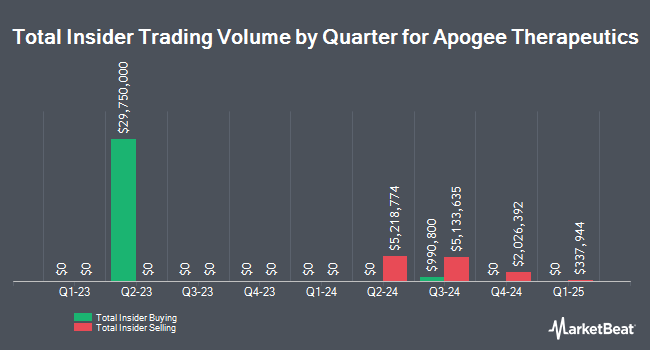

Apogee Therapeutics, Inc. (NASDAQ:APGE - Get Free Report) CEO Michael Thomas Henderson sold 15,000 shares of Apogee Therapeutics stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $59.22, for a total transaction of $888,300.00. Following the completion of the sale, the chief executive officer now directly owns 1,339,487 shares in the company, valued at approximately $79,324,420.14. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at the SEC website.

Michael Thomas Henderson also recently made the following trade(s):

- On Wednesday, October 2nd, Michael Thomas Henderson sold 40,000 shares of Apogee Therapeutics stock. The shares were sold at an average price of $56.23, for a total value of $2,249,200.00.

- On Wednesday, September 4th, Michael Thomas Henderson sold 40,000 shares of Apogee Therapeutics stock. The stock was sold at an average price of $47.62, for a total value of $1,904,800.00.

Apogee Therapeutics Price Performance

Apogee Therapeutics stock traded up $3.07 during mid-day trading on Friday, reaching $61.12. 407,357 shares of the stock traded hands, compared to its average volume of 496,236. The business's 50-day moving average is $54.05 and its 200-day moving average is $48.70. The stock has a market capitalization of $2.75 billion, a PE ratio of -28.04 and a beta of 2.93. Apogee Therapeutics, Inc. has a 12-month low of $14.19 and a 12-month high of $72.29.

Apogee Therapeutics (NASDAQ:APGE - Get Free Report) last released its quarterly earnings data on Monday, August 12th. The company reported ($0.60) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of ($0.60). Equities analysts anticipate that Apogee Therapeutics, Inc. will post -2.57 EPS for the current fiscal year.

Analysts Set New Price Targets

Separately, Wedbush reaffirmed an "outperform" rating and set a $87.00 target price on shares of Apogee Therapeutics in a report on Friday, October 25th. Six investment analysts have rated the stock with a buy rating, According to MarketBeat.com, the stock presently has an average rating of "Buy" and a consensus target price of $78.50.

Read Our Latest Stock Analysis on Apogee Therapeutics

Institutional Trading of Apogee Therapeutics

Institutional investors have recently bought and sold shares of the stock. Arizona State Retirement System grew its holdings in Apogee Therapeutics by 4.5% during the second quarter. Arizona State Retirement System now owns 5,993 shares of the company's stock worth $236,000 after acquiring an additional 258 shares during the period. Mirae Asset Global Investments Co. Ltd. increased its holdings in shares of Apogee Therapeutics by 21.2% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,628 shares of the company's stock valued at $94,000 after purchasing an additional 285 shares during the last quarter. EntryPoint Capital LLC increased its stake in Apogee Therapeutics by 44.7% during the first quarter. EntryPoint Capital LLC now owns 1,997 shares of the company's stock worth $133,000 after acquiring an additional 617 shares during the last quarter. Principal Financial Group Inc. grew its stake in shares of Apogee Therapeutics by 26.3% in the second quarter. Principal Financial Group Inc. now owns 6,442 shares of the company's stock valued at $253,000 after buying an additional 1,340 shares in the last quarter. Finally, Handelsbanken Fonder AB boosted its holdings in Apogee Therapeutics by 25.7% in the third quarter. Handelsbanken Fonder AB now owns 8,800 shares of the company's stock valued at $517,000 after purchasing an additional 1,800 shares during the period. 79.04% of the stock is currently owned by institutional investors and hedge funds.

About Apogee Therapeutics

(

Get Free Report)

Apogee Therapeutics, Inc, through its subsidiary, operates as a biotechnology company that develops biologics for the treatment of atopic dermatitis (AD), asthma, chronic obstructive pulmonary disease (COPD), and related inflammatory and immunology indications. The company primarily develops APG777, a subcutaneous (SQ) extended half-life monoclonal antibody (mAb) for AD; and APG808, an SQ extended half-life mAb for COPD.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Apogee Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apogee Therapeutics wasn't on the list.

While Apogee Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.