Meeder Asset Management Inc. decreased its holdings in shares of Northern Trust Co. (NASDAQ:NTRS - Free Report) by 9.3% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 99,781 shares of the asset manager's stock after selling 10,222 shares during the quarter. Meeder Asset Management Inc. owned approximately 0.05% of Northern Trust worth $8,983,000 at the end of the most recent reporting period.

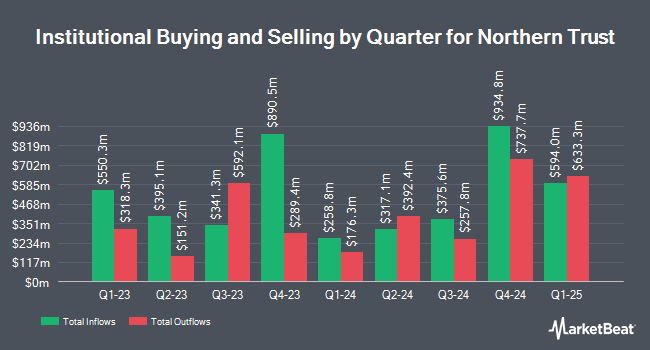

Several other hedge funds have also added to or reduced their stakes in the business. Massachusetts Financial Services Co. MA lifted its holdings in shares of Northern Trust by 13.0% during the second quarter. Massachusetts Financial Services Co. MA now owns 7,413,620 shares of the asset manager's stock worth $622,596,000 after buying an additional 850,556 shares in the last quarter. Panagora Asset Management Inc. lifted its holdings in shares of Northern Trust by 4,660.5% during the second quarter. Panagora Asset Management Inc. now owns 399,932 shares of the asset manager's stock worth $33,586,000 after buying an additional 391,531 shares in the last quarter. Primecap Management Co. CA lifted its holdings in shares of Northern Trust by 3.9% during the second quarter. Primecap Management Co. CA now owns 7,046,757 shares of the asset manager's stock worth $591,787,000 after buying an additional 261,285 shares in the last quarter. Dimensional Fund Advisors LP lifted its holdings in shares of Northern Trust by 12.3% during the second quarter. Dimensional Fund Advisors LP now owns 2,003,675 shares of the asset manager's stock worth $168,253,000 after buying an additional 219,387 shares in the last quarter. Finally, AQR Capital Management LLC lifted its holdings in shares of Northern Trust by 55.1% during the second quarter. AQR Capital Management LLC now owns 597,146 shares of the asset manager's stock worth $49,575,000 after buying an additional 212,089 shares in the last quarter. Institutional investors and hedge funds own 83.19% of the company's stock.

Insider Activity

In other news, Vice Chairman Steven L. Fradkin sold 27,874 shares of the company's stock in a transaction that occurred on Friday, October 25th. The stock was sold at an average price of $100.50, for a total value of $2,801,337.00. Following the completion of the transaction, the insider now owns 46,078 shares of the company's stock, valued at $4,630,839. This represents a 37.69 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Also, Director Charles A. Tribbett sold 1,855 shares of the company's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $88.12, for a total value of $163,462.60. Following the completion of the sale, the director now owns 1,000 shares in the company, valued at $88,120. The trade was a 64.97 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 80,906 shares of company stock valued at $8,176,652 over the last quarter. 0.64% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

A number of research firms have recently weighed in on NTRS. Bank of America lifted their target price on Northern Trust from $103.00 to $115.00 and gave the stock a "buy" rating in a report on Thursday, October 24th. Deutsche Bank Aktiengesellschaft raised their price target on Northern Trust from $100.00 to $108.00 and gave the stock a "hold" rating in a research report on Monday, November 11th. Royal Bank of Canada raised their price target on Northern Trust from $100.00 to $107.00 and gave the stock an "outperform" rating in a research report on Thursday, October 24th. Morgan Stanley raised their price target on Northern Trust from $97.00 to $103.00 and gave the stock an "underweight" rating in a research report on Thursday, October 24th. Finally, The Goldman Sachs Group cut Northern Trust from a "neutral" rating to a "sell" rating and decreased their price target for the stock from $84.00 to $82.00 in a research report on Thursday, September 26th. Three research analysts have rated the stock with a sell rating, six have issued a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $100.67.

Get Our Latest Research Report on Northern Trust

Northern Trust Price Performance

Northern Trust stock traded down $1.09 during midday trading on Tuesday, reaching $107.84. The company's stock had a trading volume of 848,593 shares, compared to its average volume of 1,301,755. The stock has a market cap of $21.38 billion, a PE ratio of 13.41, a price-to-earnings-growth ratio of 1.21 and a beta of 1.06. The company has a current ratio of 0.71, a quick ratio of 0.71 and a debt-to-equity ratio of 0.58. The business has a 50-day moving average price of $96.49 and a 200-day moving average price of $89.29. Northern Trust Co. has a 52 week low of $74.63 and a 52 week high of $109.54.

Northern Trust Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 1st. Stockholders of record on Friday, December 6th will be paid a $0.75 dividend. This represents a $3.00 annualized dividend and a dividend yield of 2.78%. The ex-dividend date is Friday, December 6th. Northern Trust's dividend payout ratio is currently 37.31%.

Northern Trust Profile

(

Free Report)

Northern Trust Corporation, a financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide. It operates in two segments, Asset Servicing and Wealth Management. The Asset Servicing segment offers asset servicing and related services, including custody, fund administration, investment operations outsourcing, investment management, investment risk and analytical services, employee benefit services, securities lending, foreign exchange, treasury management, brokerage services, transition management services, banking, and cash management services.

See Also

Before you consider Northern Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northern Trust wasn't on the list.

While Northern Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report