MFA Financial (NYSE:MFA - Get Free Report) was downgraded by investment analysts at StockNews.com from a "buy" rating to a "hold" rating in a report released on Friday.

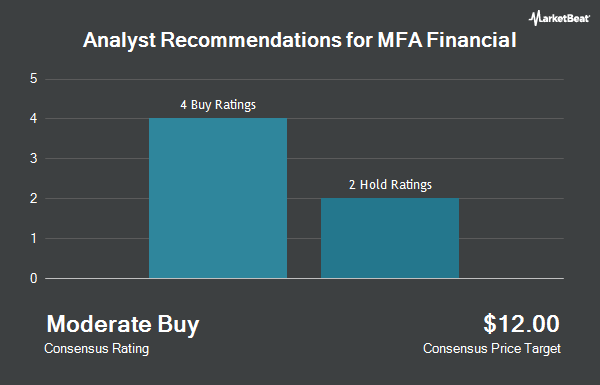

A number of other brokerages have also weighed in on MFA. Keefe, Bruyette & Woods lowered their price objective on MFA Financial from $13.50 to $12.50 and set an "outperform" rating on the stock in a report on Thursday, February 20th. JMP Securities decreased their price target on MFA Financial from $13.50 to $12.50 and set a "market outperform" rating on the stock in a research note on Thursday, January 23rd. Finally, Janney Montgomery Scott started coverage on MFA Financial in a report on Thursday, January 2nd. They set a "buy" rating and a $14.00 price objective on the stock. One analyst has rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $13.70.

View Our Latest Research Report on MFA

MFA Financial Trading Down 2.6 %

Shares of MFA Financial stock traded down $0.28 during trading hours on Friday, hitting $10.29. 1,164,876 shares of the company were exchanged, compared to its average volume of 843,951. The business has a 50-day moving average of $10.58 and a 200-day moving average of $11.13. MFA Financial has a 1 year low of $9.36 and a 1 year high of $13.45. The stock has a market capitalization of $1.05 billion, a price-to-earnings ratio of 12.70 and a beta of 2.18.

MFA Financial (NYSE:MFA - Get Free Report) last announced its quarterly earnings data on Wednesday, February 19th. The real estate investment trust reported $0.38 EPS for the quarter, missing analysts' consensus estimates of $0.40 by ($0.02). The firm had revenue of $50.80 million for the quarter, compared to analysts' expectations of $58.06 million. MFA Financial had a return on equity of 9.61% and a net margin of 16.47%. As a group, research analysts anticipate that MFA Financial will post 1.5 earnings per share for the current fiscal year.

Hedge Funds Weigh In On MFA Financial

Several hedge funds have recently bought and sold shares of MFA. Wellington Management Group LLP grew its holdings in MFA Financial by 1.0% in the third quarter. Wellington Management Group LLP now owns 11,005,138 shares of the real estate investment trust's stock valued at $139,985,000 after purchasing an additional 111,331 shares during the last quarter. Vaughan Nelson Investment Management L.P. grew its stake in MFA Financial by 11.0% in the 4th quarter. Vaughan Nelson Investment Management L.P. now owns 5,085,927 shares of the real estate investment trust's stock valued at $51,824,000 after acquiring an additional 502,840 shares during the last quarter. State Street Corp grew its stake in MFA Financial by 6.2% in the 3rd quarter. State Street Corp now owns 2,579,818 shares of the real estate investment trust's stock valued at $33,700,000 after acquiring an additional 151,321 shares during the last quarter. Geode Capital Management LLC increased its holdings in MFA Financial by 0.9% during the 3rd quarter. Geode Capital Management LLC now owns 2,407,455 shares of the real estate investment trust's stock valued at $30,629,000 after acquiring an additional 21,331 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. raised its position in MFA Financial by 3.3% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,895,670 shares of the real estate investment trust's stock worth $19,317,000 after acquiring an additional 60,261 shares during the last quarter. 65.28% of the stock is owned by hedge funds and other institutional investors.

MFA Financial Company Profile

(

Get Free Report)

MFA Financial, Inc, together with its subsidiaries, operates as a real estate investment trust in the United States. It invests in residential mortgage securities, including non-agency mortgage-backed securities, agency MBS, and credit risk transfer securities; residential whole loans, including purchased performing loans, purchased credit deteriorated, and non-performing loans; and mortgage servicing rights related assets.

See Also

Before you consider MFA Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MFA Financial wasn't on the list.

While MFA Financial currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.