MGB Wealth Management LLC decreased its position in Microsoft Co. (NASDAQ:MSFT - Free Report) by 6.5% in the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 26,348 shares of the software giant's stock after selling 1,833 shares during the period. Microsoft accounts for about 4.1% of MGB Wealth Management LLC's investment portfolio, making the stock its 3rd biggest position. MGB Wealth Management LLC's holdings in Microsoft were worth $11,331,000 at the end of the most recent reporting period.

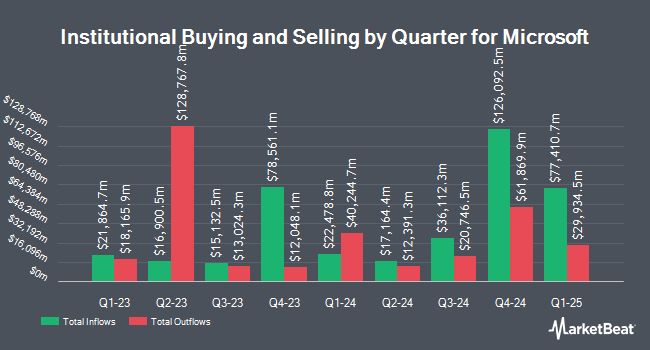

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Wescott Financial Advisory Group LLC raised its holdings in shares of Microsoft by 0.9% in the 3rd quarter. Wescott Financial Advisory Group LLC now owns 7,777 shares of the software giant's stock valued at $3,346,000 after purchasing an additional 68 shares in the last quarter. Family Capital Management Inc. raised its stake in Microsoft by 0.7% in the third quarter. Family Capital Management Inc. now owns 6,192 shares of the software giant's stock worth $2,664,000 after buying an additional 40 shares in the last quarter. Truepoint Inc. lifted its holdings in Microsoft by 47.1% during the third quarter. Truepoint Inc. now owns 7,538 shares of the software giant's stock worth $3,244,000 after buying an additional 2,413 shares during the period. Jim Saulnier & Associates LLC bought a new stake in Microsoft during the 3rd quarter valued at $538,000. Finally, Algert Global LLC purchased a new position in shares of Microsoft in the 3rd quarter valued at $25,586,000. Institutional investors own 71.13% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages recently weighed in on MSFT. Sanford C. Bernstein dropped their price objective on Microsoft from $501.00 to $500.00 and set an "outperform" rating on the stock in a research report on Friday, October 25th. Oppenheimer downgraded shares of Microsoft from an "outperform" rating to a "market perform" rating in a research report on Tuesday, October 8th. Piper Sandler reissued an "overweight" rating and set a $470.00 target price on shares of Microsoft in a research report on Thursday, October 31st. TD Cowen cut their price target on shares of Microsoft from $495.00 to $475.00 and set a "buy" rating on the stock in a report on Thursday, October 31st. Finally, KeyCorp upped their price target on Microsoft from $490.00 to $505.00 and gave the stock an "overweight" rating in a research report on Friday, October 18th. Two equities research analysts have rated the stock with a hold rating and twenty-eight have assigned a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $503.03.

Check Out Our Latest Report on MSFT

Insider Activity

In other news, insider Bradford L. Smith sold 40,000 shares of the company's stock in a transaction on Monday, September 9th. The shares were sold at an average price of $402.59, for a total transaction of $16,103,600.00. Following the completion of the sale, the insider now owns 544,847 shares of the company's stock, valued at $219,349,953.73. This represents a 6.84 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CFO Amy Hood sold 38,000 shares of the firm's stock in a transaction dated Thursday, September 5th. The stock was sold at an average price of $410.55, for a total transaction of $15,600,900.00. Following the completion of the transaction, the chief financial officer now directly owns 496,369 shares in the company, valued at approximately $203,784,292.95. This represents a 7.11 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 134,578 shares of company stock worth $55,279,956 over the last 90 days. 0.03% of the stock is currently owned by company insiders.

Microsoft Price Performance

Shares of Microsoft stock traded up $6.34 on Wednesday, hitting $437.54. The company's stock had a trading volume of 7,004,814 shares, compared to its average volume of 20,481,127. The company has a market capitalization of $3.25 trillion, a price-to-earnings ratio of 35.58, a price-to-earnings-growth ratio of 2.29 and a beta of 0.90. Microsoft Co. has a 1 year low of $364.13 and a 1 year high of $468.35. The company has a debt-to-equity ratio of 0.15, a quick ratio of 1.29 and a current ratio of 1.30. The firm has a fifty day moving average price of $420.83 and a 200-day moving average price of $426.70.

Microsoft (NASDAQ:MSFT - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The software giant reported $3.30 EPS for the quarter, beating analysts' consensus estimates of $3.10 by $0.20. Microsoft had a return on equity of 34.56% and a net margin of 35.61%. The business had revenue of $65.59 billion during the quarter, compared to analysts' expectations of $64.57 billion. During the same period in the previous year, the business earned $2.99 earnings per share. The business's revenue was up 16.0% compared to the same quarter last year. As a group, sell-side analysts anticipate that Microsoft Co. will post 12.93 earnings per share for the current fiscal year.

Microsoft Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, March 13th. Shareholders of record on Thursday, February 20th will be issued a dividend of $0.83 per share. This represents a $3.32 annualized dividend and a yield of 0.76%. Microsoft's payout ratio is 27.39%.

Microsoft declared that its board has authorized a share buyback program on Monday, September 16th that allows the company to repurchase $60.00 billion in outstanding shares. This repurchase authorization allows the software giant to purchase up to 1.9% of its shares through open market purchases. Shares repurchase programs are generally a sign that the company's board of directors believes its stock is undervalued.

About Microsoft

(

Free Report)

Microsoft Corporation develops and supports software, services, devices and solutions worldwide. The Productivity and Business Processes segment offers office, exchange, SharePoint, Microsoft Teams, office 365 Security and Compliance, Microsoft viva, and Microsoft 365 copilot; and office consumer services, such as Microsoft 365 consumer subscriptions, Office licensed on-premises, and other office services.

See Also

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.