MetLife Investment Management LLC grew its holdings in shares of WNS (Holdings) Limited (NYSE:WNS - Free Report) by 117.3% during the third quarter, according to the company in its most recent disclosure with the SEC. The fund owned 25,388 shares of the business services provider's stock after buying an additional 13,702 shares during the quarter. MetLife Investment Management LLC owned 0.05% of WNS worth $1,338,000 at the end of the most recent reporting period.

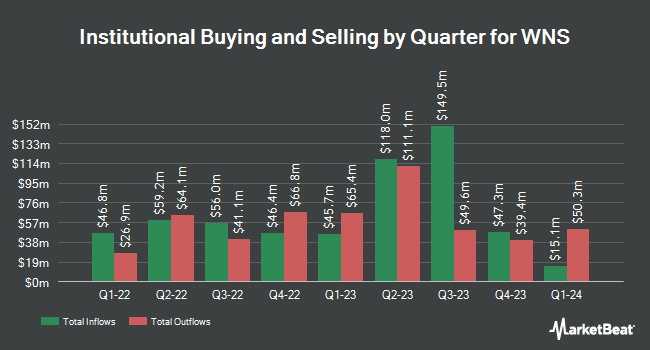

Several other hedge funds and other institutional investors have also recently modified their holdings of the business. GAMMA Investing LLC boosted its holdings in shares of WNS by 64.1% in the second quarter. GAMMA Investing LLC now owns 635 shares of the business services provider's stock valued at $33,000 after purchasing an additional 248 shares during the period. Hunter Perkins Capital Management LLC purchased a new stake in shares of WNS in the 2nd quarter worth $387,000. Nicholas Company Inc. grew its position in shares of WNS by 10.4% during the 2nd quarter. Nicholas Company Inc. now owns 118,505 shares of the business services provider's stock worth $6,222,000 after buying an additional 11,190 shares in the last quarter. JB Capital LLC purchased a new position in shares of WNS during the second quarter valued at $1,422,000. Finally, Calamos Advisors LLC bought a new stake in shares of WNS in the second quarter valued at about $1,114,000. 97.36% of the stock is currently owned by hedge funds and other institutional investors.

WNS Stock Performance

Shares of WNS stock traded down $1.16 during trading hours on Friday, hitting $49.65. The company's stock had a trading volume of 387,184 shares, compared to its average volume of 544,256. The stock has a market cap of $2.37 billion and a PE ratio of 19.10. WNS has a 12-month low of $39.85 and a 12-month high of $72.57. The company has a 50 day moving average of $50.12 and a 200 day moving average of $53.36. The company has a current ratio of 1.62, a quick ratio of 1.62 and a debt-to-equity ratio of 0.23.

WNS (NYSE:WNS - Get Free Report) last announced its quarterly earnings results on Thursday, October 17th. The business services provider reported $0.99 earnings per share for the quarter, topping the consensus estimate of $0.78 by $0.21. WNS had a return on equity of 22.76% and a net margin of 9.39%. The company had revenue of $310.70 million for the quarter, compared to the consensus estimate of $313.66 million. On average, sell-side analysts forecast that WNS will post 3.52 EPS for the current fiscal year.

Analysts Set New Price Targets

Several equities analysts recently issued reports on the stock. JPMorgan Chase & Co. lifted their price objective on shares of WNS from $60.00 to $73.00 and gave the company a "neutral" rating in a report on Friday, September 6th. Needham & Company LLC cut their price objective on shares of WNS from $70.00 to $60.00 and set a "buy" rating on the stock in a research report on Friday, October 18th. Deutsche Bank Aktiengesellschaft decreased their target price on shares of WNS from $55.00 to $51.00 and set a "hold" rating for the company in a research report on Thursday, October 3rd. Barrington Research reaffirmed an "outperform" rating and issued a $70.00 price target on shares of WNS in a report on Friday, October 18th. Finally, TD Cowen lowered WNS from a "buy" rating to a "hold" rating and decreased their price objective for the company from $64.00 to $53.00 in a report on Thursday, October 17th. Four equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $60.33.

Read Our Latest Report on WNS

WNS Profile

(

Free Report)

WNS (Holdings) Limited, a business process management (BPM) company, provides data, voice, analytical, and business transformation services worldwide. The company operates through TSLU, MRHP, HCLS, and BFSI segments. It engages in diversified business, including manufacturing, retail, consumer packaged goods, media and entertainment, and telecommunication; travel and leisure, utilities, shipping, and logistics; healthcare and life sciences; banking, financial services, and insurance; and Hi-tech and professional services, as well as procurement.

Featured Stories

Before you consider WNS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WNS wasn't on the list.

While WNS currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.