CIBC Asset Management Inc boosted its stake in MicroStrategy Incorporated (NASDAQ:MSTR - Free Report) by 935.8% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 4,340 shares of the software maker's stock after purchasing an additional 3,921 shares during the period. CIBC Asset Management Inc's holdings in MicroStrategy were worth $732,000 at the end of the most recent reporting period.

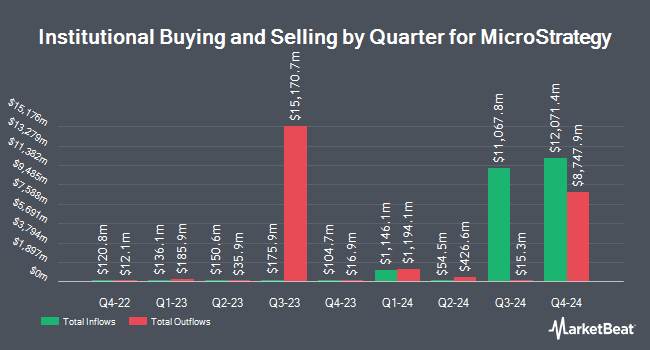

Several other hedge funds and other institutional investors have also recently bought and sold shares of MSTR. Sumitomo Mitsui Trust Group Inc. raised its position in MicroStrategy by 1,077.0% during the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 343,164 shares of the software maker's stock valued at $57,857,000 after purchasing an additional 314,007 shares during the last quarter. National Pension Service raised its holdings in shares of MicroStrategy by 900.0% during the third quarter. National Pension Service now owns 245,000 shares of the software maker's stock valued at $41,307,000 after acquiring an additional 220,500 shares in the last quarter. International Assets Investment Management LLC lifted its stake in MicroStrategy by 224,965.1% in the third quarter. International Assets Investment Management LLC now owns 238,569 shares of the software maker's stock worth $40,223,000 after acquiring an additional 238,463 shares during the period. Commonwealth Equity Services LLC increased its position in MicroStrategy by 827.3% during the 3rd quarter. Commonwealth Equity Services LLC now owns 225,531 shares of the software maker's stock valued at $38,025,000 after purchasing an additional 201,210 shares during the period. Finally, Yong Rong HK Asset Management Ltd purchased a new position in MicroStrategy during the 3rd quarter valued at $35,558,000. Institutional investors own 72.03% of the company's stock.

MicroStrategy Price Performance

Shares of MSTR stock opened at $473.83 on Thursday. MicroStrategy Incorporated has a twelve month low of $43.87 and a twelve month high of $504.83. The stock has a fifty day simple moving average of $222.94 and a two-hundred day simple moving average of $172.36. The stock has a market capitalization of $96.02 billion, a price-to-earnings ratio of -224.88 and a beta of 3.05. The company has a current ratio of 0.65, a quick ratio of 0.65 and a debt-to-equity ratio of 1.12.

MicroStrategy (NASDAQ:MSTR - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The software maker reported ($1.56) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.12) by ($1.44). MicroStrategy had a negative net margin of 87.05% and a negative return on equity of 17.31%. The business had revenue of $116.07 million for the quarter, compared to the consensus estimate of $121.45 million. During the same quarter in the prior year, the business posted ($8.98) earnings per share. MicroStrategy's revenue for the quarter was down 10.3% on a year-over-year basis.

Insider Buying and Selling

In related news, EVP Wei-Ming Shao sold 18,000 shares of MicroStrategy stock in a transaction dated Wednesday, November 13th. The stock was sold at an average price of $368.01, for a total transaction of $6,624,180.00. Following the completion of the sale, the executive vice president now owns 6,460 shares of the company's stock, valued at $2,377,344.60. The trade was a 73.59 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CAO Jeanine Montgomery sold 56,250 shares of the company's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $257.41, for a total transaction of $14,479,312.50. Following the completion of the sale, the chief accounting officer now directly owns 5,670 shares in the company, valued at $1,459,514.70. This trade represents a 90.84 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 82,000 shares of company stock worth $23,231,977 in the last 90 days. 13.18% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

Several brokerages recently issued reports on MSTR. Benchmark increased their price target on shares of MicroStrategy from $300.00 to $450.00 and gave the stock a "buy" rating in a research note on Tuesday. BTIG Research upped their price objective on MicroStrategy from $290.00 to $570.00 and gave the company a "buy" rating in a research report on Thursday. Canaccord Genuity Group increased their price objective on shares of MicroStrategy from $173.00 to $300.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Sanford C. Bernstein reduced their price target on MicroStrategy from $2,890.00 to $290.00 and set an "outperform" rating for the company in a research report on Wednesday, October 9th. Finally, Maxim Group increased their price target on MicroStrategy from $193.00 to $270.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. One investment analyst has rated the stock with a sell rating and eight have given a buy rating to the company's stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $331.13.

View Our Latest Stock Analysis on MSTR

MicroStrategy Company Profile

(

Free Report)

MicroStrategy Incorporated provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally. It offers MicroStrategy ONE, which provides non-technical users with the ability to directly access novel and actionable insights for decision-making; and MicroStrategy Cloud for Government service, which offers always-on threat monitoring that meets the rigorous technical and regulatory needs of governments and financial institutions.

Featured Articles

Before you consider MicroStrategy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MicroStrategy wasn't on the list.

While MicroStrategy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.