Mid-America Apartment Communities (NYSE:MAA - Get Free Report) had its price objective dropped by Scotiabank from $174.00 to $173.00 in a research report issued on Thursday,Benzinga reports. The brokerage presently has a "sector perform" rating on the real estate investment trust's stock. Scotiabank's price objective would suggest a potential upside of 9.93% from the stock's previous close.

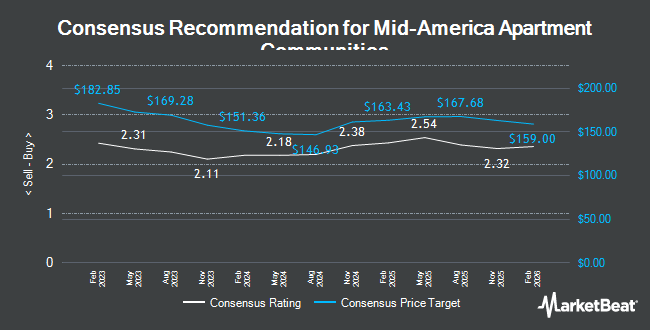

A number of other equities research analysts also recently commented on the stock. Royal Bank of Canada cut their target price on shares of Mid-America Apartment Communities from $169.00 to $165.00 and set a "sector perform" rating for the company in a research report on Friday, November 1st. Piper Sandler upped their price objective on Mid-America Apartment Communities from $140.00 to $165.00 and gave the company a "neutral" rating in a research report on Monday, August 26th. Wedbush raised their target price on Mid-America Apartment Communities from $154.00 to $184.00 and gave the stock an "outperform" rating in a research report on Monday, August 5th. Raymond James raised shares of Mid-America Apartment Communities from a "market perform" rating to a "strong-buy" rating and set a $175.00 price target for the company in a research report on Monday, October 21st. Finally, JMP Securities increased their price objective on shares of Mid-America Apartment Communities from $145.00 to $160.00 and gave the stock a "market outperform" rating in a research note on Friday, August 2nd. Two investment analysts have rated the stock with a sell rating, eight have issued a hold rating, eight have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $161.64.

Check Out Our Latest Research Report on MAA

Mid-America Apartment Communities Stock Down 2.5 %

MAA traded down $3.97 during trading on Thursday, hitting $157.37. 617,413 shares of the company's stock traded hands, compared to its average volume of 753,369. The stock has a market capitalization of $18.39 billion, a price-to-earnings ratio of 35.52, a PEG ratio of 2.57 and a beta of 0.88. The company's 50 day simple moving average is $157.29 and its two-hundred day simple moving average is $147.84. Mid-America Apartment Communities has a 12-month low of $120.32 and a 12-month high of $167.39. The company has a current ratio of 0.09, a quick ratio of 0.09 and a debt-to-equity ratio of 0.80.

Mid-America Apartment Communities (NYSE:MAA - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The real estate investment trust reported $0.98 EPS for the quarter, missing the consensus estimate of $2.18 by ($1.20). Mid-America Apartment Communities had a net margin of 23.84% and a return on equity of 8.38%. The business had revenue of $551.13 million for the quarter, compared to analysts' expectations of $548.53 million. During the same period last year, the business earned $2.29 earnings per share. The company's quarterly revenue was up 1.7% on a year-over-year basis. Analysts predict that Mid-America Apartment Communities will post 8.88 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of MAA. Empowered Funds LLC bought a new position in Mid-America Apartment Communities in the first quarter worth approximately $232,000. BNP PARIBAS ASSET MANAGEMENT Holding S.A. lifted its holdings in shares of Mid-America Apartment Communities by 397.3% in the 1st quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 62,537 shares of the real estate investment trust's stock worth $8,229,000 after buying an additional 49,962 shares during the period. State Board of Administration of Florida Retirement System increased its stake in shares of Mid-America Apartment Communities by 5.1% during the first quarter. State Board of Administration of Florida Retirement System now owns 147,815 shares of the real estate investment trust's stock valued at $19,449,000 after buying an additional 7,141 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd. lifted its stake in Mid-America Apartment Communities by 14.8% in the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 207,190 shares of the real estate investment trust's stock worth $27,262,000 after acquiring an additional 26,769 shares during the period. Finally, Centersquare Investment Management LLC lifted its stake in Mid-America Apartment Communities by 12.0% in the first quarter. Centersquare Investment Management LLC now owns 118,650 shares of the real estate investment trust's stock worth $15,424,000 after acquiring an additional 12,727 shares during the period. 93.60% of the stock is owned by hedge funds and other institutional investors.

Mid-America Apartment Communities Company Profile

(

Get Free Report)

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

See Also

Before you consider Mid-America Apartment Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mid-America Apartment Communities wasn't on the list.

While Mid-America Apartment Communities currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.