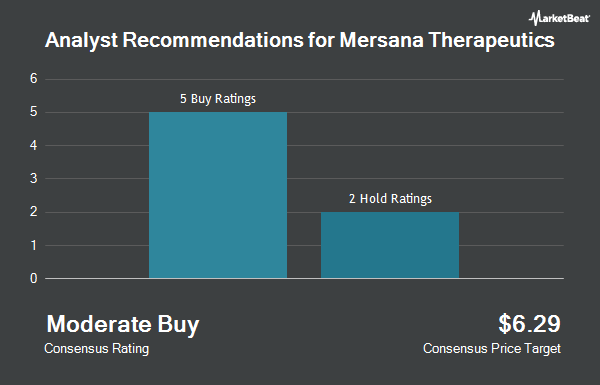

Shares of Mersana Therapeutics, Inc. (NASDAQ:MRSN - Get Free Report) have earned an average rating of "Moderate Buy" from the eight research firms that are currently covering the stock, MarketBeat Ratings reports. Two investment analysts have rated the stock with a hold recommendation, five have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average 1 year price target among brokerages that have updated their coverage on the stock in the last year is $6.00.

MRSN has been the subject of several recent analyst reports. Citigroup reduced their price objective on shares of Mersana Therapeutics from $6.00 to $5.00 and set a "buy" rating for the company in a research note on Tuesday, August 27th. Lifesci Capital upgraded shares of Mersana Therapeutics to a "strong-buy" rating in a report on Monday, July 29th. Finally, Robert W. Baird dropped their target price on shares of Mersana Therapeutics from $4.00 to $3.00 and set a "neutral" rating for the company in a report on Wednesday, August 14th.

View Our Latest Stock Analysis on MRSN

Insider Buying and Selling

In related news, CEO Martin H. Jr. Huber sold 50,423 shares of the firm's stock in a transaction that occurred on Thursday, September 12th. The shares were sold at an average price of $1.76, for a total value of $88,744.48. Following the sale, the chief executive officer now directly owns 116,327 shares of the company's stock, valued at approximately $204,735.52. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Over the last three months, insiders have sold 70,849 shares of company stock valued at $129,184. Insiders own 11.80% of the company's stock.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of MRSN. Mirae Asset Global Investments Co. Ltd. acquired a new position in Mersana Therapeutics during the first quarter valued at approximately $226,000. BNP Paribas Financial Markets lifted its position in Mersana Therapeutics by 90.0% during the first quarter. BNP Paribas Financial Markets now owns 80,735 shares of the company's stock valued at $362,000 after buying an additional 38,239 shares in the last quarter. ClariVest Asset Management LLC acquired a new position in shares of Mersana Therapeutics during the first quarter worth $2,114,000. Susquehanna Fundamental Investments LLC acquired a new position in shares of Mersana Therapeutics during the first quarter worth $1,049,000. Finally, Russell Investments Group Ltd. lifted its position in shares of Mersana Therapeutics by 976.7% during the first quarter. Russell Investments Group Ltd. now owns 9,453 shares of the company's stock worth $42,000 after purchasing an additional 8,575 shares in the last quarter. 93.92% of the stock is owned by institutional investors and hedge funds.

Mersana Therapeutics Stock Performance

Shares of MRSN stock traded up $0.02 during mid-day trading on Friday, hitting $2.57. The stock had a trading volume of 3,714,921 shares, compared to its average volume of 1,614,494. The company has a debt-to-equity ratio of 2.02, a current ratio of 2.72 and a quick ratio of 2.72. Mersana Therapeutics has a fifty-two week low of $1.15 and a fifty-two week high of $6.28. The company's 50-day simple moving average is $1.92 and its 200-day simple moving average is $2.09. The firm has a market cap of $315.29 million, a PE ratio of -2.93 and a beta of 1.50.

Mersana Therapeutics (NASDAQ:MRSN - Get Free Report) last announced its quarterly earnings data on Tuesday, August 13th. The company reported ($0.20) EPS for the quarter, missing the consensus estimate of ($0.17) by ($0.03). Mersana Therapeutics had a negative net margin of 349.98% and a negative return on equity of 333.91%. The company had revenue of $2.30 million during the quarter, compared to analyst estimates of $8.72 million. During the same quarter last year, the business earned ($0.47) EPS. The firm's revenue for the quarter was down 78.3% on a year-over-year basis. Sell-side analysts anticipate that Mersana Therapeutics will post -0.71 earnings per share for the current year.

Mersana Therapeutics Company Profile

(

Get Free ReportMersana Therapeutics, Inc, a clinical stage biopharmaceutical company, develops antibody drug conjugates (ADC) for cancer patients with unmet needs. The company develops XMT-1660, a B7-H4-targeted Dolasynthen ADC candidate; and XMT-2056, an immunosynthen ADC. It has research and development collaborations with Janssen Biotech, Inc, Ares Trading SA, Merck KGaA, and Asana BioSciences, LLC for the development of ADC product candidates.

Featured Stories

Before you consider Mersana Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mersana Therapeutics wasn't on the list.

While Mersana Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.