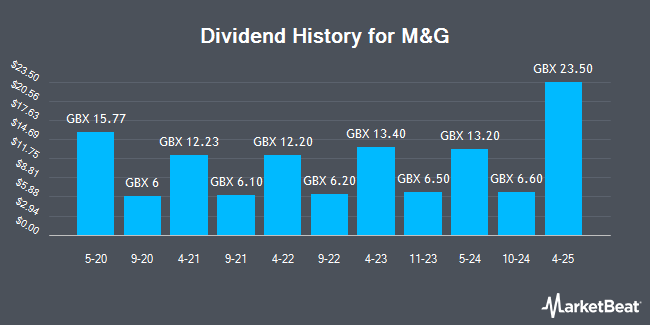

M&G plc (LON:MNG - Get Free Report) announced a dividend on Wednesday, March 19th, Upcoming Dividends.Co.Uk reports. Shareholders of record on Thursday, March 27th will be paid a dividend of GBX 23.50 ($0.30) per share on Friday, May 9th. This represents a yield of 4.25%. The ex-dividend date is Thursday, March 27th. This is a 256.1% increase from M&G's previous dividend of $6.60. The official announcement can be viewed at this link.

M&G Trading Up 0.2 %

M&G stock traded up GBX 0.50 ($0.01) during trading hours on Friday, reaching GBX 217.50 ($2.81). The stock had a trading volume of 15,931,646 shares, compared to its average volume of 27,324,143. The stock has a market cap of £5.18 billion, a PE ratio of 31.02, a PEG ratio of -2.76 and a beta of 1.47. M&G has a 52 week low of GBX 184 ($2.38) and a 52 week high of GBX 239.90 ($3.10). The company has a debt-to-equity ratio of 218.70, a current ratio of 0.40 and a quick ratio of 0.39. The company has a fifty day simple moving average of GBX 209.97 and a 200-day simple moving average of GBX 204.38.

M&G (LON:MNG - Get Free Report) last announced its quarterly earnings results on Wednesday, March 19th. The company reported GBX (15.10) (($0.19)) earnings per share (EPS) for the quarter. M&G had a return on equity of 4.31% and a net margin of 1.85%. Analysts forecast that M&G will post 24.2485207 EPS for the current fiscal year.

Analyst Ratings Changes

Separately, Deutsche Bank Aktiengesellschaft cut their target price on shares of M&G from GBX 230 ($2.97) to GBX 225 ($2.91) and set a "hold" rating on the stock in a research note on Monday, February 24th.

View Our Latest Analysis on MNG

About M&G

(

Get Free Report)

M&G plc is a leading savings and investments business, managing investments for both individuals and for large institutional investors, such as pension funds, around the world.

We have a single corporate identity, M&G plc, and two customer-facing brands: Prudential and M&G Investments. Prudential offers savings and insurance for customers in the UK and Europe and for asset management in South Africa.

Further Reading

Before you consider M&G, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M&G wasn't on the list.

While M&G currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.