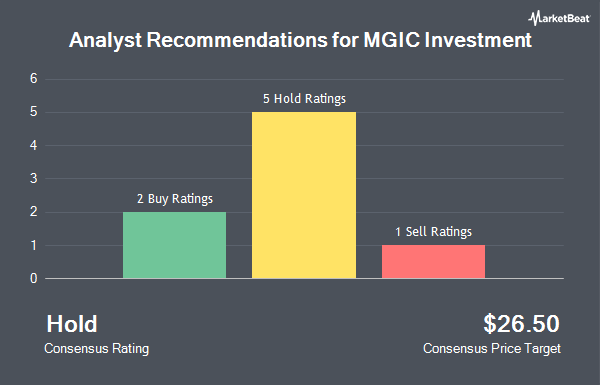

Shares of MGIC Investment Co. (NYSE:MTG - Get Free Report) have been assigned a consensus recommendation of "Hold" from the seven ratings firms that are covering the stock, MarketBeat.com reports. One research analyst has rated the stock with a sell recommendation, four have issued a hold recommendation and two have assigned a buy recommendation to the company. The average 12-month target price among brokers that have covered the stock in the last year is $26.00.

MTG has been the subject of a number of research analyst reports. Barclays raised their target price on MGIC Investment from $23.00 to $24.00 and gave the company an "equal weight" rating in a report on Tuesday, October 8th. Royal Bank of Canada reduced their price target on MGIC Investment from $28.00 to $27.00 and set a "sector perform" rating on the stock in a research report on Wednesday, November 6th. Bank of America lowered shares of MGIC Investment from a "buy" rating to an "underperform" rating and cut their target price for the stock from $26.00 to $25.00 in a research note on Monday, December 9th. Finally, Keefe, Bruyette & Woods reaffirmed a "market perform" rating and issued a $29.00 target price on shares of MGIC Investment in a report on Tuesday, December 10th.

View Our Latest Stock Report on MGIC Investment

Institutional Trading of MGIC Investment

Several institutional investors have recently modified their holdings of the stock. Dimensional Fund Advisors LP lifted its holdings in shares of MGIC Investment by 3.8% in the 2nd quarter. Dimensional Fund Advisors LP now owns 15,145,206 shares of the insurance provider's stock valued at $326,375,000 after purchasing an additional 556,859 shares during the last quarter. Caisse DE Depot ET Placement DU Quebec purchased a new stake in MGIC Investment in the third quarter valued at approximately $13,535,000. WINTON GROUP Ltd boosted its holdings in shares of MGIC Investment by 440.3% in the second quarter. WINTON GROUP Ltd now owns 521,001 shares of the insurance provider's stock valued at $11,228,000 after acquiring an additional 424,580 shares during the period. Vest Financial LLC grew its position in shares of MGIC Investment by 22.7% during the second quarter. Vest Financial LLC now owns 1,073,756 shares of the insurance provider's stock worth $23,139,000 after acquiring an additional 198,553 shares during the last quarter. Finally, Barclays PLC increased its holdings in shares of MGIC Investment by 75.1% in the 3rd quarter. Barclays PLC now owns 457,706 shares of the insurance provider's stock valued at $11,716,000 after acquiring an additional 196,252 shares during the period. Hedge funds and other institutional investors own 95.58% of the company's stock.

MGIC Investment Trading Down 1.2 %

Shares of MTG stock traded down $0.31 during trading hours on Friday, hitting $24.55. The company had a trading volume of 2,152,502 shares, compared to its average volume of 1,733,938. The company has a debt-to-equity ratio of 0.12, a current ratio of 1.25 and a quick ratio of 1.25. The stock has a market capitalization of $6.22 billion, a PE ratio of 8.64, a price-to-earnings-growth ratio of 1.77 and a beta of 1.27. The company's fifty day moving average is $25.22 and its 200 day moving average is $24.03. MGIC Investment has a fifty-two week low of $18.68 and a fifty-two week high of $26.56.

MGIC Investment (NYSE:MTG - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The insurance provider reported $0.77 EPS for the quarter, topping analysts' consensus estimates of $0.66 by $0.11. MGIC Investment had a return on equity of 14.99% and a net margin of 64.09%. The company had revenue of $306.65 million for the quarter, compared to analysts' expectations of $306.03 million. During the same period in the prior year, the firm earned $0.64 earnings per share. The firm's revenue was up 3.4% compared to the same quarter last year. Research analysts expect that MGIC Investment will post 2.85 earnings per share for the current fiscal year.

MGIC Investment Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Thursday, November 21st. Shareholders of record on Thursday, November 7th were paid a $0.13 dividend. The ex-dividend date was Thursday, November 7th. This represents a $0.52 annualized dividend and a yield of 2.12%. MGIC Investment's dividend payout ratio is currently 18.31%.

About MGIC Investment

(

Get Free ReportMGIC Investment Corporation, through its subsidiaries, provides private mortgage insurance, other mortgage credit risk management solutions, and ancillary services to lenders and government sponsored entities in the United States, the District of Columbia, Puerto Rico, and Guam. The company offers primary mortgage insurance that provides mortgage default protection on individual loans, as well as covers unpaid loan principal, delinquent interest, and various expenses associated with the default and subsequent foreclosure.

Featured Stories

Before you consider MGIC Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGIC Investment wasn't on the list.

While MGIC Investment currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.