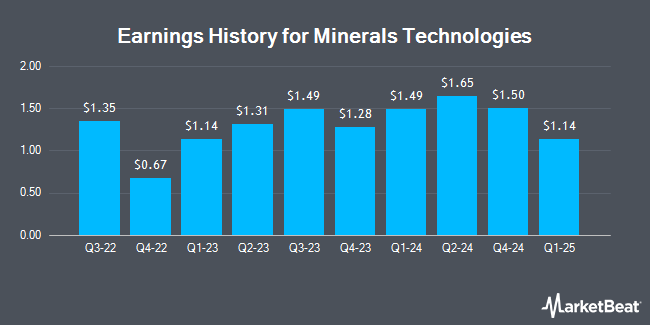

Minerals Technologies (NYSE:MTX - Get Free Report) is expected to post its quarterly earnings results after the market closes on Thursday, February 6th. Analysts expect Minerals Technologies to post earnings of $1.38 per share and revenue of $522.93 million for the quarter. Parties that wish to register for the company's conference call can do so using this link.

Minerals Technologies Price Performance

MTX traded up $0.36 during trading on Thursday, reaching $77.01. The company's stock had a trading volume of 24,176 shares, compared to its average volume of 138,472. The company has a market cap of $2.46 billion, a price-to-earnings ratio of 16.32 and a beta of 1.31. The firm has a fifty day simple moving average of $77.73 and a two-hundred day simple moving average of $77.24. Minerals Technologies has a 1 year low of $64.91 and a 1 year high of $90.29. The company has a quick ratio of 1.72, a current ratio of 2.46 and a debt-to-equity ratio of 0.51.

Minerals Technologies Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, March 7th. Shareholders of record on Friday, February 14th will be paid a $0.11 dividend. This represents a $0.44 dividend on an annualized basis and a dividend yield of 0.57%. The ex-dividend date of this dividend is Friday, February 14th. Minerals Technologies's dividend payout ratio (DPR) is presently 9.32%.

Analysts Set New Price Targets

Several analysts have recently weighed in on MTX shares. Truist Financial initiated coverage on shares of Minerals Technologies in a research note on Tuesday. They issued a "buy" rating and a $103.00 price target for the company. StockNews.com downgraded shares of Minerals Technologies from a "buy" rating to a "hold" rating in a research note on Wednesday, October 30th.

Read Our Latest Report on Minerals Technologies

About Minerals Technologies

(

Get Free Report)

Minerals Technologies Inc develops, produces, and markets various mineral, mineral-based, and related systems and services. The company operates through two segments, Consumer & Specialties, and Engineered Solutions segments. The Consumer & Specialties segment offers household and personal care products, such as pet litter, personal care, fabric care, edible oil and other fluid purification, animal health, and agricultural products; and specialty additives products, including precipitated calcium carbonate and ground calcium carbonate products that are used in the paper, paperboard, and fiber based packaging industries, as well as automotive, construction, and table and food applications.

See Also

Before you consider Minerals Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Minerals Technologies wasn't on the list.

While Minerals Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.