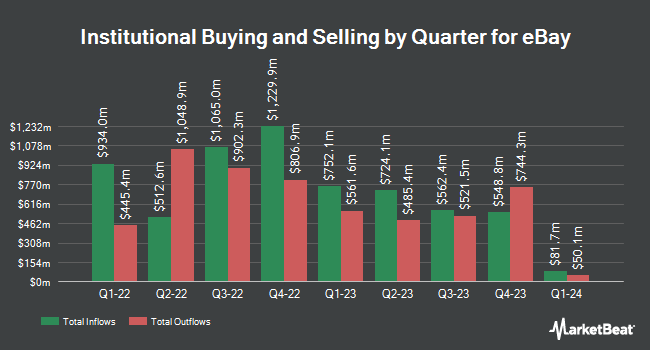

Meriwether Wealth & Planning LLC acquired a new stake in eBay Inc. (NASDAQ:EBAY - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor acquired 15,206 shares of the e-commerce company's stock, valued at approximately $942,000.

Several other hedge funds and other institutional investors have also recently bought and sold shares of EBAY. Wellington Management Group LLP acquired a new stake in eBay in the third quarter worth about $105,506,000. Raymond James Financial Inc. acquired a new stake in eBay in the 4th quarter valued at approximately $96,214,000. Amundi raised its position in eBay by 16.8% in the 4th quarter. Amundi now owns 4,719,128 shares of the e-commerce company's stock valued at $292,350,000 after buying an additional 677,389 shares during the last quarter. Allianz Asset Management GmbH raised its position in eBay by 23.2% in the 4th quarter. Allianz Asset Management GmbH now owns 2,460,879 shares of the e-commerce company's stock valued at $152,451,000 after buying an additional 463,015 shares during the last quarter. Finally, DJE Kapital AG acquired a new stake in eBay in the 4th quarter valued at approximately $26,833,000. 87.48% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other eBay news, CFO Stephen J. Priest sold 5,252 shares of the stock in a transaction that occurred on Monday, December 16th. The stock was sold at an average price of $63.63, for a total value of $334,184.76. Following the transaction, the chief financial officer now owns 65,080 shares in the company, valued at approximately $4,141,040.40. This represents a 7.47 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, SVP Cornelius Boone sold 3,989 shares of the stock in a transaction that occurred on Tuesday, December 17th. The stock was sold at an average price of $65.20, for a total value of $260,082.80. Following the completion of the transaction, the senior vice president now owns 71,469 shares in the company, valued at approximately $4,659,778.80. The trade was a 5.29 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 21,524 shares of company stock worth $1,390,509. Corporate insiders own 0.38% of the company's stock.

eBay Trading Down 0.1 %

Shares of eBay stock traded down $0.09 on Wednesday, hitting $65.13. 5,012,546 shares of the company's stock traded hands, compared to its average volume of 4,824,464. eBay Inc. has a one year low of $48.52 and a one year high of $71.61. The company has a debt-to-equity ratio of 1.14, a current ratio of 1.25 and a quick ratio of 1.25. The company has a fifty day moving average of $66.85 and a two-hundred day moving average of $64.33. The company has a market capitalization of $30.35 billion, a price-to-earnings ratio of 16.36, a price-to-earnings-growth ratio of 2.22 and a beta of 1.45.

eBay Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, March 28th. Shareholders of record on Friday, March 14th will be issued a $0.29 dividend. The ex-dividend date is Friday, March 14th. This represents a $1.16 annualized dividend and a yield of 1.78%. This is a positive change from eBay's previous quarterly dividend of $0.27. eBay's dividend payout ratio is presently 29.07%.

Analyst Ratings Changes

EBAY has been the topic of several recent analyst reports. BMO Capital Markets boosted their price target on eBay from $59.00 to $63.00 and gave the stock a "market perform" rating in a research report on Thursday, February 27th. Stifel Nicolaus cut their target price on eBay from $64.00 to $63.00 and set a "hold" rating for the company in a research report on Thursday, February 27th. UBS Group upped their target price on eBay from $66.00 to $72.00 and gave the company a "neutral" rating in a research report on Monday, February 24th. JPMorgan Chase & Co. upped their target price on eBay from $58.00 to $60.00 and gave the company a "neutral" rating in a research report on Thursday, February 27th. Finally, Morgan Stanley upped their target price on eBay from $70.00 to $72.00 and gave the company an "overweight" rating in a research report on Monday, January 13th. Two equities research analysts have rated the stock with a sell rating, sixteen have assigned a hold rating and ten have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus target price of $65.54.

View Our Latest Report on EBAY

eBay Company Profile

(

Free Report)

eBay Inc, together with its subsidiaries, operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally. The company's marketplace platform includes its online marketplace at ebay.com, off-platform businesses, and the eBay suite of mobile apps.

See Also

Before you consider eBay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and eBay wasn't on the list.

While eBay currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.