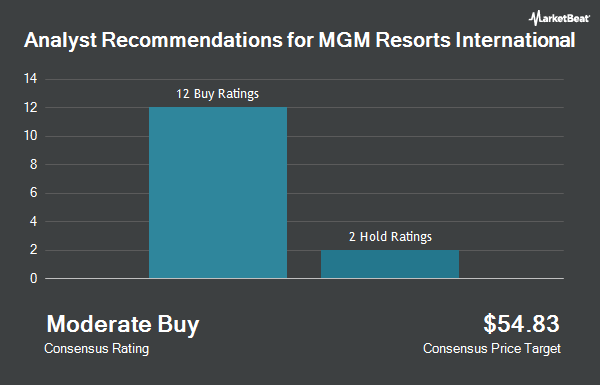

Shares of MGM Resorts International (NYSE:MGM - Get Free Report) have received an average recommendation of "Moderate Buy" from the fourteen brokerages that are covering the stock, Marketbeat reports. Three analysts have rated the stock with a hold rating and eleven have issued a buy rating on the company. The average 1 year target price among analysts that have issued a report on the stock in the last year is $53.15.

MGM has been the topic of a number of research analyst reports. Susquehanna raised their price target on MGM Resorts International from $54.00 to $55.00 and gave the company a "positive" rating in a report on Thursday, August 1st. Mizuho lowered their price objective on shares of MGM Resorts International from $57.00 to $56.00 and set an "outperform" rating on the stock in a research report on Thursday, October 31st. Stifel Nicolaus raised their price objective on MGM Resorts International from $60.00 to $63.00 and gave the company a "buy" rating in a research note on Thursday, August 1st. Deutsche Bank Aktiengesellschaft cut their price target on MGM Resorts International from $57.00 to $52.00 and set a "buy" rating for the company in a report on Tuesday, October 1st. Finally, Morgan Stanley upped their target price on shares of MGM Resorts International from $43.00 to $44.00 and gave the stock an "equal weight" rating in a report on Tuesday, October 22nd.

Read Our Latest Research Report on MGM

Insider Transactions at MGM Resorts International

In other MGM Resorts International news, Director Keith A. Meister sold 121,000 shares of the company's stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $36.72, for a total transaction of $4,443,120.00. Following the transaction, the director now owns 5,738,478 shares in the company, valued at approximately $210,716,912.16. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 2.13% of the company's stock.

Institutional Investors Weigh In On MGM Resorts International

Hedge funds and other institutional investors have recently added to or reduced their stakes in the company. International Assets Investment Management LLC bought a new position in shares of MGM Resorts International during the 2nd quarter valued at approximately $28,000. MidAtlantic Capital Management Inc. purchased a new position in shares of MGM Resorts International during the third quarter valued at $28,000. Eastern Bank purchased a new position in shares of MGM Resorts International during the third quarter valued at $35,000. EverSource Wealth Advisors LLC increased its stake in shares of MGM Resorts International by 60.7% during the first quarter. EverSource Wealth Advisors LLC now owns 871 shares of the company's stock valued at $41,000 after buying an additional 329 shares during the period. Finally, UMB Bank n.a. grew its stake in MGM Resorts International by 33.3% in the second quarter. UMB Bank n.a. now owns 949 shares of the company's stock valued at $42,000 after purchasing an additional 237 shares during the last quarter. 68.11% of the stock is owned by hedge funds and other institutional investors.

MGM Resorts International Price Performance

Shares of MGM traded up $0.13 during trading hours on Tuesday, reaching $36.85. The company had a trading volume of 3,773,319 shares, compared to its average volume of 4,110,629. The company has a current ratio of 1.24, a quick ratio of 1.21 and a debt-to-equity ratio of 1.63. MGM Resorts International has a 12-month low of $33.44 and a 12-month high of $48.24. The firm has a 50 day simple moving average of $38.32 and a 200-day simple moving average of $39.90. The company has a market capitalization of $10.97 billion, a price-to-earnings ratio of 13.11, a PEG ratio of 2.62 and a beta of 2.23.

MGM Resorts International (NYSE:MGM - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The company reported $0.54 earnings per share for the quarter, missing the consensus estimate of $0.58 by ($0.04). MGM Resorts International had a return on equity of 25.84% and a net margin of 5.23%. The company had revenue of $4.18 billion for the quarter, compared to analysts' expectations of $4.21 billion. During the same quarter in the previous year, the company earned $0.64 earnings per share. The company's revenue was up 5.3% on a year-over-year basis. Research analysts expect that MGM Resorts International will post 2.5 earnings per share for the current year.

MGM Resorts International Company Profile

(

Get Free ReportMGM Resorts International, through its subsidiaries, owns and operates casino, hotel, and entertainment resorts in the United States and internationally. The company operates through three segments: Las Vegas Strip Resorts, Regional Operations, and MGM China. Its casino resorts offer gaming, hotel, convention, dining, entertainment, retail, and other resort amenities.

See Also

Before you consider MGM Resorts International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGM Resorts International wasn't on the list.

While MGM Resorts International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.