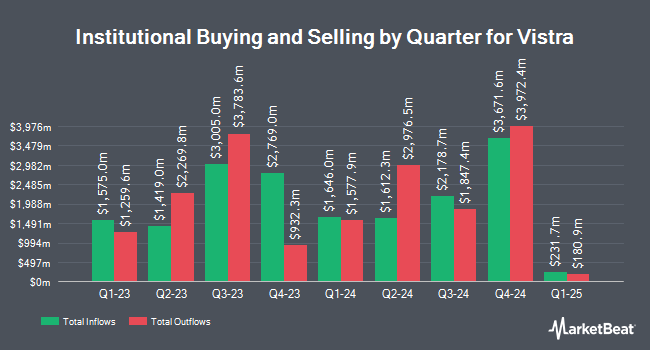

Merewether Investment Management LP decreased its position in Vistra Corp. (NYSE:VST - Free Report) by 54.1% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 879,979 shares of the company's stock after selling 1,037,622 shares during the period. Vistra makes up approximately 4.8% of Merewether Investment Management LP's holdings, making the stock its 5th biggest position. Merewether Investment Management LP owned 0.26% of Vistra worth $104,313,000 at the end of the most recent reporting period.

A number of other hedge funds also recently bought and sold shares of the company. Morse Asset Management Inc bought a new position in Vistra in the 3rd quarter worth about $631,000. IHT Wealth Management LLC boosted its stake in Vistra by 45.9% in the 3rd quarter. IHT Wealth Management LLC now owns 9,473 shares of the company's stock worth $1,126,000 after purchasing an additional 2,981 shares in the last quarter. Integrated Wealth Concepts LLC boosted its stake in Vistra by 4.8% in the 3rd quarter. Integrated Wealth Concepts LLC now owns 4,469 shares of the company's stock worth $530,000 after purchasing an additional 204 shares in the last quarter. Investment Management Corp of Ontario boosted its stake in Vistra by 12.0% in the 3rd quarter. Investment Management Corp of Ontario now owns 35,480 shares of the company's stock worth $4,206,000 after purchasing an additional 3,800 shares in the last quarter. Finally, IronBridge Private Wealth LLC bought a new position in Vistra during the 3rd quarter valued at about $236,000. Institutional investors own 90.88% of the company's stock.

Vistra Stock Performance

Vistra stock traded up $7.16 during midday trading on Wednesday, hitting $161.32. The stock had a trading volume of 5,268,611 shares, compared to its average volume of 6,836,936. The firm's fifty day moving average is $135.20 and its two-hundred day moving average is $103.22. The company has a market capitalization of $54.89 billion, a PE ratio of 29.93, a P/E/G ratio of 1.98 and a beta of 1.16. Vistra Corp. has a 52-week low of $36.17 and a 52-week high of $168.67. The company has a current ratio of 1.11, a quick ratio of 0.99 and a debt-to-equity ratio of 4.68.

Vistra Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, December 20th will be issued a $0.221 dividend. This represents a $0.88 annualized dividend and a yield of 0.55%. This is a positive change from Vistra's previous quarterly dividend of $0.22. The ex-dividend date is Friday, December 20th. Vistra's dividend payout ratio is currently 16.42%.

Vistra declared that its board has approved a share repurchase plan on Thursday, November 7th that permits the company to buyback $1.00 billion in shares. This buyback authorization permits the company to purchase up to 2.1% of its stock through open market purchases. Stock buyback plans are often a sign that the company's board believes its shares are undervalued.

Wall Street Analyst Weigh In

Several equities analysts have issued reports on VST shares. JPMorgan Chase & Co. started coverage on shares of Vistra in a research note on Thursday, October 17th. They set an "overweight" rating and a $178.00 target price on the stock. UBS Group lowered their target price on shares of Vistra from $157.00 to $150.00 and set a "buy" rating on the stock in a research note on Tuesday, October 22nd. Jefferies Financial Group upped their price target on shares of Vistra from $99.00 to $137.00 and gave the company a "buy" rating in a research report on Tuesday, September 24th. Guggenheim upped their price target on shares of Vistra from $133.00 to $177.00 and gave the company a "buy" rating in a research report on Tuesday, October 8th. Finally, Morgan Stanley upped their price target on shares of Vistra from $135.00 to $169.00 and gave the company an "overweight" rating in a research report on Friday, November 22nd. Ten research analysts have rated the stock with a buy rating, Based on data from MarketBeat, Vistra currently has an average rating of "Buy" and an average price target of $149.10.

View Our Latest Research Report on Vistra

Insider Buying and Selling

In other Vistra news, EVP Scott A. Hudson sold 115,000 shares of the stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $164.16, for a total transaction of $18,878,400.00. Following the completion of the sale, the executive vice president now directly owns 254,932 shares of the company's stock, valued at $41,849,637.12. This trade represents a 31.09 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, EVP Stephen J. Muscato sold 207,100 shares of the stock in a transaction that occurred on Friday, November 22nd. The shares were sold at an average price of $161.34, for a total transaction of $33,413,514.00. Following the sale, the executive vice president now directly owns 318,287 shares of the company's stock, valued at approximately $51,352,424.58. This trade represents a 39.42 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.42% of the stock is currently owned by insiders.

Vistra Company Profile

(

Free Report)

Vistra Corp., together with its subsidiaries, operates as an integrated retail electricity and power generation company. The company operates through six segments: Retail, Texas, East, West, Sunset, and Asset Closure. It retails electricity and natural gas to residential, commercial, and industrial customers across states in the United States and the District of Columbia.

See Also

Before you consider Vistra, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vistra wasn't on the list.

While Vistra currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.