Skandinaviska Enskilda Banken AB publ boosted its holdings in Microsoft Co. (NASDAQ:MSFT - Free Report) by 24.6% in the second quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 3,831,437 shares of the software giant's stock after purchasing an additional 757,654 shares during the quarter. Microsoft comprises 8.2% of Skandinaviska Enskilda Banken AB publ's holdings, making the stock its largest holding. Skandinaviska Enskilda Banken AB publ owned 0.05% of Microsoft worth $1,711,852,000 as of its most recent SEC filing.

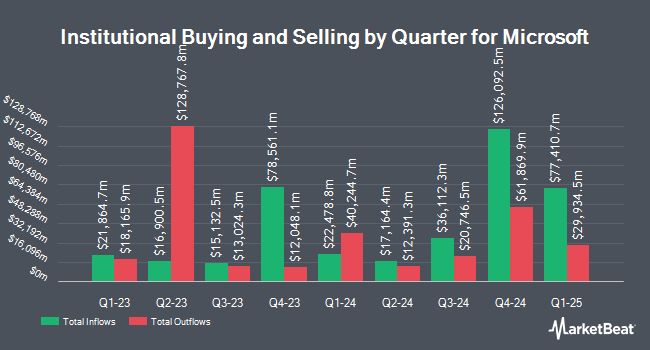

A number of other institutional investors and hedge funds have also recently modified their holdings of MSFT. Vicus Capital lifted its holdings in shares of Microsoft by 0.5% in the 1st quarter. Vicus Capital now owns 92,924 shares of the software giant's stock worth $39,095,000 after purchasing an additional 428 shares in the last quarter. Kathleen S. Wright Associates Inc. lifted its stake in shares of Microsoft by 178.0% in the first quarter. Kathleen S. Wright Associates Inc. now owns 645 shares of the software giant's stock valued at $272,000 after buying an additional 413 shares in the last quarter. Legend Financial Advisors Inc. grew its holdings in shares of Microsoft by 24.1% during the first quarter. Legend Financial Advisors Inc. now owns 427 shares of the software giant's stock valued at $180,000 after buying an additional 83 shares during the last quarter. Coston McIsaac & Partners increased its position in shares of Microsoft by 0.5% during the first quarter. Coston McIsaac & Partners now owns 11,842 shares of the software giant's stock worth $4,982,000 after acquiring an additional 61 shares in the last quarter. Finally, Brown Miller Wealth Management LLC raised its holdings in shares of Microsoft by 1.3% in the 1st quarter. Brown Miller Wealth Management LLC now owns 37,813 shares of the software giant's stock worth $15,908,000 after acquiring an additional 503 shares during the last quarter. 71.13% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several brokerages recently issued reports on MSFT. Royal Bank of Canada reiterated an "outperform" rating and set a $500.00 price target on shares of Microsoft in a report on Tuesday. Morgan Stanley upped their target price on shares of Microsoft from $506.00 to $548.00 and gave the stock an "overweight" rating in a research note on Thursday, October 31st. Oppenheimer lowered shares of Microsoft from an "outperform" rating to a "market perform" rating in a research report on Tuesday, October 8th. TD Cowen reduced their price objective on shares of Microsoft from $495.00 to $475.00 and set a "buy" rating for the company in a research report on Thursday, October 31st. Finally, DA Davidson cut shares of Microsoft from a "buy" rating to a "neutral" rating and set a $475.00 target price on the stock. in a research report on Monday, September 23rd. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and twenty-six have issued a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $503.03.

Get Our Latest Analysis on MSFT

Microsoft Trading Up 1.2 %

Shares of MSFT traded up $5.25 during trading hours on Thursday, hitting $425.43. The company had a trading volume of 19,865,725 shares, compared to its average volume of 20,436,930. The firm has a market cap of $3.16 trillion, a P/E ratio of 35.10, a P/E/G ratio of 2.16 and a beta of 0.91. Microsoft Co. has a 52-week low of $360.36 and a 52-week high of $468.35. The stock's 50 day moving average price is $420.74 and its 200 day moving average price is $424.80. The company has a quick ratio of 1.29, a current ratio of 1.30 and a debt-to-equity ratio of 0.15.

Microsoft (NASDAQ:MSFT - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The software giant reported $3.30 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.10 by $0.20. Microsoft had a net margin of 35.61% and a return on equity of 34.56%. The firm had revenue of $65.59 billion for the quarter, compared to analysts' expectations of $64.57 billion. The company's revenue for the quarter was up 16.0% compared to the same quarter last year. During the same quarter in the previous year, the company earned $2.99 earnings per share. On average, research analysts predict that Microsoft Co. will post 12.95 EPS for the current year.

Microsoft Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, December 12th. Stockholders of record on Thursday, November 21st will be paid a dividend of $0.83 per share. This is a positive change from Microsoft's previous quarterly dividend of $0.75. The ex-dividend date of this dividend is Thursday, November 21st. This represents a $3.32 dividend on an annualized basis and a dividend yield of 0.78%. Microsoft's payout ratio is presently 27.39%.

Microsoft announced that its board has initiated a stock buyback plan on Monday, September 16th that authorizes the company to buyback $60.00 billion in shares. This buyback authorization authorizes the software giant to buy up to 1.9% of its shares through open market purchases. Shares buyback plans are typically a sign that the company's board believes its stock is undervalued.

Insider Activity at Microsoft

In other news, CEO Satya Nadella sold 14,398 shares of the stock in a transaction that occurred on Friday, August 23rd. The stock was sold at an average price of $417.41, for a total value of $6,009,869.18. Following the completion of the transaction, the chief executive officer now owns 786,933 shares of the company's stock, valued at approximately $328,473,703.53. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other news, CFO Amy Hood sold 38,000 shares of Microsoft stock in a transaction dated Thursday, September 5th. The stock was sold at an average price of $410.55, for a total value of $15,600,900.00. Following the completion of the transaction, the chief financial officer now owns 496,369 shares of the company's stock, valued at $203,784,292.95. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Satya Nadella sold 14,398 shares of the stock in a transaction that occurred on Friday, August 23rd. The stock was sold at an average price of $417.41, for a total transaction of $6,009,869.18. Following the completion of the transaction, the chief executive officer now owns 786,933 shares in the company, valued at $328,473,703.53. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 190,629 shares of company stock worth $77,916,485 over the last 90 days. 0.03% of the stock is owned by company insiders.

Microsoft Profile

(

Free Report)

Microsoft Corporation develops and supports software, services, devices and solutions worldwide. The Productivity and Business Processes segment offers office, exchange, SharePoint, Microsoft Teams, office 365 Security and Compliance, Microsoft viva, and Microsoft 365 copilot; and office consumer services, such as Microsoft 365 consumer subscriptions, Office licensed on-premises, and other office services.

Recommended Stories

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report