Landscape Capital Management L.L.C. cut its position in shares of MFS Intermediate Income Trust (NYSE:MIN - Free Report) by 64.4% during the 3rd quarter, according to the company in its most recent filing with the SEC. The firm owned 138,776 shares of the financial services provider's stock after selling 250,625 shares during the quarter. Landscape Capital Management L.L.C. owned 0.12% of MFS Intermediate Income Trust worth $377,000 as of its most recent filing with the SEC.

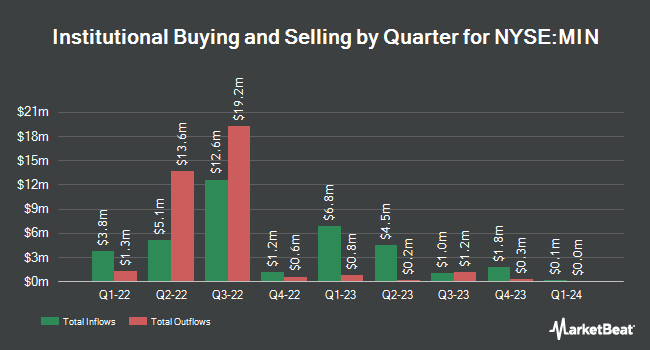

A number of other institutional investors and hedge funds also recently modified their holdings of the stock. Westfuller Advisors LLC purchased a new stake in MFS Intermediate Income Trust in the 3rd quarter worth about $28,000. PFG Investments LLC bought a new stake in MFS Intermediate Income Trust during the 3rd quarter valued at approximately $35,000. Sanctuary Advisors LLC bought a new stake in MFS Intermediate Income Trust during the 2nd quarter valued at approximately $62,000. Choreo LLC bought a new stake in MFS Intermediate Income Trust during the 2nd quarter valued at approximately $73,000. Finally, Wolverine Asset Management LLC bought a new stake in MFS Intermediate Income Trust during the 3rd quarter valued at approximately $129,000. 50.90% of the stock is owned by institutional investors and hedge funds.

MFS Intermediate Income Trust Price Performance

NYSE:MIN traded up $0.02 during mid-day trading on Monday, hitting $2.69. 113,087 shares of the company's stock traded hands, compared to its average volume of 238,800. The firm has a 50 day moving average of $2.72 and a two-hundred day moving average of $2.69. MFS Intermediate Income Trust has a 12 month low of $2.56 and a 12 month high of $2.85.

MFS Intermediate Income Trust Cuts Dividend

The company also recently disclosed a monthly dividend, which will be paid on Friday, November 29th. Shareholders of record on Tuesday, November 12th will be given a $0.0201 dividend. The ex-dividend date is Tuesday, November 12th. This represents a $0.24 dividend on an annualized basis and a dividend yield of 8.96%.

MFS Intermediate Income Trust Profile

(

Free Report)

MFS Intermediate Income Trust is a closed ended fixed income mutual fund launched and managed by Massachusetts Financial Services Company. The fund invests in fixed income markets across the globe. It primarily invests in debt instruments. The fund seeks to benchmarks the performance of its portfolio against the Barclays Intermediate U.S.

Read More

Before you consider MFS Intermediate Income Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MFS Intermediate Income Trust wasn't on the list.

While MFS Intermediate Income Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.