Metis Global Partners LLC lifted its position in shares of ONEOK, Inc. (NYSE:OKE - Free Report) by 41.5% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 76,873 shares of the utilities provider's stock after acquiring an additional 22,534 shares during the quarter. Metis Global Partners LLC's holdings in ONEOK were worth $7,005,000 at the end of the most recent reporting period.

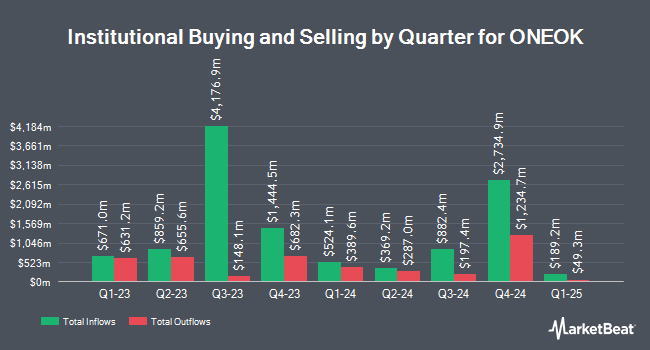

Other hedge funds also recently modified their holdings of the company. National Pension Service boosted its holdings in shares of ONEOK by 1.6% during the 3rd quarter. National Pension Service now owns 763,833 shares of the utilities provider's stock valued at $69,608,000 after acquiring an additional 12,349 shares in the last quarter. Leavell Investment Management Inc. raised its position in ONEOK by 3.8% during the 3rd quarter. Leavell Investment Management Inc. now owns 141,236 shares of the utilities provider's stock worth $12,871,000 after purchasing an additional 5,175 shares during the last quarter. Caxton Associates LP bought a new position in ONEOK during the 2nd quarter worth $1,225,000. Point72 Europe London LLP bought a new position in ONEOK during the 2nd quarter worth $15,008,000. Finally, Nations Financial Group Inc. IA ADV raised its position in ONEOK by 11.1% during the 3rd quarter. Nations Financial Group Inc. IA ADV now owns 54,557 shares of the utilities provider's stock worth $4,972,000 after purchasing an additional 5,451 shares during the last quarter. Institutional investors and hedge funds own 69.13% of the company's stock.

Insider Buying and Selling at ONEOK

In related news, Director Pattye L. Moore sold 3,379 shares of the stock in a transaction dated Thursday, September 5th. The shares were sold at an average price of $92.01, for a total value of $310,901.79. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Company insiders own 0.20% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages recently issued reports on OKE. Tudor Pickering raised ONEOK to a "hold" rating in a research report on Thursday, July 18th. Citigroup raised their target price on ONEOK from $85.00 to $102.00 and gave the stock a "buy" rating in a research report on Tuesday, September 3rd. Mizuho raised ONEOK to a "hold" rating in a research report on Thursday, November 7th. Scotiabank lifted their price objective on ONEOK from $88.00 to $102.00 and gave the stock a "sector outperform" rating in a research report on Friday, August 30th. Finally, Morgan Stanley raised ONEOK from an "equal weight" rating to an "overweight" rating and lifted their price objective for the stock from $103.00 to $111.00 in a research report on Monday, September 16th. Eight research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $96.92.

Get Our Latest Stock Report on OKE

ONEOK Price Performance

Shares of ONEOK stock traded down $0.29 during trading on Thursday, hitting $107.88. The stock had a trading volume of 2,621,723 shares, compared to its average volume of 2,763,003. The firm has a market cap of $63.02 billion, a price-to-earnings ratio of 22.63, a P/E/G ratio of 5.38 and a beta of 1.66. ONEOK, Inc. has a 12 month low of $64.68 and a 12 month high of $109.21. The business's 50-day moving average is $95.84 and its 200 day moving average is $87.24. The company has a current ratio of 0.81, a quick ratio of 0.59 and a debt-to-equity ratio of 1.59.

ONEOK (NYSE:OKE - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The utilities provider reported $1.18 earnings per share for the quarter, missing the consensus estimate of $1.23 by ($0.05). The firm had revenue of $5.02 billion during the quarter, compared to the consensus estimate of $5.81 billion. ONEOK had a return on equity of 16.84% and a net margin of 14.05%. During the same period in the previous year, the company posted $0.99 EPS. As a group, sell-side analysts anticipate that ONEOK, Inc. will post 5.15 earnings per share for the current year.

ONEOK Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Thursday, November 14th. Investors of record on Friday, November 1st will be given a $0.99 dividend. The ex-dividend date of this dividend is Friday, November 1st. This represents a $3.96 annualized dividend and a yield of 3.67%. ONEOK's dividend payout ratio (DPR) is presently 82.85%.

About ONEOK

(

Free Report)

ONEOK, Inc engages in gathering, processing, fractionation, storage, transportation, and marketing of natural gas and natural gas liquids (NGL) in the United States. It operates through four segments: Natural Gas Gathering and Processing, Natural Gas Liquids, Natural Gas Pipelines, and Refined Products and Crude.

Recommended Stories

Before you consider ONEOK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ONEOK wasn't on the list.

While ONEOK currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.