MillerKnoll (NASDAQ:MLKN - Get Free Report) issued an update on its FY25 earnings guidance on Wednesday morning. The company provided EPS guidance of $1.81-1.87 for the period, compared to the consensus EPS estimate of $2.12. The company issued revenue guidance of $3.618-3.658 billion, compared to the consensus revenue estimate of $3.71 billion. MillerKnoll also updated its FY 2025 guidance to 1.810-1.870 EPS.

MillerKnoll Stock Down 2.7 %

Shares of MillerKnoll stock traded down $0.54 during trading hours on Friday, hitting $19.76. The company had a trading volume of 991,095 shares, compared to its average volume of 599,561. The company has a debt-to-equity ratio of 1.02, a current ratio of 1.60 and a quick ratio of 0.99. The company's 50-day moving average is $21.22 and its two-hundred day moving average is $23.07. The company has a market cap of $1.35 billion, a P/E ratio of 21.71, a price-to-earnings-growth ratio of 0.89 and a beta of 1.22. MillerKnoll has a twelve month low of $17.83 and a twelve month high of $31.73.

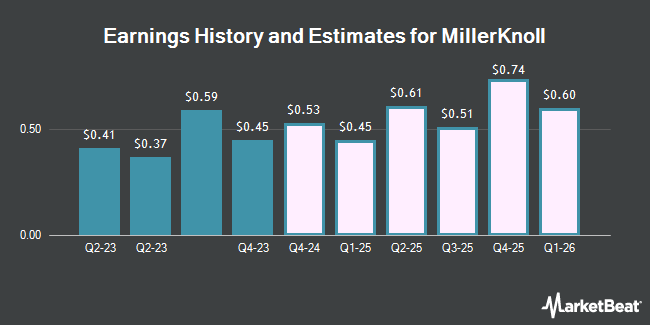

MillerKnoll (NASDAQ:MLKN - Get Free Report) last posted its quarterly earnings data on Wednesday, March 26th. The company reported $0.44 earnings per share for the quarter, meeting the consensus estimate of $0.44. MillerKnoll had a return on equity of 10.74% and a net margin of 1.81%. The business had revenue of $876.20 million during the quarter, compared to the consensus estimate of $918.88 million. During the same period in the prior year, the company earned $0.45 earnings per share. The company's revenue was up .4% compared to the same quarter last year. Analysts anticipate that MillerKnoll will post 2.12 earnings per share for the current fiscal year.

MillerKnoll Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Saturday, March 1st will be issued a $0.1875 dividend. The ex-dividend date of this dividend is Friday, February 28th. This represents a $0.75 dividend on an annualized basis and a dividend yield of 3.80%. MillerKnoll's payout ratio is 82.42%.

Analyst Ratings Changes

Several research firms recently weighed in on MLKN. StockNews.com downgraded MillerKnoll from a "buy" rating to a "hold" rating in a research note on Saturday. Sidoti upgraded shares of MillerKnoll to a "hold" rating in a research report on Tuesday, March 25th.

Get Our Latest Stock Analysis on MLKN

About MillerKnoll

(

Get Free Report)

MillerKnoll, Inc researches, designs, manufactures, and distributes interior furnishings worldwide. It operates through three segments: Americas Contract, International Contract & Specialty, and Global Retail. The company also provides seating products, furniture systems, other freestanding furniture elements, textiles, leather, felt, home furnishings and related services, casegoods, storage products, as well as residential, education, and healthcare furniture solutions.

Featured Articles

Before you consider MillerKnoll, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MillerKnoll wasn't on the list.

While MillerKnoll currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.