Migdal Insurance & Financial Holdings Ltd. raised its holdings in Camtek Ltd. (NASDAQ:CAMT - Free Report) by 7.5% during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 856,453 shares of the semiconductor company's stock after buying an additional 60,088 shares during the quarter. Camtek comprises 1.1% of Migdal Insurance & Financial Holdings Ltd.'s investment portfolio, making the stock its 24th largest position. Migdal Insurance & Financial Holdings Ltd. owned approximately 1.89% of Camtek worth $68,388,000 as of its most recent SEC filing.

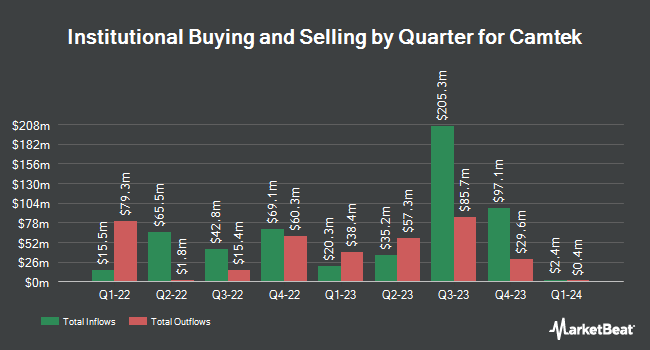

Other large investors have also recently made changes to their positions in the company. Fred Alger Management LLC bought a new stake in shares of Camtek during the second quarter valued at approximately $8,386,000. Meitav Investment House Ltd. boosted its position in shares of Camtek by 14.1% during the third quarter. Meitav Investment House Ltd. now owns 373,044 shares of the semiconductor company's stock valued at $29,887,000 after purchasing an additional 46,016 shares in the last quarter. Sei Investments Co. boosted its position in shares of Camtek by 41.5% during the first quarter. Sei Investments Co. now owns 94,473 shares of the semiconductor company's stock valued at $7,914,000 after purchasing an additional 27,707 shares in the last quarter. Squarepoint Ops LLC bought a new stake in shares of Camtek during the second quarter valued at approximately $1,423,000. Finally, Tidal Investments LLC bought a new stake in shares of Camtek during the first quarter valued at approximately $1,716,000. 41.93% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

CAMT has been the subject of a number of recent research reports. Needham & Company LLC reiterated a "buy" rating and set a $140.00 price objective on shares of Camtek in a research note on Friday, August 2nd. StockNews.com upgraded Camtek from a "sell" rating to a "hold" rating in a research note on Friday, October 25th. Northland Securities upgraded Camtek from a "market perform" rating to an "outperform" rating and set a $99.00 price objective for the company in a research note on Monday, August 5th. Northland Capmk upgraded Camtek from a "hold" rating to a "strong-buy" rating in a research note on Monday, August 5th. Finally, B. Riley lowered their price objective on Camtek from $150.00 to $140.00 and set a "buy" rating for the company in a research note on Friday, August 2nd. One investment analyst has rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, Camtek has a consensus rating of "Buy" and an average price target of $116.57.

Get Our Latest Stock Analysis on CAMT

Camtek Stock Down 2.4 %

Shares of CAMT stock traded down $1.98 during mid-day trading on Friday, hitting $80.53. The company's stock had a trading volume of 325,965 shares, compared to its average volume of 438,439. Camtek Ltd. has a 52-week low of $58.55 and a 52-week high of $140.50. The business has a 50-day moving average price of $79.70 and a 200 day moving average price of $95.74. The company has a debt-to-equity ratio of 0.42, a quick ratio of 4.29 and a current ratio of 5.21. The stock has a market cap of $3.65 billion, a price-to-earnings ratio of 41.09, a PEG ratio of 1.58 and a beta of 1.38.

Camtek Profile

(

Free Report)

Camtek Ltd., together with its subsidiaries, develops, manufactures, and sells inspection and metrology equipment for semiconductor industry. The company provides Eagle-i, a system that delivers 2D inspection and metrology capabilities; Eagle-AP, which addresses the advanced packaging market using software and hardware technologies that deliver superior 2D and 3D inspection and metrology capabilities on the same platform; and Golden Eagle, a panel inspection and metrology system to address the challenges fanout wafer level packaging applications.

See Also

Before you consider Camtek, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camtek wasn't on the list.

While Camtek currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.