HighTower Advisors LLC increased its stake in Minerals Technologies Inc. (NYSE:MTX - Free Report) by 602.4% during the fourth quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 27,877 shares of the basic materials company's stock after purchasing an additional 23,908 shares during the quarter. HighTower Advisors LLC owned approximately 0.09% of Minerals Technologies worth $2,125,000 at the end of the most recent quarter.

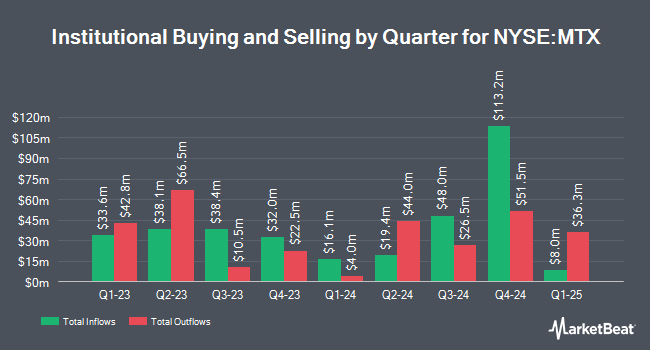

Other institutional investors and hedge funds also recently bought and sold shares of the company. Smartleaf Asset Management LLC lifted its stake in shares of Minerals Technologies by 181.1% during the 4th quarter. Smartleaf Asset Management LLC now owns 506 shares of the basic materials company's stock valued at $38,000 after buying an additional 326 shares in the last quarter. Blue Trust Inc. boosted its stake in shares of Minerals Technologies by 21.4% in the fourth quarter. Blue Trust Inc. now owns 1,009 shares of the basic materials company's stock worth $78,000 after acquiring an additional 178 shares during the period. Venturi Wealth Management LLC purchased a new stake in shares of Minerals Technologies during the fourth quarter worth about $78,000. KBC Group NV raised its stake in Minerals Technologies by 43.9% during the 4th quarter. KBC Group NV now owns 1,478 shares of the basic materials company's stock valued at $113,000 after purchasing an additional 451 shares during the period. Finally, SG Americas Securities LLC purchased a new position in Minerals Technologies in the 4th quarter worth approximately $145,000. 97.29% of the stock is currently owned by hedge funds and other institutional investors.

Minerals Technologies Price Performance

Minerals Technologies stock traded up $0.29 during midday trading on Wednesday, reaching $65.42. 122,220 shares of the stock traded hands, compared to its average volume of 155,974. The stock has a market cap of $2.09 billion, a P/E ratio of 12.63 and a beta of 1.28. The stock's fifty day moving average is $71.57 and its 200-day moving average is $75.30. The company has a quick ratio of 1.98, a current ratio of 2.84 and a debt-to-equity ratio of 0.54. Minerals Technologies Inc. has a 12 month low of $64.30 and a 12 month high of $90.30.

Minerals Technologies (NYSE:MTX - Get Free Report) last posted its earnings results on Thursday, February 6th. The basic materials company reported $1.50 EPS for the quarter, beating analysts' consensus estimates of $1.39 by $0.11. Minerals Technologies had a return on equity of 11.49% and a net margin of 7.89%. As a group, equities research analysts anticipate that Minerals Technologies Inc. will post 6.62 EPS for the current year.

Minerals Technologies Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, March 7th. Stockholders of record on Friday, February 14th were issued a $0.11 dividend. The ex-dividend date was Friday, February 14th. This represents a $0.44 dividend on an annualized basis and a dividend yield of 0.67%. Minerals Technologies's dividend payout ratio (DPR) is presently 8.49%.

Analysts Set New Price Targets

A number of equities research analysts have issued reports on MTX shares. Truist Financial cut their price objective on shares of Minerals Technologies from $103.00 to $101.00 and set a "buy" rating for the company in a report on Monday, February 10th. StockNews.com downgraded shares of Minerals Technologies from a "buy" rating to a "hold" rating in a report on Wednesday, March 19th.

Check Out Our Latest Research Report on Minerals Technologies

Minerals Technologies Company Profile

(

Free Report)

Minerals Technologies Inc develops, produces, and markets various mineral, mineral-based, and related systems and services. The company operates through two segments, Consumer & Specialties, and Engineered Solutions segments. The Consumer & Specialties segment offers household and personal care products, such as pet litter, personal care, fabric care, edible oil and other fluid purification, animal health, and agricultural products; and specialty additives products, including precipitated calcium carbonate and ground calcium carbonate products that are used in the paper, paperboard, and fiber based packaging industries, as well as automotive, construction, and table and food applications.

Read More

Before you consider Minerals Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Minerals Technologies wasn't on the list.

While Minerals Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.