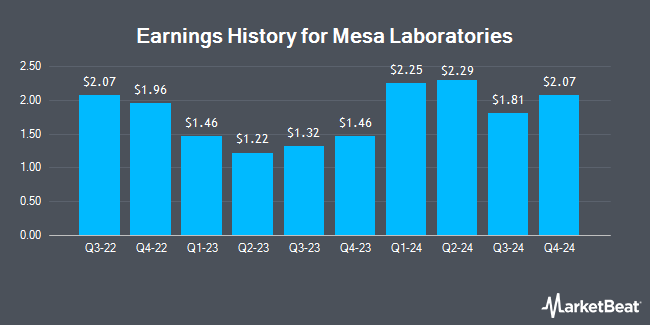

Mesa Laboratories (NASDAQ:MLAB - Get Free Report) is expected to be announcing its earnings results before the market opens on Monday, February 3rd. Analysts expect the company to announce earnings of $1.41 per share and revenue of $58,170.00 billion for the quarter. Parties that are interested in participating in the company's conference call can do so using this link.

Mesa Laboratories (NASDAQ:MLAB - Get Free Report) last posted its quarterly earnings results on Thursday, November 7th. The medical instruments supplier reported $1.81 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.95 by ($0.14). Mesa Laboratories had a positive return on equity of 28.52% and a negative net margin of 107.56%. The firm had revenue of $57.83 million for the quarter, compared to analysts' expectations of $58.60 million. On average, analysts expect Mesa Laboratories to post $7 EPS for the current fiscal year and $8 EPS for the next fiscal year.

Mesa Laboratories Stock Performance

MLAB traded down $0.98 during trading on Monday, reaching $139.49. The company's stock had a trading volume of 36,263 shares, compared to its average volume of 31,010. The company has a market capitalization of $757.43 million, a price-to-earnings ratio of -3.06 and a beta of 0.82. The company's fifty day moving average price is $129.48 and its 200-day moving average price is $124.32. Mesa Laboratories has a 52-week low of $83.68 and a 52-week high of $149.50. The company has a debt-to-equity ratio of 0.65, a quick ratio of 0.51 and a current ratio of 0.70.

Mesa Laboratories Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, March 17th. Investors of record on Friday, February 28th will be issued a dividend of $0.16 per share. This represents a $0.64 dividend on an annualized basis and a yield of 0.46%. The ex-dividend date of this dividend is Friday, February 28th. Mesa Laboratories's dividend payout ratio is presently -1.40%.

Wall Street Analysts Forecast Growth

A number of equities research analysts have commented on the company. StockNews.com downgraded Mesa Laboratories from a "buy" rating to a "hold" rating in a report on Wednesday, November 13th. Evercore ISI boosted their price objective on shares of Mesa Laboratories from $120.00 to $160.00 and gave the stock an "outperform" rating in a report on Tuesday, October 1st.

Check Out Our Latest Research Report on Mesa Laboratories

About Mesa Laboratories

(

Get Free Report)

Mesa Laboratories, Inc develops, designs, manufactures, sells, and services life sciences tools and quality control products and services in North America, Europe, the Asia Pacific, and internationally. The Sterilization and Disinfection Control segment offers biological, chemical, and cleaning indicators, used to assess the effectiveness of sterilization decontamination, disinfection, and cleaning processes in the pharmaceutical, medical device, and healthcare industries.

See Also

Before you consider Mesa Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mesa Laboratories wasn't on the list.

While Mesa Laboratories currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.