Melqart Asset Management UK Ltd cut its position in Broadcom Inc. (NASDAQ:AVGO - Free Report) by 20.0% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 85,971 shares of the semiconductor manufacturer's stock after selling 21,531 shares during the period. Broadcom accounts for approximately 2.4% of Melqart Asset Management UK Ltd's investment portfolio, making the stock its 13th biggest holding. Melqart Asset Management UK Ltd's holdings in Broadcom were worth $19,932,000 at the end of the most recent reporting period.

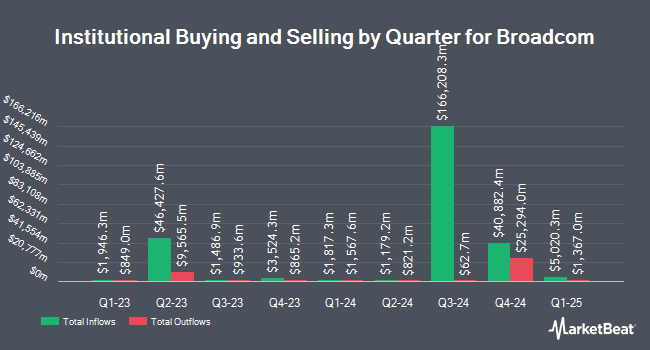

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in the company. KFA Private Wealth Group LLC increased its position in Broadcom by 2.5% during the 4th quarter. KFA Private Wealth Group LLC now owns 1,756 shares of the semiconductor manufacturer's stock valued at $407,000 after purchasing an additional 42 shares during the period. Dakota Community Bank & Trust NA boosted its stake in shares of Broadcom by 2.7% during the fourth quarter. Dakota Community Bank & Trust NA now owns 1,685 shares of the semiconductor manufacturer's stock valued at $391,000 after purchasing an additional 45 shares in the last quarter. Bryant Woods Investment Advisors LLC increased its holdings in Broadcom by 3.5% during the fourth quarter. Bryant Woods Investment Advisors LLC now owns 1,317 shares of the semiconductor manufacturer's stock valued at $305,000 after buying an additional 45 shares during the period. Marest Capital LLC raised its stake in Broadcom by 1.0% in the fourth quarter. Marest Capital LLC now owns 4,539 shares of the semiconductor manufacturer's stock worth $1,052,000 after buying an additional 46 shares in the last quarter. Finally, Defined Wealth Management LLC lifted its holdings in Broadcom by 0.4% during the fourth quarter. Defined Wealth Management LLC now owns 12,712 shares of the semiconductor manufacturer's stock worth $2,947,000 after buying an additional 47 shares during the period. 76.43% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of brokerages have recently issued reports on AVGO. Truist Financial lifted their price target on Broadcom from $260.00 to $267.00 and gave the company a "buy" rating in a report on Friday, March 7th. Citigroup reduced their target price on shares of Broadcom from $220.00 to $210.00 and set a "buy" rating for the company in a report on Friday, April 11th. Barclays lowered their price target on shares of Broadcom from $260.00 to $215.00 and set an "overweight" rating on the stock in a report on Tuesday, April 22nd. KeyCorp boosted their price objective on shares of Broadcom from $260.00 to $275.00 and gave the stock an "overweight" rating in a research note on Friday, March 7th. Finally, Rosenblatt Securities reaffirmed a "buy" rating and issued a $250.00 price target on shares of Broadcom in a report on Friday, March 7th. Three research analysts have rated the stock with a hold rating and twenty-five have assigned a buy rating to the stock. According to MarketBeat.com, Broadcom presently has an average rating of "Moderate Buy" and an average price target of $229.48.

View Our Latest Stock Analysis on Broadcom

Insider Buying and Selling

In other news, Director Justine Page sold 800 shares of the firm's stock in a transaction that occurred on Monday, April 14th. The shares were sold at an average price of $185.00, for a total transaction of $148,000.00. Following the sale, the director now owns 25,380 shares of the company's stock, valued at $4,695,300. This trade represents a 3.06 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, insider Mark David Brazeal sold 25,000 shares of the business's stock in a transaction on Friday, April 11th. The shares were sold at an average price of $180.00, for a total transaction of $4,500,000.00. Following the completion of the transaction, the insider now owns 465,956 shares of the company's stock, valued at approximately $83,872,080. This represents a 5.09 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 719,776 shares of company stock valued at $131,065,542 over the last ninety days. Company insiders own 2.00% of the company's stock.

Broadcom Price Performance

NASDAQ:AVGO opened at $192.31 on Friday. The firm's fifty day moving average is $184.36 and its two-hundred day moving average is $196.09. The firm has a market cap of $904.23 billion, a price-to-earnings ratio of 156.86, a PEG ratio of 2.29 and a beta of 1.05. The company has a debt-to-equity ratio of 0.98, a quick ratio of 1.07 and a current ratio of 1.17. Broadcom Inc. has a one year low of $122.33 and a one year high of $251.88.

Broadcom Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Monday, March 31st. Stockholders of record on Thursday, March 20th were paid a $0.59 dividend. The ex-dividend date was Thursday, March 20th. This represents a $2.36 dividend on an annualized basis and a dividend yield of 1.23%. Broadcom's payout ratio is 113.46%.

Broadcom declared that its Board of Directors has authorized a stock buyback plan on Monday, April 7th that allows the company to repurchase $10.00 billion in shares. This repurchase authorization allows the semiconductor manufacturer to reacquire up to 1.4% of its stock through open market purchases. Stock repurchase plans are generally an indication that the company's leadership believes its shares are undervalued.

Broadcom Profile

(

Free Report)

Broadcom Inc designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide. The company operates in two segments, Semiconductor Solutions and Infrastructure Software.

Featured Articles

Want to see what other hedge funds are holding AVGO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Broadcom Inc. (NASDAQ:AVGO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Broadcom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadcom wasn't on the list.

While Broadcom currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.