M&G PLC acquired a new position in Cameco Co. (NYSE:CCJ - Free Report) TSE: CCO during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor acquired 1,378,147 shares of the basic materials company's stock, valued at approximately $66,227,000. M&G PLC owned 0.32% of Cameco at the end of the most recent reporting period.

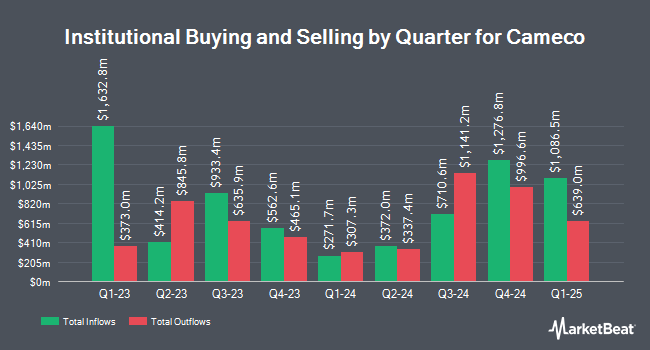

Several other large investors have also modified their holdings of CCJ. Massachusetts Financial Services Co. MA purchased a new position in Cameco in the 2nd quarter worth about $73,125,000. BNP PARIBAS ASSET MANAGEMENT Holding S.A. purchased a new stake in shares of Cameco in the first quarter valued at approximately $31,131,000. King Luther Capital Management Corp bought a new position in Cameco in the second quarter worth approximately $32,740,000. Van ECK Associates Corp increased its holdings in Cameco by 48.1% during the 3rd quarter. Van ECK Associates Corp now owns 1,584,822 shares of the basic materials company's stock worth $75,691,000 after purchasing an additional 515,046 shares during the period. Finally, The Manufacturers Life Insurance Company raised its position in Cameco by 28.3% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 1,987,526 shares of the basic materials company's stock valued at $97,653,000 after purchasing an additional 437,921 shares in the last quarter. Hedge funds and other institutional investors own 70.21% of the company's stock.

Cameco Price Performance

CCJ stock traded up $2.37 during midday trading on Thursday, reaching $53.58. The stock had a trading volume of 5,744,165 shares, compared to its average volume of 4,413,915. Cameco Co. has a 52-week low of $35.43 and a 52-week high of $58.72. The company has a current ratio of 3.22, a quick ratio of 1.48 and a debt-to-equity ratio of 0.23. The company's fifty day simple moving average is $47.77 and its 200 day simple moving average is $48.11. The company has a market cap of $23.32 billion, a price-to-earnings ratio of 123.74 and a beta of 0.89.

Wall Street Analyst Weigh In

A number of analysts recently weighed in on the stock. National Bank Financial raised shares of Cameco to a "strong-buy" rating in a research note on Tuesday, September 3rd. Janney Montgomery Scott upgraded shares of Cameco to a "strong-buy" rating in a research note on Friday, October 4th. Glj Research reissued a "buy" rating and issued a $63.73 price objective on shares of Cameco in a research note on Wednesday, August 14th. Cantor Fitzgerald raised Cameco from a "neutral" rating to an "overweight" rating in a research report on Wednesday, July 31st. Finally, Scotiabank reduced their price target on Cameco from $81.00 to $80.00 and set an "outperform" rating for the company in a research report on Monday, August 19th. One analyst has rated the stock with a sell rating, five have assigned a buy rating and two have assigned a strong buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Buy" and an average target price of $66.56.

Get Our Latest Research Report on Cameco

About Cameco

(

Free Report)

Cameco Corporation provides uranium for the generation of electricity. It operates through Uranium, Fuel Services, Westinghouse segments. The Uranium segment is involved in the exploration for, mining, and milling, purchase, and sale of uranium concentrate. The Fuel Services segment engages in the refining, conversion, and fabrication of uranium concentrate, as well as the purchase and sale of conversion services.

Recommended Stories

Before you consider Cameco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cameco wasn't on the list.

While Cameco currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.