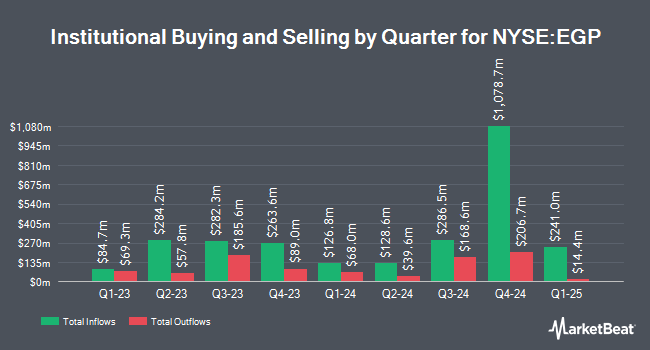

Mesirow Institutional Investment Management Inc. boosted its position in shares of EastGroup Properties, Inc. (NYSE:EGP - Free Report) by 21.5% in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 27,447 shares of the real estate investment trust's stock after buying an additional 4,863 shares during the quarter. Mesirow Institutional Investment Management Inc. owned 0.06% of EastGroup Properties worth $4,405,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors have also recently bought and sold shares of EGP. CIBC Asset Management Inc grew its holdings in shares of EastGroup Properties by 5.2% in the 4th quarter. CIBC Asset Management Inc now owns 1,458 shares of the real estate investment trust's stock worth $234,000 after acquiring an additional 72 shares during the last quarter. Principal Securities Inc. raised its holdings in EastGroup Properties by 18.5% during the 4th quarter. Principal Securities Inc. now owns 538 shares of the real estate investment trust's stock worth $86,000 after buying an additional 84 shares during the period. Versant Capital Management Inc lifted its stake in EastGroup Properties by 18.7% during the fourth quarter. Versant Capital Management Inc now owns 602 shares of the real estate investment trust's stock valued at $97,000 after buying an additional 95 shares in the last quarter. waypoint wealth counsel boosted its holdings in shares of EastGroup Properties by 1.9% in the fourth quarter. waypoint wealth counsel now owns 5,400 shares of the real estate investment trust's stock worth $867,000 after buying an additional 100 shares during the period. Finally, Oregon Public Employees Retirement Fund increased its position in shares of EastGroup Properties by 1.0% in the fourth quarter. Oregon Public Employees Retirement Fund now owns 10,042 shares of the real estate investment trust's stock worth $1,612,000 after acquiring an additional 100 shares in the last quarter. 92.14% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several brokerages recently commented on EGP. Jefferies Financial Group raised shares of EastGroup Properties from a "hold" rating to a "buy" rating and raised their price objective for the stock from $174.00 to $194.00 in a research note on Thursday, January 2nd. Morgan Stanley decreased their target price on EastGroup Properties from $186.00 to $180.00 and set an "equal weight" rating for the company in a research report on Monday, December 30th. Deutsche Bank Aktiengesellschaft initiated coverage on shares of EastGroup Properties in a report on Tuesday, January 14th. They set a "buy" rating and a $180.00 price target for the company. Truist Financial upgraded shares of EastGroup Properties from a "hold" rating to a "buy" rating and set a $180.00 price objective on the stock in a research note on Thursday, April 10th. Finally, Raymond James set a $190.00 target price on shares of EastGroup Properties and gave the stock a "strong-buy" rating in a research report on Monday, April 14th. One investment analyst has rated the stock with a sell rating, eight have given a hold rating, seven have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $188.13.

Get Our Latest Research Report on EastGroup Properties

EastGroup Properties Stock Performance

EGP traded up $1.33 during trading on Wednesday, hitting $160.32. The stock had a trading volume of 533,020 shares, compared to its average volume of 366,588. The firm has a market cap of $8.38 billion, a PE ratio of 34.48, a P/E/G ratio of 3.35 and a beta of 0.94. The company has a current ratio of 0.12, a quick ratio of 0.12 and a debt-to-equity ratio of 0.46. EastGroup Properties, Inc. has a 12 month low of $137.67 and a 12 month high of $192.61. The company has a 50 day simple moving average of $171.71 and a 200-day simple moving average of $170.88.

EastGroup Properties (NYSE:EGP - Get Free Report) last issued its quarterly earnings results on Wednesday, April 23rd. The real estate investment trust reported $2.12 EPS for the quarter, topping the consensus estimate of $2.11 by $0.01. EastGroup Properties had a return on equity of 7.89% and a net margin of 35.57%. Analysts expect that EastGroup Properties, Inc. will post 8.94 EPS for the current year.

EastGroup Properties Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, April 15th. Stockholders of record on Monday, March 31st were issued a dividend of $1.40 per share. The ex-dividend date was Monday, March 31st. This represents a $5.60 annualized dividend and a dividend yield of 3.49%. EastGroup Properties's payout ratio is 120.43%.

About EastGroup Properties

(

Free Report)

EastGroup Properties, Inc NYSE: EGP, a member of the S&P Mid-Cap 400 and Russell 1000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in major Sunbelt markets throughout the United States with an emphasis in the states of Florida, Texas, Arizona, California and North Carolina.

Featured Stories

Before you consider EastGroup Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EastGroup Properties wasn't on the list.

While EastGroup Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.