Advisors Asset Management Inc. increased its holdings in shares of MidCap Financial Investment Co. (NASDAQ:MFIC - Free Report) by 139.5% in the third quarter, according to its most recent filing with the SEC. The fund owned 444,531 shares of the company's stock after acquiring an additional 258,940 shares during the period. Advisors Asset Management Inc. owned about 0.47% of MidCap Financial Investment worth $5,952,000 at the end of the most recent quarter.

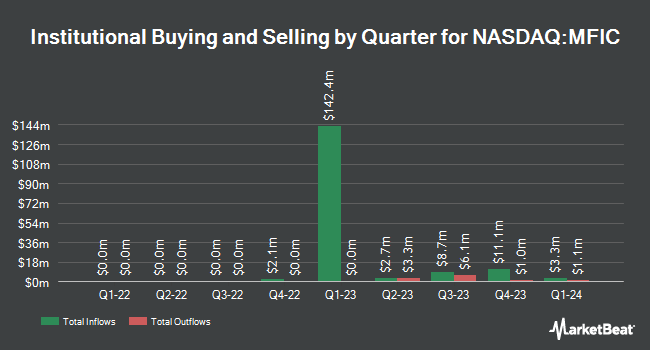

Other institutional investors also recently bought and sold shares of the company. Brown Brothers Harriman & Co. acquired a new stake in MidCap Financial Investment in the 2nd quarter worth approximately $81,000. Accel Wealth Management acquired a new stake in shares of MidCap Financial Investment during the second quarter worth $151,000. HB Wealth Management LLC purchased a new stake in shares of MidCap Financial Investment during the second quarter valued at $153,000. Essex Financial Services Inc. acquired a new position in shares of MidCap Financial Investment in the 2nd quarter valued at $154,000. Finally, ProShare Advisors LLC acquired a new stake in MidCap Financial Investment during the 2nd quarter worth about $159,000. 28.45% of the stock is currently owned by institutional investors and hedge funds.

MidCap Financial Investment Stock Up 1.2 %

MidCap Financial Investment stock traded up $0.17 during mid-day trading on Friday, hitting $13.99. The company had a trading volume of 259,444 shares, compared to its average volume of 324,811. The company has a quick ratio of 8.51, a current ratio of 8.51 and a debt-to-equity ratio of 1.25. MidCap Financial Investment Co. has a 1 year low of $12.26 and a 1 year high of $16.36. The stock has a market cap of $1.31 billion, a price-to-earnings ratio of 8.86 and a beta of 1.50. The business has a fifty day moving average of $13.47 and a 200 day moving average of $14.33.

MidCap Financial Investment Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 26th. Investors of record on Tuesday, December 10th will be paid a $0.38 dividend. This represents a $1.52 annualized dividend and a dividend yield of 10.86%. The ex-dividend date is Tuesday, December 10th. MidCap Financial Investment's dividend payout ratio (DPR) is 97.44%.

Analysts Set New Price Targets

MFIC has been the topic of several recent research reports. Keefe, Bruyette & Woods raised shares of MidCap Financial Investment from a "market perform" rating to an "outperform" rating and set a $15.00 price objective on the stock in a report on Monday, August 5th. Compass Point raised shares of MidCap Financial Investment from a "neutral" rating to a "buy" rating and set a $16.00 price objective on the stock in a research note on Thursday, July 25th. Royal Bank of Canada reaffirmed a "sector perform" rating and set a $14.00 target price on shares of MidCap Financial Investment in a report on Tuesday. Wells Fargo & Company cut their price objective on shares of MidCap Financial Investment from $15.00 to $14.00 and set an "overweight" rating for the company in a report on Tuesday, October 29th. Finally, JPMorgan Chase & Co. cut their price target on shares of MidCap Financial Investment from $15.00 to $14.00 and set a "neutral" rating for the company in a report on Monday, July 29th. Three research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $14.71.

Check Out Our Latest Stock Analysis on MidCap Financial Investment

MidCap Financial Investment Company Profile

(

Free Report)

MidCap Financial Investment Corporation (Former name Apollo Investment Corporation) is business development company and a closed-end, externally managed, non-diversified management investment company. It is elected to be treated as a business development company (BDC) under the Investment Company Act of 1940 (the 1940 Act) specializing in private equity investments in leveraged buyouts, acquisitions, recapitalizations, growth capital, refinancing and private middle market companies.

Read More

Before you consider MidCap Financial Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MidCap Financial Investment wasn't on the list.

While MidCap Financial Investment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.