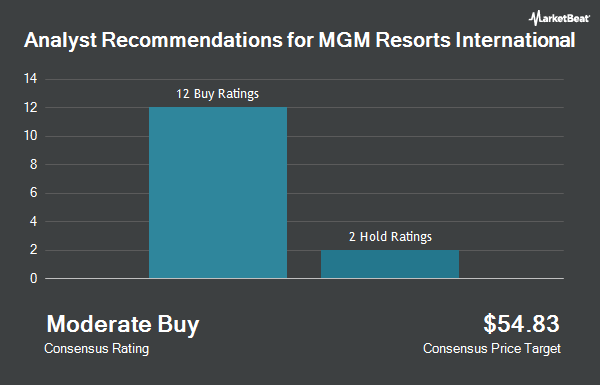

Shares of MGM Resorts International (NYSE:MGM - Get Free Report) have been assigned a consensus recommendation of "Moderate Buy" from the fourteen brokerages that are covering the stock, MarketBeat reports. Three analysts have rated the stock with a hold rating and eleven have issued a buy rating on the company. The average 12 month price target among analysts that have covered the stock in the last year is $52.85.

A number of equities research analysts have recently issued reports on the company. Barclays cut their target price on MGM Resorts International from $54.00 to $50.00 and set an "overweight" rating on the stock in a research report on Thursday, October 31st. Mizuho cut their price objective on MGM Resorts International from $57.00 to $56.00 and set an "outperform" rating on the stock in a report on Thursday, October 31st. UBS Group raised shares of MGM Resorts International to a "hold" rating in a research note on Friday, August 23rd. JMP Securities dropped their target price on shares of MGM Resorts International from $54.00 to $50.00 and set a "market outperform" rating on the stock in a research report on Monday, November 25th. Finally, Morgan Stanley upped their price target on shares of MGM Resorts International from $43.00 to $44.00 and gave the company an "equal weight" rating in a research report on Tuesday, October 22nd.

Check Out Our Latest Stock Analysis on MGM Resorts International

Insider Buying and Selling at MGM Resorts International

In other MGM Resorts International news, Director Keith A. Meister sold 121,000 shares of the business's stock in a transaction dated Friday, September 13th. The stock was sold at an average price of $36.72, for a total value of $4,443,120.00. Following the completion of the sale, the director now owns 5,738,478 shares of the company's stock, valued at $210,716,912.16. The trade was a 2.07 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Corporate insiders own 2.13% of the company's stock.

Institutional Inflows and Outflows

Hedge funds have recently made changes to their positions in the stock. International Assets Investment Management LLC acquired a new position in MGM Resorts International during the second quarter valued at approximately $28,000. MidAtlantic Capital Management Inc. bought a new stake in shares of MGM Resorts International during the 3rd quarter worth $28,000. Eastern Bank acquired a new position in MGM Resorts International in the 3rd quarter valued at $35,000. UMB Bank n.a. raised its holdings in MGM Resorts International by 33.3% in the 2nd quarter. UMB Bank n.a. now owns 949 shares of the company's stock worth $42,000 after acquiring an additional 237 shares during the period. Finally, Brooklyn Investment Group acquired a new position in MGM Resorts International during the 3rd quarter worth $44,000. Institutional investors and hedge funds own 68.11% of the company's stock.

MGM Resorts International Price Performance

Shares of NYSE:MGM traded down $0.18 during trading hours on Friday, hitting $36.66. 5,294,351 shares of the company's stock traded hands, compared to its average volume of 3,309,350. The company has a debt-to-equity ratio of 1.63, a quick ratio of 1.21 and a current ratio of 1.24. The company's fifty day simple moving average is $38.65 and its two-hundred day simple moving average is $39.47. MGM Resorts International has a 52 week low of $33.44 and a 52 week high of $48.24. The company has a market cap of $10.92 billion, a price-to-earnings ratio of 13.09, a price-to-earnings-growth ratio of 2.68 and a beta of 2.20.

MGM Resorts International (NYSE:MGM - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $0.54 earnings per share for the quarter, missing analysts' consensus estimates of $0.58 by ($0.04). The business had revenue of $4.18 billion for the quarter, compared to the consensus estimate of $4.21 billion. MGM Resorts International had a return on equity of 25.84% and a net margin of 5.23%. The company's quarterly revenue was up 5.3% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.64 earnings per share. As a group, equities analysts anticipate that MGM Resorts International will post 2.48 EPS for the current fiscal year.

MGM Resorts International Company Profile

(

Get Free ReportMGM Resorts International, through its subsidiaries, owns and operates casino, hotel, and entertainment resorts in the United States and internationally. The company operates through three segments: Las Vegas Strip Resorts, Regional Operations, and MGM China. Its casino resorts offer gaming, hotel, convention, dining, entertainment, retail, and other resort amenities.

Recommended Stories

Before you consider MGM Resorts International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGM Resorts International wasn't on the list.

While MGM Resorts International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.