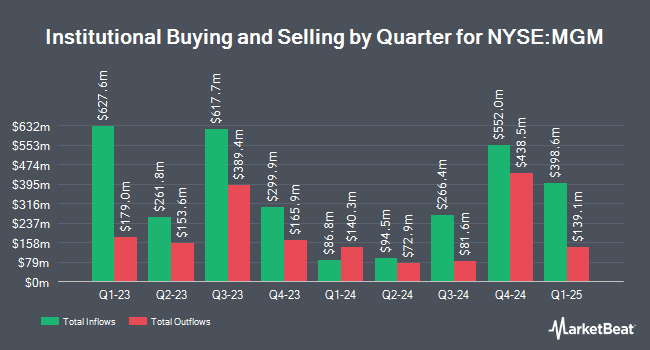

American Assets Capital Advisers LLC increased its stake in MGM Resorts International (NYSE:MGM - Free Report) by 135.0% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 469,552 shares of the company's stock after purchasing an additional 269,761 shares during the quarter. MGM Resorts International accounts for 5.6% of American Assets Capital Advisers LLC's investment portfolio, making the stock its 7th largest position. American Assets Capital Advisers LLC owned approximately 0.16% of MGM Resorts International worth $18,355,000 as of its most recent filing with the Securities & Exchange Commission.

Other hedge funds also recently added to or reduced their stakes in the company. Victory Capital Management Inc. increased its holdings in MGM Resorts International by 4.3% during the 3rd quarter. Victory Capital Management Inc. now owns 114,385 shares of the company's stock valued at $4,471,000 after acquiring an additional 4,745 shares in the last quarter. Aigen Investment Management LP purchased a new stake in MGM Resorts International during the 3rd quarter worth about $4,639,000. Sumitomo Mitsui Trust Group Inc. raised its stake in MGM Resorts International by 1.8% in the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 455,672 shares of the company's stock valued at $17,812,000 after purchasing an additional 7,917 shares during the last quarter. Entropy Technologies LP grew its position in shares of MGM Resorts International by 156.9% in the third quarter. Entropy Technologies LP now owns 55,311 shares of the company's stock valued at $2,162,000 after purchasing an additional 33,777 shares during the period. Finally, Apollon Wealth Management LLC grew its position in shares of MGM Resorts International by 6.6% in the third quarter. Apollon Wealth Management LLC now owns 10,997 shares of the company's stock valued at $430,000 after purchasing an additional 681 shares during the period. 68.11% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at MGM Resorts International

In related news, Director Keith A. Meister sold 121,000 shares of the firm's stock in a transaction that occurred on Friday, September 13th. The stock was sold at an average price of $36.72, for a total value of $4,443,120.00. Following the sale, the director now directly owns 5,738,478 shares in the company, valued at $210,716,912.16. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Insiders own 2.13% of the company's stock.

Analyst Ratings Changes

Several research firms have commented on MGM. JMP Securities lowered their price target on MGM Resorts International from $56.00 to $54.00 and set a "market outperform" rating for the company in a report on Thursday, October 31st. Deutsche Bank Aktiengesellschaft dropped their price target on shares of MGM Resorts International from $57.00 to $52.00 and set a "buy" rating on the stock in a research note on Tuesday, October 1st. Mizuho dropped their price objective on MGM Resorts International from $57.00 to $56.00 and set an "outperform" rating on the stock in a report on Thursday, October 31st. Morgan Stanley lifted their price objective on MGM Resorts International from $43.00 to $44.00 and gave the stock an "equal weight" rating in a report on Tuesday, October 22nd. Finally, Wells Fargo & Company dropped their price target on shares of MGM Resorts International from $53.00 to $47.00 and set an "overweight" rating for the company in a research note on Thursday, October 17th. Four analysts have rated the stock with a hold rating and eleven have given a buy rating to the stock. According to data from MarketBeat, MGM Resorts International currently has an average rating of "Moderate Buy" and a consensus target price of $53.15.

Get Our Latest Stock Report on MGM Resorts International

MGM Resorts International Stock Performance

MGM traded up $0.03 during trading on Tuesday, reaching $36.75. 6,173,285 shares of the company were exchanged, compared to its average volume of 4,123,727. The stock has a market cap of $10.94 billion, a P/E ratio of 13.13, a PEG ratio of 2.62 and a beta of 2.23. The firm has a 50 day moving average of $38.33 and a 200 day moving average of $39.87. The company has a current ratio of 1.24, a quick ratio of 1.21 and a debt-to-equity ratio of 1.63. MGM Resorts International has a 52 week low of $33.44 and a 52 week high of $48.24.

MGM Resorts International (NYSE:MGM - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The company reported $0.54 earnings per share for the quarter, missing the consensus estimate of $0.58 by ($0.04). MGM Resorts International had a net margin of 5.23% and a return on equity of 25.84%. The firm had revenue of $4.18 billion during the quarter, compared to the consensus estimate of $4.21 billion. During the same quarter in the prior year, the business earned $0.64 earnings per share. The company's revenue for the quarter was up 5.3% compared to the same quarter last year. On average, sell-side analysts forecast that MGM Resorts International will post 2.5 EPS for the current fiscal year.

MGM Resorts International Profile

(

Free Report)

MGM Resorts International, through its subsidiaries, owns and operates casino, hotel, and entertainment resorts in the United States and internationally. The company operates through three segments: Las Vegas Strip Resorts, Regional Operations, and MGM China. Its casino resorts offer gaming, hotel, convention, dining, entertainment, retail, and other resort amenities.

Featured Stories

Before you consider MGM Resorts International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGM Resorts International wasn't on the list.

While MGM Resorts International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.