145,078 shares of the stock were exchanged, compared to its average volume of 4,119,800. The company has a market cap of $46.96 billion, a price-to-earnings ratio of -22.21, a P/E/G ratio of 7.50 and a beta of 1.05. The company has a quick ratio of 0.65, a current ratio of 0.65 and a debt-to-equity ratio of 0.22. American International Group, Inc. has a 12-month low of $63.79 and a 12-month high of $80.83. The firm has a 50 day simple moving average of $75.33 and a 200-day simple moving average of $75.65.

American International Group (NYSE:AIG - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The insurance provider reported $1.23 earnings per share for the quarter, beating the consensus estimate of $1.10 by $0.13. The firm had revenue of $6.75 billion for the quarter, compared to analyst estimates of $6.62 billion. American International Group had a negative net margin of 6.19% and a positive return on equity of 8.63%. During the same quarter last year, the firm earned $1.61 earnings per share. Research analysts forecast that American International Group, Inc. will post 5.13 EPS for the current year.

American International Group Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, December 30th. Investors of record on Monday, December 16th will be issued a $0.40 dividend. The ex-dividend date is Monday, December 16th. This represents a $1.60 annualized dividend and a yield of 2.13%. American International Group's dividend payout ratio (DPR) is presently -47.20%.

About American International Group

(

Free Report)

American International Group, Inc offers insurance products for commercial, institutional, and individual customers in North America and internationally. It operates through three segments: General Insurance, Life and Retirement, and Other Operations. The General Insurance segment provides commercial and industrial property insurance, including business interruption and package insurance that cover exposure to made and natural disasters; general liability, environmental, commercial automobile liability, workers' compensation, excess casualty, and crisis management insurance products; and professional liability insurance.

Read More

Before you consider American International Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American International Group wasn't on the list.

While American International Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.