Microchip Technology (NASDAQ:MCHP - Get Free Report) was downgraded by equities research analysts at Bank of America from a "neutral" rating to an "underperform" rating in a report released on Monday, Marketbeat reports. They currently have a $65.00 target price on the semiconductor company's stock, down from their previous target price of $80.00. Bank of America's price target would suggest a potential upside of 10.02% from the company's current price.

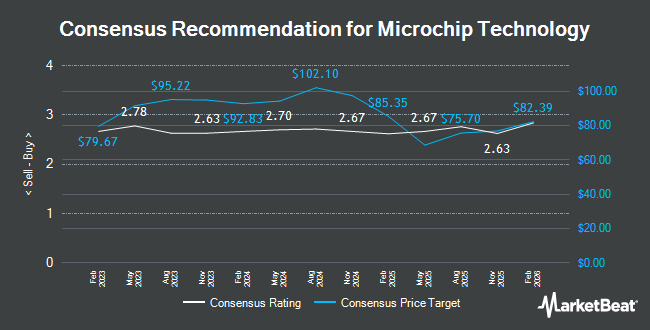

A number of other equities research analysts have also weighed in on MCHP. Jefferies Financial Group lowered their target price on shares of Microchip Technology from $100.00 to $90.00 and set a "buy" rating on the stock in a report on Wednesday, November 6th. Susquehanna lowered their target price on shares of Microchip Technology from $95.00 to $90.00 and set a "positive" rating on the stock in a report on Wednesday, November 6th. Truist Financial lowered shares of Microchip Technology from a "buy" rating to a "hold" rating and lowered their target price for the stock from $89.00 to $80.00 in a report on Monday, September 23rd. TD Cowen lowered their target price on shares of Microchip Technology from $80.00 to $70.00 and set a "hold" rating on the stock in a report on Wednesday, November 6th. Finally, Stifel Nicolaus decreased their price objective on shares of Microchip Technology from $90.00 to $87.00 and set a "buy" rating for the company in a research note on Tuesday, December 3rd. One research analyst has rated the stock with a sell rating, five have given a hold rating and fourteen have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $89.63.

Get Our Latest Report on MCHP

Microchip Technology Stock Down 1.4 %

Shares of NASDAQ MCHP traded down $0.85 during trading on Monday, hitting $59.08. 11,618,414 shares of the company traded hands, compared to its average volume of 6,225,922. The business's fifty day moving average is $70.49 and its 200 day moving average is $79.80. Microchip Technology has a fifty-two week low of $57.94 and a fifty-two week high of $100.57. The firm has a market capitalization of $31.73 billion, a price-to-earnings ratio of 41.91 and a beta of 1.50. The company has a debt-to-equity ratio of 0.71, a quick ratio of 0.48 and a current ratio of 0.88.

Microchip Technology (NASDAQ:MCHP - Get Free Report) last announced its quarterly earnings data on Tuesday, November 5th. The semiconductor company reported $0.46 earnings per share for the quarter, beating the consensus estimate of $0.43 by $0.03. Microchip Technology had a net margin of 14.22% and a return on equity of 19.47%. The firm had revenue of $1.16 billion for the quarter, compared to analyst estimates of $1.15 billion. During the same quarter in the prior year, the business earned $1.54 earnings per share. The business's quarterly revenue was down 48.4% compared to the same quarter last year. Equities research analysts predict that Microchip Technology will post 1.33 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the business. Franklin Resources Inc. boosted its holdings in Microchip Technology by 30.2% in the 3rd quarter. Franklin Resources Inc. now owns 3,347,643 shares of the semiconductor company's stock worth $264,430,000 after buying an additional 776,408 shares during the period. Synovus Financial Corp boosted its holdings in Microchip Technology by 9.6% in the 3rd quarter. Synovus Financial Corp now owns 70,644 shares of the semiconductor company's stock valued at $5,672,000 after purchasing an additional 6,191 shares during the period. Tidal Investments LLC boosted its holdings in Microchip Technology by 3.2% in the 3rd quarter. Tidal Investments LLC now owns 36,267 shares of the semiconductor company's stock valued at $2,912,000 after purchasing an additional 1,108 shares during the period. Wilmington Savings Fund Society FSB boosted its holdings in Microchip Technology by 16.6% in the 3rd quarter. Wilmington Savings Fund Society FSB now owns 60,394 shares of the semiconductor company's stock valued at $4,849,000 after purchasing an additional 8,592 shares during the period. Finally, Arvest Bank Trust Division bought a new position in Microchip Technology in the 3rd quarter valued at $223,000. 91.51% of the stock is owned by institutional investors.

About Microchip Technology

(

Get Free Report)

Microchip Technology Incorporated engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit mixed-signal microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

See Also

Before you consider Microchip Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microchip Technology wasn't on the list.

While Microchip Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.