Meridian Wealth Management LLC acquired a new position in The Procter & Gamble Company (NYSE:PG - Free Report) during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 58,152 shares of the company's stock, valued at approximately $10,072,000.

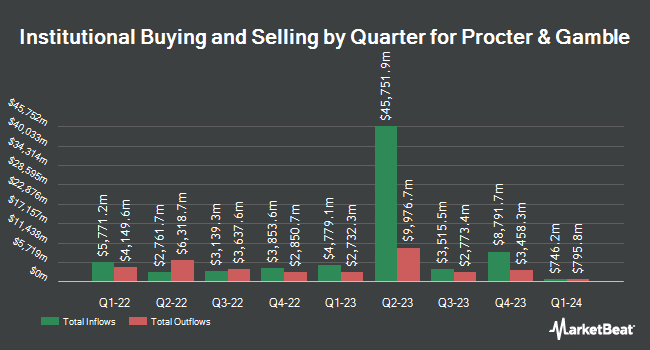

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Legal & General Group Plc grew its position in Procter & Gamble by 0.6% during the second quarter. Legal & General Group Plc now owns 21,632,054 shares of the company's stock valued at $3,567,556,000 after buying an additional 122,190 shares during the period. Charles Schwab Investment Management Inc. grew its position in Procter & Gamble by 0.6% during the third quarter. Charles Schwab Investment Management Inc. now owns 16,422,470 shares of the company's stock valued at $2,844,442,000 after buying an additional 105,734 shares during the period. Dimensional Fund Advisors LP grew its position in Procter & Gamble by 8.2% during the second quarter. Dimensional Fund Advisors LP now owns 9,691,925 shares of the company's stock valued at $1,598,510,000 after buying an additional 733,440 shares during the period. Swiss National Bank grew its position in shares of Procter & Gamble by 0.6% in the third quarter. Swiss National Bank now owns 7,005,790 shares of the company's stock valued at $1,213,403,000 after purchasing an additional 39,000 shares during the period. Finally, Janus Henderson Group PLC grew its position in shares of Procter & Gamble by 1.3% in the first quarter. Janus Henderson Group PLC now owns 6,008,938 shares of the company's stock valued at $974,914,000 after purchasing an additional 79,665 shares during the period. Institutional investors and hedge funds own 65.77% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on PG shares. Dbs Bank downgraded shares of Procter & Gamble from a "strong-buy" rating to a "hold" rating in a research note on Thursday, August 1st. Morgan Stanley lifted their target price on shares of Procter & Gamble from $174.00 to $191.00 and gave the stock an "overweight" rating in a research note on Monday, October 21st. Piper Sandler started coverage on shares of Procter & Gamble in a research report on Tuesday, September 24th. They set a "neutral" rating and a $174.00 price target for the company. StockNews.com cut shares of Procter & Gamble from a "buy" rating to a "hold" rating in a research report on Thursday, August 1st. Finally, Royal Bank of Canada restated a "sector perform" rating and issued a $164.00 price objective on shares of Procter & Gamble in a report on Monday, October 21st. Nine analysts have rated the stock with a hold rating, thirteen have issued a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $178.00.

Read Our Latest Report on Procter & Gamble

Procter & Gamble Stock Up 1.0 %

PG stock opened at $174.48 on Friday. The company has a fifty day moving average price of $170.00 and a 200 day moving average price of $168.54. The Procter & Gamble Company has a 12 month low of $142.50 and a 12 month high of $177.94. The company has a market cap of $410.91 billion, a price-to-earnings ratio of 29.87, a price-to-earnings-growth ratio of 3.69 and a beta of 0.42. The company has a debt-to-equity ratio of 0.50, a current ratio of 0.75 and a quick ratio of 0.55.

Procter & Gamble (NYSE:PG - Get Free Report) last announced its quarterly earnings data on Friday, October 18th. The company reported $1.93 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.90 by $0.03. The company had revenue of $21.74 billion for the quarter, compared to analysts' expectations of $21.99 billion. Procter & Gamble had a net margin of 17.07% and a return on equity of 33.25%. Procter & Gamble's revenue was down .6% compared to the same quarter last year. During the same period in the previous year, the company posted $1.83 EPS. Sell-side analysts expect that The Procter & Gamble Company will post 6.94 earnings per share for the current year.

Procter & Gamble Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Friday, October 18th were paid a dividend of $1.0065 per share. The ex-dividend date of this dividend was Friday, October 18th. This represents a $4.03 dividend on an annualized basis and a dividend yield of 2.31%. Procter & Gamble's dividend payout ratio (DPR) is presently 69.48%.

Insider Transactions at Procter & Gamble

In related news, insider Balaji Purushothaman sold 12,800 shares of the stock in a transaction dated Thursday, October 24th. The shares were sold at an average price of $168.99, for a total value of $2,163,072.00. Following the sale, the insider now directly owns 11,566 shares of the company's stock, valued at approximately $1,954,538.34. This represents a 52.53 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Jon R. Moeller sold 87,979 shares of the stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $170.40, for a total transaction of $14,991,621.60. Following the completion of the sale, the chief executive officer now directly owns 300,777 shares in the company, valued at approximately $51,252,400.80. The trade was a 22.63 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 160,693 shares of company stock valued at $27,311,345 in the last ninety days. 0.18% of the stock is currently owned by company insiders.

Procter & Gamble Profile

(

Free Report)

The Procter & Gamble Company engages in the provision of branded consumer packaged goods worldwide. The company operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care. The Beauty segment offers conditioners, shampoos, styling aids, and treatments under the Head & Shoulders, Herbal Essences, Pantene, and Rejoice brands; and antiperspirants and deodorants, personal cleansing, and skin care products under the Olay, Old Spice, Safeguard, Secret, SK-II, and Native brands.

Read More

Want to see what other hedge funds are holding PG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The Procter & Gamble Company (NYSE:PG - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Procter & Gamble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procter & Gamble wasn't on the list.

While Procter & Gamble currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report