Microchip Technology (NASDAQ:MCHP - Get Free Report)'s stock had its "buy" rating reissued by investment analysts at Rosenblatt Securities in a note issued to investors on Wednesday, Benzinga reports. They presently have a $90.00 price target on the semiconductor company's stock. Rosenblatt Securities' target price points to a potential upside of 22.03% from the stock's current price.

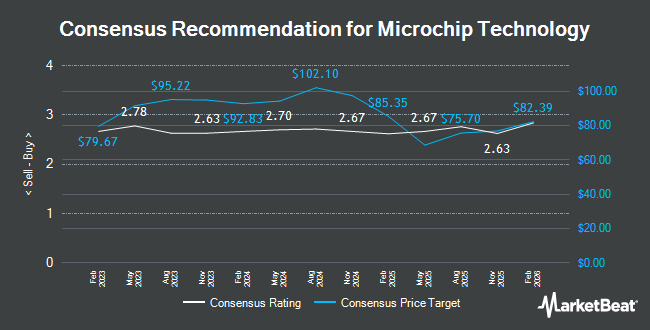

A number of other research analysts have also weighed in on the stock. Morgan Stanley lowered shares of Microchip Technology from an "overweight" rating to an "equal weight" rating and cut their target price for the company from $102.00 to $100.00 in a report on Thursday, July 11th. Bank of America lowered shares of Microchip Technology from a "buy" rating to a "neutral" rating and cut their target price for the company from $110.00 to $90.00 in a report on Friday, August 2nd. TD Cowen cut their target price on shares of Microchip Technology from $80.00 to $70.00 and set a "hold" rating for the company in a report on Wednesday. Piper Sandler cut their target price on shares of Microchip Technology from $100.00 to $85.00 and set an "overweight" rating for the company in a report on Wednesday. Finally, Needham & Company LLC cut their target price on shares of Microchip Technology from $96.00 to $85.00 and set a "buy" rating for the company in a report on Wednesday. Six investment analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $92.00.

Read Our Latest Report on MCHP

Microchip Technology Price Performance

Shares of Microchip Technology stock traded down $1.34 on Wednesday, hitting $73.75. 11,331,622 shares of the company traded hands, compared to its average volume of 5,960,178. The stock has a market capitalization of $39.57 billion, a P/E ratio of 29.47 and a beta of 1.53. The company has a debt-to-equity ratio of 0.96, a quick ratio of 1.08 and a current ratio of 1.94. Microchip Technology has a 52 week low of $71.76 and a 52 week high of $100.57. The business has a 50-day simple moving average of $77.17 and a 200 day simple moving average of $85.20.

Insider Transactions at Microchip Technology

In other Microchip Technology news, CFO James Eric Bjornholt sold 2,154 shares of the business's stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $81.50, for a total value of $175,551.00. Following the completion of the transaction, the chief financial officer now directly owns 33,257 shares in the company, valued at approximately $2,710,445.50. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Corporate insiders own 2.10% of the company's stock.

Hedge Funds Weigh In On Microchip Technology

A number of large investors have recently added to or reduced their stakes in the company. Pathway Financial Advisers LLC purchased a new stake in shares of Microchip Technology during the first quarter worth about $39,000. Versant Capital Management Inc grew its stake in shares of Microchip Technology by 148.8% during the second quarter. Versant Capital Management Inc now owns 530 shares of the semiconductor company's stock worth $48,000 after acquiring an additional 317 shares during the last quarter. Wolff Wiese Magana LLC grew its stake in shares of Microchip Technology by 55.2% during the third quarter. Wolff Wiese Magana LLC now owns 613 shares of the semiconductor company's stock worth $49,000 after acquiring an additional 218 shares during the last quarter. CarsonAllaria Wealth Management Ltd. purchased a new stake in shares of Microchip Technology during the first quarter worth about $54,000. Finally, TruNorth Capital Management LLC purchased a new stake in shares of Microchip Technology during the second quarter worth about $55,000. 91.51% of the stock is currently owned by institutional investors.

Microchip Technology Company Profile

(

Get Free Report)

Microchip Technology Incorporated engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit mixed-signal microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

Recommended Stories

Before you consider Microchip Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microchip Technology wasn't on the list.

While Microchip Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.