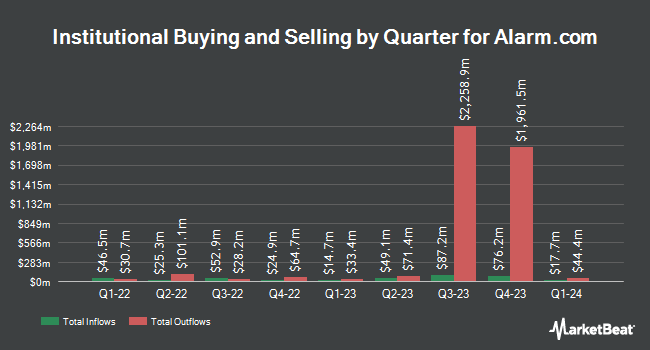

M&G PLC acquired a new position in Alarm.com Holdings, Inc. (NASDAQ:ALRM - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund acquired 174,241 shares of the software maker's stock, valued at approximately $9,583,000. M&G PLC owned 0.35% of Alarm.com as of its most recent filing with the Securities & Exchange Commission.

Several other large investors also recently added to or reduced their stakes in the company. Vanguard Group Inc. lifted its stake in Alarm.com by 1.1% during the first quarter. Vanguard Group Inc. now owns 5,880,922 shares of the software maker's stock worth $426,190,000 after purchasing an additional 63,653 shares during the last quarter. Disciplined Growth Investors Inc. MN increased its stake in shares of Alarm.com by 6.2% in the 2nd quarter. Disciplined Growth Investors Inc. MN now owns 2,710,998 shares of the software maker's stock worth $172,257,000 after acquiring an additional 158,465 shares in the last quarter. Dimensional Fund Advisors LP grew its stake in shares of Alarm.com by 3.8% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,162,877 shares of the software maker's stock worth $73,889,000 after buying an additional 42,281 shares during the last quarter. Bank of New York Mellon Corp raised its position in shares of Alarm.com by 15.8% in the 2nd quarter. Bank of New York Mellon Corp now owns 472,948 shares of the software maker's stock worth $30,051,000 after purchasing an additional 64,424 shares during the last quarter. Finally, Assenagon Asset Management S.A. grew its holdings in shares of Alarm.com by 230.6% during the third quarter. Assenagon Asset Management S.A. now owns 381,277 shares of the software maker's stock valued at $20,844,000 after buying an additional 265,936 shares during the last quarter. Hedge funds and other institutional investors own 91.74% of the company's stock.

Insider Transactions at Alarm.com

In related news, CFO Steve Valenzuela sold 7,400 shares of the stock in a transaction on Thursday, August 22nd. The shares were sold at an average price of $60.27, for a total transaction of $445,998.00. Following the sale, the chief financial officer now directly owns 37,500 shares of the company's stock, valued at approximately $2,260,125. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. In related news, CFO Steve Valenzuela sold 7,400 shares of the company's stock in a transaction dated Thursday, August 22nd. The stock was sold at an average price of $60.27, for a total value of $445,998.00. Following the completion of the transaction, the chief financial officer now owns 37,500 shares of the company's stock, valued at approximately $2,260,125. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Daniel Ramos sold 9,476 shares of the company's stock in a transaction that occurred on Friday, August 23rd. The stock was sold at an average price of $61.81, for a total value of $585,711.56. Following the transaction, the insider now directly owns 41,100 shares of the company's stock, valued at approximately $2,540,391. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 5.60% of the company's stock.

Analyst Upgrades and Downgrades

ALRM has been the topic of several research analyst reports. Barclays upped their target price on shares of Alarm.com from $60.00 to $67.00 and gave the company an "equal weight" rating in a research note on Friday. Jefferies Financial Group initiated coverage on shares of Alarm.com in a report on Tuesday. They issued a "buy" rating and a $65.00 target price for the company. The Goldman Sachs Group boosted their price objective on Alarm.com from $64.00 to $67.00 and gave the company a "neutral" rating in a research report on Friday. Roth Mkm cut their target price on shares of Alarm.com from $78.00 to $73.00 and set a "buy" rating for the company in a research note on Wednesday, October 9th. Finally, StockNews.com raised Alarm.com from a "hold" rating to a "buy" rating in a research report on Friday, September 13th. Four analysts have rated the stock with a hold rating and three have issued a buy rating to the company's stock. According to MarketBeat.com, Alarm.com has a consensus rating of "Hold" and an average price target of $68.40.

Check Out Our Latest Research Report on Alarm.com

Alarm.com Stock Performance

NASDAQ:ALRM traded up $6.37 during midday trading on Friday, hitting $63.51. The company's stock had a trading volume of 903,713 shares, compared to its average volume of 370,904. The firm has a market cap of $3.13 billion, a P/E ratio of 31.60, a P/E/G ratio of 3.25 and a beta of 0.90. The firm's 50 day moving average is $54.81 and its 200-day moving average is $61.38. Alarm.com Holdings, Inc. has a fifty-two week low of $51.19 and a fifty-two week high of $77.29. The company has a debt-to-equity ratio of 1.52, a current ratio of 9.25 and a quick ratio of 8.70.

Alarm.com (NASDAQ:ALRM - Get Free Report) last released its quarterly earnings data on Thursday, August 8th. The software maker reported $0.58 earnings per share for the quarter, beating analysts' consensus estimates of $0.49 by $0.09. The business had revenue of $233.80 million during the quarter, compared to analyst estimates of $227.35 million. Alarm.com had a return on equity of 13.00% and a net margin of 11.92%. The company's revenue was up 4.4% on a year-over-year basis. During the same quarter last year, the business posted $0.33 EPS. Equities analysts anticipate that Alarm.com Holdings, Inc. will post 1.4 earnings per share for the current fiscal year.

Alarm.com Profile

(

Free Report)

Alarm.com Holdings, Inc provides various Internet of Things (IoT) and solutions for residential, multi-family, small business, and enterprise commercial markets in North America and internationally. The company operates through two segments, Alarm.com and Other. It offers solutions to control and monitor security systems, as well as to IoT devices, including door locks, garage doors, thermostats, and video cameras; and video monitoring and analytics solutions, such as video analytics, escalated events, video doorbells, intelligent integration, live streaming, secure cloud storage, and video alerts.

Further Reading

Before you consider Alarm.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alarm.com wasn't on the list.

While Alarm.com currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report