UBS Group upgraded shares of MeridianLink (NYSE:MLNK - Free Report) from a sell rating to a neutral rating in a report issued on Monday morning, Marketbeat Ratings reports. The firm currently has $22.50 price objective on the stock, up from their prior price objective of $18.00.

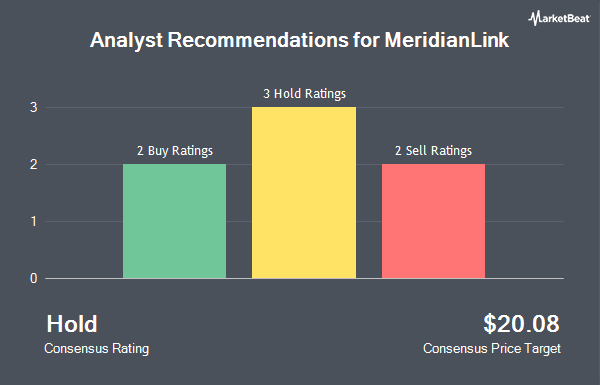

MLNK has been the subject of several other reports. Raymond James boosted their price objective on MeridianLink from $26.00 to $28.00 and gave the stock an "outperform" rating in a research report on Friday. Stifel Nicolaus boosted their price target on MeridianLink from $18.00 to $22.00 and gave the stock a "hold" rating in a research report on Friday, August 9th. Finally, Barclays raised their price target on MeridianLink from $18.00 to $20.00 and gave the company an "underweight" rating in a report on Friday, August 9th. One research analyst has rated the stock with a sell rating, four have issued a hold rating and two have given a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $22.90.

Check Out Our Latest Stock Analysis on MLNK

MeridianLink Stock Performance

MLNK traded up $0.94 during trading on Monday, reaching $25.03. 256,926 shares of the company were exchanged, compared to its average volume of 271,037. MeridianLink has a 52 week low of $16.49 and a 52 week high of $25.88. The company has a current ratio of 2.04, a quick ratio of 2.04 and a debt-to-equity ratio of 1.06. The firm has a 50 day moving average of $22.17 and a 200 day moving average of $21.16. The stock has a market cap of $1.90 billion, a P/E ratio of -35.96 and a beta of 0.98.

MeridianLink (NYSE:MLNK - Get Free Report) last issued its quarterly earnings data on Thursday, August 8th. The company reported $0.04 earnings per share for the quarter, missing the consensus estimate of $0.08 by ($0.04). MeridianLink had a negative net margin of 16.57% and a negative return on equity of 9.30%. The firm had revenue of $78.70 million during the quarter, compared to the consensus estimate of $78.08 million. During the same quarter in the prior year, the business earned ($0.06) earnings per share. The company's revenue for the quarter was up 4.4% compared to the same quarter last year. On average, sell-side analysts forecast that MeridianLink will post -0.27 EPS for the current fiscal year.

Insider Transactions at MeridianLink

In related news, major shareholder Thoma Bravo Ugp, Llc sold 6,000,000 shares of MeridianLink stock in a transaction dated Monday, September 30th. The stock was sold at an average price of $21.05, for a total transaction of $126,300,000.00. Following the transaction, the insider now directly owns 29,582,388 shares of the company's stock, valued at $622,709,267.40. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Company insiders own 21.30% of the company's stock.

Institutional Investors Weigh In On MeridianLink

A number of institutional investors and hedge funds have recently modified their holdings of MLNK. nVerses Capital LLC purchased a new position in MeridianLink in the 2nd quarter worth about $41,000. SG Americas Securities LLC purchased a new stake in shares of MeridianLink in the 3rd quarter valued at approximately $231,000. Russell Investments Group Ltd. boosted its stake in MeridianLink by 26.4% in the 1st quarter. Russell Investments Group Ltd. now owns 15,430 shares of the company's stock worth $289,000 after purchasing an additional 3,226 shares during the period. Squarepoint Ops LLC purchased a new position in MeridianLink during the 2nd quarter worth approximately $336,000. Finally, The Manufacturers Life Insurance Company raised its stake in MeridianLink by 10.1% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 16,218 shares of the company's stock valued at $346,000 after purchasing an additional 1,490 shares during the period. 82.65% of the stock is owned by institutional investors and hedge funds.

About MeridianLink

(

Get Free Report)

MeridianLink, Inc, a software and services company, provides software solutions for banks, credit unions, mortgage lenders, specialty lending providers, and consumer reporting agencies in the United States. The company offers MeridianLink One, a multi-product platform that can be tailored to meet the needs of customers as they digitally transform their organizations and adapt to changing business and consumer demands; MeridianLink Portal, a Point of Sale system that allows financial institutions to expand existing lending and deposit account; MeridianLink Opening, a cloud-based online account opening and deposit software solution; MeridianLink Consumer, a full loan solution suite to banks and credit unions; and MeridianLink DecisionLender, a loan origination software (LOS) for finance companies.

Featured Stories

Before you consider MeridianLink, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MeridianLink wasn't on the list.

While MeridianLink currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.