Quest Partners LLC raised its position in MGE Energy, Inc. (NASDAQ:MGEE - Free Report) by 2,789.7% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 13,495 shares of the utilities provider's stock after acquiring an additional 13,028 shares during the quarter. Quest Partners LLC's holdings in MGE Energy were worth $1,234,000 as of its most recent SEC filing.

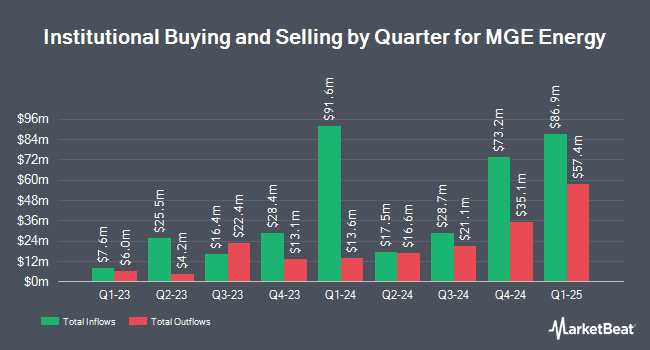

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. SG Americas Securities LLC purchased a new stake in MGE Energy in the first quarter valued at $100,000. ProShare Advisors LLC grew its stake in MGE Energy by 21.6% during the 1st quarter. ProShare Advisors LLC now owns 7,351 shares of the utilities provider's stock worth $579,000 after buying an additional 1,307 shares during the last quarter. State Board of Administration of Florida Retirement System increased its position in MGE Energy by 41.7% during the first quarter. State Board of Administration of Florida Retirement System now owns 15,116 shares of the utilities provider's stock worth $1,174,000 after buying an additional 4,450 shares during the period. Vanguard Group Inc. lifted its stake in MGE Energy by 12.4% in the first quarter. Vanguard Group Inc. now owns 4,699,072 shares of the utilities provider's stock valued at $369,911,000 after buying an additional 518,466 shares during the last quarter. Finally, Edgestream Partners L.P. acquired a new stake in shares of MGE Energy in the first quarter valued at approximately $1,178,000. Institutional investors and hedge funds own 52.58% of the company's stock.

Analyst Upgrades and Downgrades

Separately, Morgan Stanley lifted their target price on shares of MGE Energy from $71.00 to $74.00 and gave the company an "underweight" rating in a report on Wednesday, September 25th.

Get Our Latest Report on MGEE

MGE Energy Stock Performance

Shares of MGE Energy stock traded down $0.64 on Wednesday, reaching $103.89. 93,711 shares of the stock were exchanged, compared to its average volume of 213,532. The company has a current ratio of 1.41, a quick ratio of 0.94 and a debt-to-equity ratio of 0.60. The firm has a market capitalization of $3.76 billion, a PE ratio of 31.97 and a beta of 0.71. MGE Energy, Inc. has a 1-year low of $61.94 and a 1-year high of $109.22. The business has a fifty day moving average price of $93.43 and a two-hundred day moving average price of $85.69.

MGE Energy Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Sunday, December 15th. Investors of record on Sunday, December 1st will be paid a $0.45 dividend. The ex-dividend date of this dividend is Friday, November 29th. This represents a $1.80 dividend on an annualized basis and a dividend yield of 1.73%. MGE Energy's dividend payout ratio (DPR) is presently 55.05%.

MGE Energy Profile

(

Free Report)

MGE Energy, Inc, through its subsidiaries, operates as a public utility holding company primarily in the United States. It operates through Regulated Electric Utility Operations; Regulated Gas Utility Operations; Nonregulated Energy Operations; Transmission Investments; and All Other segments. The company generates, purchases, and distributes electricity and natural gas in Wisconsin and Iowa; owns and leases electric generating capacity; and plans, constructs, operates, maintains, and expands transmission facilities to provide transmission power services.

Featured Stories

Before you consider MGE Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGE Energy wasn't on the list.

While MGE Energy currently has a "Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.